Decentralized finance (DeFi) protocol Sturdy Finance has warned the entity behind the recent crypto hack that the ground was shrinking beneath its feet.

Sturdy has identified the hacker and warned them, “This isn’t going away until you return funds.”

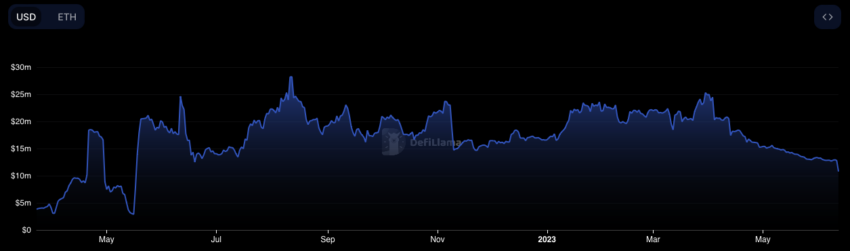

DeFi Hacker Stole $760,000 From Sturdy Finance

The protocol hired on-chain and off-chain specialists and international law enforcement to apprehend the criminal. They warned that the hacker’s “best option” is to admit guilt.

The hacker stole 440 ETH on June 12 and later moved the funds to Tornado Cash. At the time, the price of ETH meant the theft cost Sturdy Finance about $768,000.

Rather than being caused by a smart contract or other cyber vulnerability, Sturdy suspected a price manipulation attack and paused all markets. Sturdy Finance offers yield farming using staked crypto collateral.

DeFi hacks cost crypto protocols $20 million in May, a 79% decline from April. Most hackers took aim at smart contract vulnerabilities. Firms like AnChain.AI and Cyver.AI use machine learning to identify bugs in DeFi protocols.

The Atomic Wallet hack in June cost investors $35 million. Police in Estonia are investigating the exploit with Chainalysis. Atomic Wallet hasn’t released investigation findings yet.

US DeFi Laws Still in Early Stages

Regulations around decentralized finance are mostly non-existent, but governments are not sitting back.

A US Treasury Department report suggested improving existing supervisory and enforcement actions. It asked the public how to determine whether a smart contract is a financial institution subject to the Bank Secrecy Act.

Thanks to efforts by Custodia Bank founder Caitlin Long, Wyoming law recognizes decentralized autonomous organizations.

The European Union’s MiCA bill neglects decentralized finance. Still, a previous report by the central bank of France suggested the government specify how it would assess risks related to decentralization or otherwise move projects to private blockchains.

Read about the best DeFi lending platforms here.

Attempts to rein in DeFi crime have had notable successes, as companies like AnChain, Elliptic, and Chainalysis help law enforcement track illegal fund flows. Police in the UK traced the origin of a narcotics ring to Spain through on-chain analytics.

The US Internal Revenue Service (IRS) uses AnChain’s on-chain tools to identify tax and white-collar criminals.

IRS agents are currently deployed in Australia, Singapore, and Germany to investigate the use of crypto, decentralized finance, and mixers in financial crimes.

The IRS will receive $60 billion in federal funding for enforcement actions involving crypto tax and other crimes.

For BeInCrypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.