The crypto market crash of 2022 has led to decreased investor interest in digital collectibles by the global NFT population.

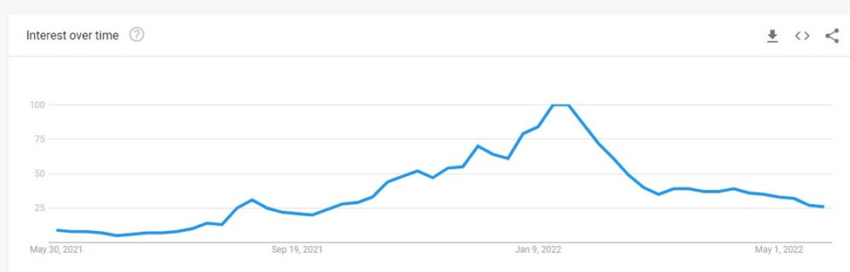

Interest in non-fungible tokens (NFT) has dropped to new high lows in May 2022. According to Be[In]Crypto research and data from Google Trends, interest in NFT-related topics by the global population has sunk.

Interest over time comprises the number of Google searches in NFT content represented by a number between 0 and 100. A value of 0 or close to 0 means there is little to no interest. On the other hand, a value of at least 50 means that the term constitutes a huge part of searches by the global population.

The term “non-fungible token” reached a value of 26 in the last days of May. This was a 74% drop from the peak interest overtime of 100 reached in January 2022.

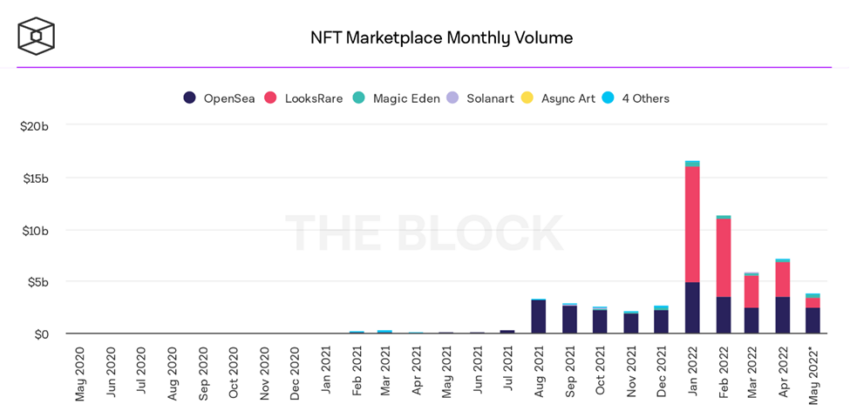

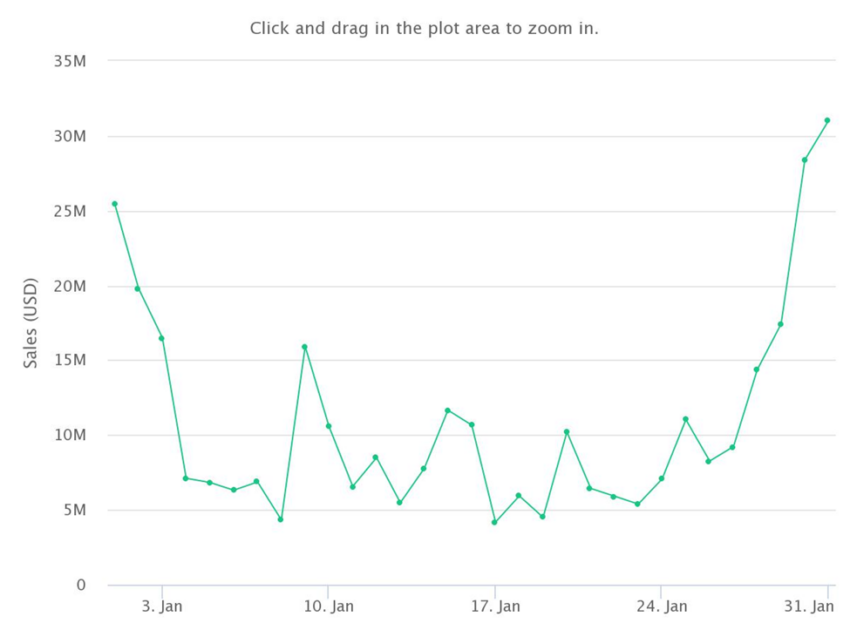

In January 2022, the major NFT marketplaces’ monthly volumes reached an all-time high of $16.54 billion. In the last days of May, the total monthly volume was approximately $4 billion, equating to a 75% decline from January’s volume.

Some of the NFTs that contributed to January’s milestone include the Bored Ape Yacht Club (BAYC), Mutant Ape Yacht Club (MAYC), and Axie Infinity.

In the last days of May, BAYC NFT sales volume was in the region of $200 million, a 41% decline in four months.

In January 2022, Axie Infinity and Mutant Ape Yacht Club sales volumes were approximately $126.49 million and $252.33 million, respectively.

The bearish market dramatically slashed these values in the second quarter of 2022.

Axie Infinity had a total sales volume of $6.6 million while MAYC had $163.96 million in May. Overall, Axie Infinity saw a decline of 94% while BAYC saw sales volume sink by 36%.

Overall, issues that continue to trend on Google across the globe are inflation, Ukraine/Russia Crisis, gun control, and the overall crypto market crash (with prices and total value locked of digital assets) dominating search patterns.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.