Recent headlines show that the Grayscale Investment trust has posted some impressive numbers over the first two quarters of 2020.

Of greatest interest thus far is the new all-time high in assets under management (AUM). The company reported at the end of May that the current AUM exceeded $3.8 billion. Of this total, nearly $3.3 billion were housed in the company’s flagship Bitcoin Investment Trust product.

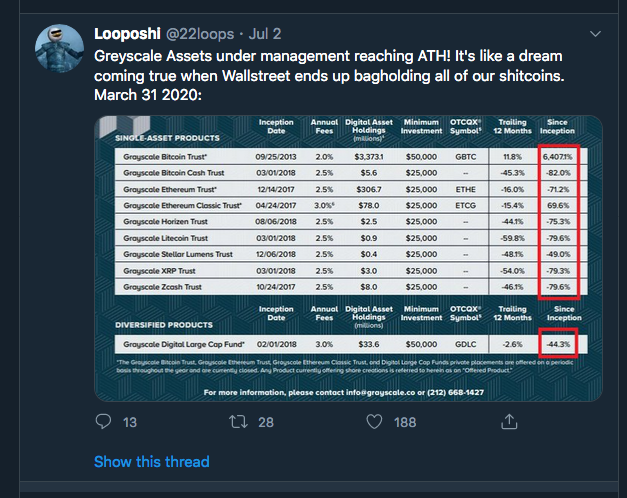

Among the company’s products, however, only two have shown a return on investment since inception. These are the Bitcoin Investment Trust and the Ethereum Classic Trust. Bitcoin saw a 6400% return, a stunning number that has made the otherwise struggling company profitable.

Ironically, the company has suffered substantial losses in the vast majority of its products. In other words, the losses in the cryptocurrency market over the past couple of years have been felt by Wall Street investors as well. The company has ostensibly been left holding the bags of its former altcoin investors.

One could argue that it created most of its investment products during the height of the ‘Crypto Bubble’ and into 2018. In other words, most of its losses are attributed to changing market conditions.

Nevertheless, the overall picture is bleak when considering all investment products. Much like with the broader cryptocurrency space, those who diversify investments outside of Bitcoin, tend to lose more.

A case in point is the recent decline in the company’s Ethereum Trust investment product. The fund, after gaining nearly 100% in late May, gave back all its gains, and then some. The net result was that investors who tried to catch the wave were left holding the bags of Wall Street manipulators.

Overall growth

The substantial growth in assets under management also reflects the company’s purchase of new assets. Grayscale has notoriously been buying up more Bitcoin and Ethereum than is being mined. The company currently owns nearly 2% of all Bitcoin in circulation.

The funds for these purchases must surely be related to the growth of its assets. As investors move funds into the company, those funds are used to grow the underlying asset bases.

The current mood is bullish since Grayscale represents a hybrid option for Wall Street to legitimately move funds into digital assets.

Puffed up?

Taking the growth as a signal, many have suggested that the increase in AUM represents the institutional acknowledgment of crypto-assets. On the other hand, the overall growth in the stock market is most likely not based on fundamentals.

Denominating stocks according to gold yields may show a very different picture. The use of gold is helpful since it fluctuates far less than the dollar.

From above, you can see that the overall movement of the market is relatively stagnant. The values of stocks are highly inflated when valued in gold, a signal that consumer inflation is on the horizon. This same statistic applies to Grayscale’s investment products.

While it’s true that assets under management have grown substantially, much of that growth is an inflow of rapidly depreciating dollars. Therefore, the actual value of the Grayscale investment portfolio is stagnant, as dollar inflows are simply keeping pace with overall inflation.

A Grayscale Silver lining?

While this may indicate that the overall value of Grayscale is mostly smoke and mirrors, there is a silver lining. The company’s business model is basically built as a hedge against inflation.

Bitcoin’s value as a hedge investment has been widely debated. Even Bitcoin bulls like Tyler Winklevoss have recently repudiated the notion. The correlation between the price of stocks and Bitcoin is widely understood as a sign of investors willing to take risks when dollars are cheap.

Grayscale’s investment model allows investors to move out of inflated assets, albeit through a mediator. Whether Bitcoin’s future is inextricably tied to stocks or not, the market will continue to move based on excess liquidity.

In this case, investors will likely continue to be left holding the bags of former altcoin investors. Grayscale’s growth may be due to inflationary pressure, but actual blockchain-based Bitcoin could well offer protection for unwitting Wall Street investors.