The Internal Revenue Service (IRS) will send cyber agents to Australia, Colombia, Singapore, and Germany to investigate the use of crypto in tax crimes.

The IRS will help international law enforcement investigate tax and financial crimes using crypto assets, decentralized finance, and mixers.

Cyber Agents Crucial to International Investigations

According to an IRS spokesperson Carissa Cutrell, the agents will participate in a 120-day pilot from June to September.

If successful, the agents will stay in their respective countries to act as a proxy for a case agent in ongoing investigations. They will advise U.S. case agents on the feasibility of obtaining certain evidence and assist with cultural and legal considerations.

Currently, the IRS has one cyber specialist posted at The Hague in the Netherlands. The agent works with Europol.

Jared Koopman, director of Cyber and Forensic Services at the IRS, told CNBC that funds seized from criminal activity are sent to hardware wallets set up by the agents responsible for enforcement action. The U.S. Marshals Service and the U.S. General Services Administration then liquidate the assets.

The new cohort will join eleven agents stationed in Mexico, Canada, Colombia, Panama, Barbados, China, Germany, the Netherlands, the U.K., Australia, and the United Arab Emirates.

IRS Focusing on Tax Evasion in 2023

The IRS uses technology developed by blockchain security firm AnChain.ai to scrutinize crypto tax disclosures and investigate white-collar crime. It is set to receive an $80 billion federal injection for enforcement actions, including crypto tax evasion.

In September last year, the IRS issued a John Doe summons to M.Y. Safra Bank, requesting transaction information for one of its crypto clients SFOX. It sought to compare SFOX’s customer information and other records to determine whether the brokerage’s clients complied with disclosure rules.

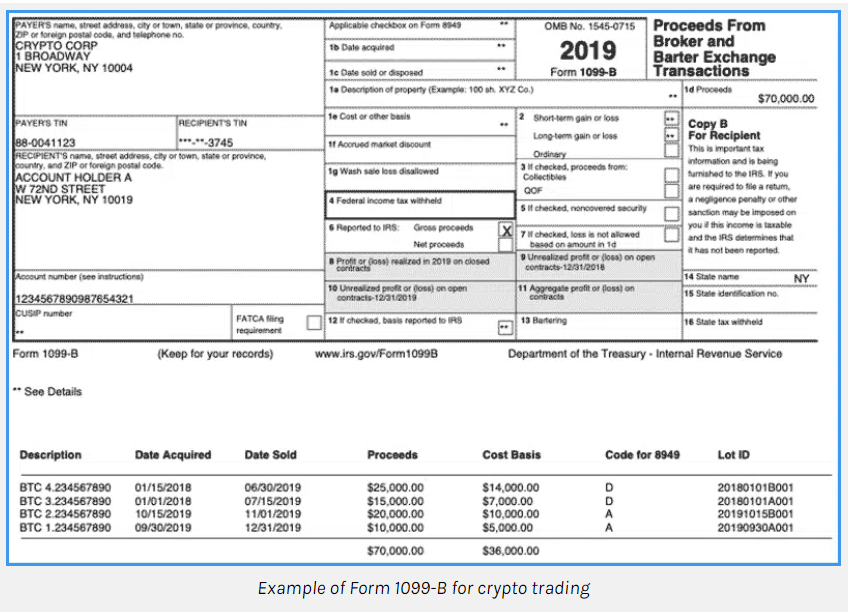

The new Infrastructure Bill will force crypto brokers to disclose clients’ identity and transaction activity from 2024. Brokers must issue form 1099-B to clients from 2024. This form will track crypto transactions from Jan. 1.

Last month, the IRS opened for comment new guidance on taxing non-fungible tokens (NFTs).

For Be[In]Crypto’s latest Bitcoin (BTC) analysis, click here.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.