The GMX price began an upward movement on June 10. It has recovered admirably since then, reclaiming an important Fib resistance level in the process.

While all signs point to the trend being bullish, GMX may undergo a short-term correction before eventually resuming its increase.

GMX Price Recovery Reclaims Important Level

The GMX price began a downward movement on April 18. In a span of 53 days, it fell by 55%, culminating in a low of $41 on June 10. At the time, it seemed that GMX had broken down from a confluence of support levels at $50.50, created by a horizontal support area and the 0.618 Fib retracement support level.

According to the Fibonacci retracement levels theory, following a significant price change in one direction, the price is expected to partially return to a previous price level before continuing in the same direction. Therefore, the $50.50 area was expected to provide support.

Read More: Best Crypto Sign-Up Bonuses in 2023

However, the GMX price has increased since June 10 and reclaimed the $50.50 area on June 20. This is a bullish development since it means that the previous breakdown was illegitimate.

Such deviations and reclaims usually lead to sharp movements in the other direction.

Additionally, the RSI supports the continuing increase. The RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold and to determine whether to accumulate or sell an asset.

Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite.

The indicator is above 50 and moving upwards, both signs of a bullish trend.

Read More: Best Upcoming Airdrops in 2023

GMX Price Prediction: Retracement Before Continuation

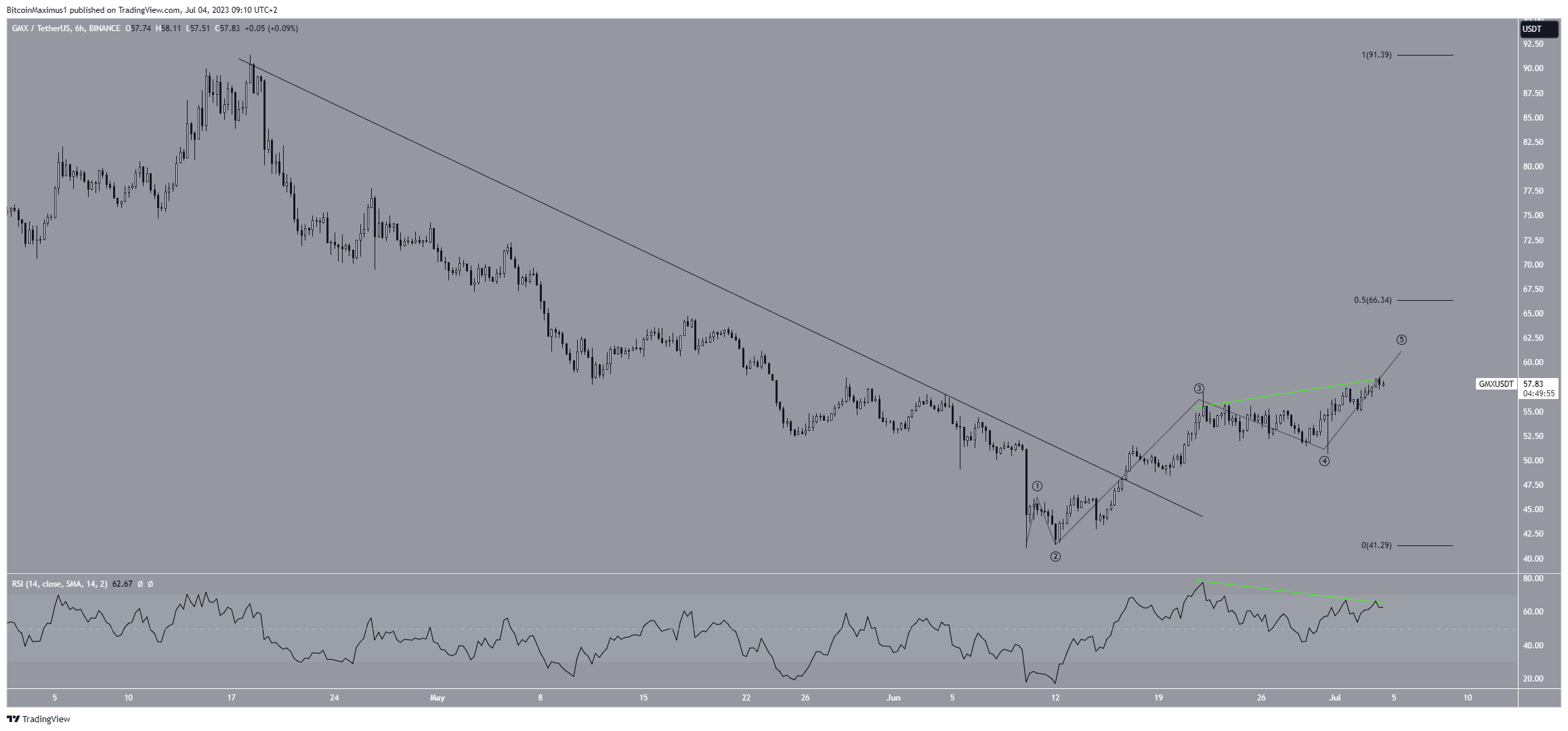

Similarly to the daily time frame, the six-hour one also provides a bullish outlook. Since the aforementioned June 10 low of $41, the GMX price has completed a five-wave increase.

This also caused a breakout from a short-term descending resistance line, confirming that the correction is complete and a new upward movement has started.

However, the price seems to be nearing the top of the fifth and final wave, after which a retracement is expected.

Moreover, the six-hour RSI has generated a bearish divergence. This is an occurrence where a momentum decrease accompanies a price increase. It is often seen at the top of the fifth wave, leading to trend reversals.

So, the GMX price may drop and find support near $50 before resuming its upward trend.

On the other hand, if the GMX price closes above $66, it will indicate that the retracement is complete, and the short-term trend is also bullish.

In that case, a price surge to $90 will likely be the scenario.

More From BeInCrypto: 9 Best AI Crypto Trading Bots to Maximize Your Profits

For BeInCrypto’s latest crypto market analysis, click here

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.