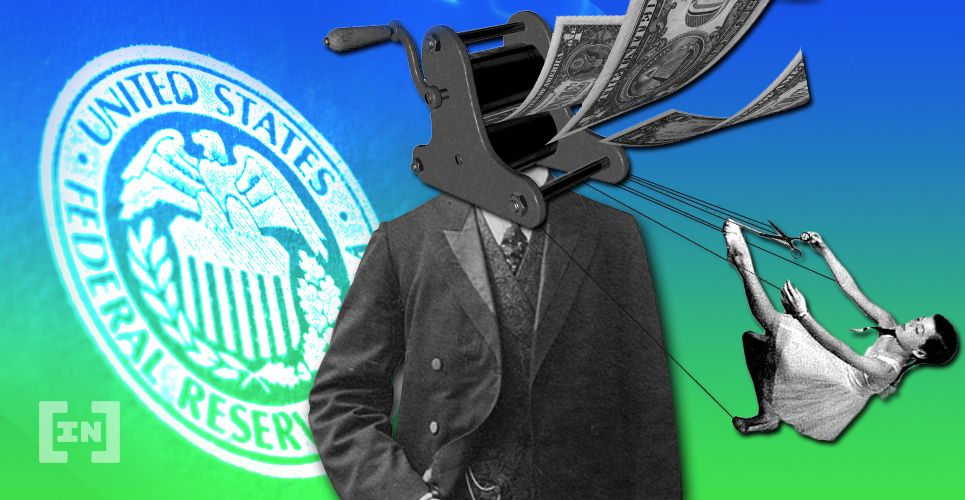

During the COVID-19 pandemic, the Federal Reserve (Fed) has quietly been accumulating corporate bonds. The list of companies receiving funds includes the likes of Apple, Anheuser-Busch, and Verizon.

The news has not made national headlines but reflects the Fed’s current monetary policy. Bond purchases allow the Fed to move needed capital into companies in a less-than-direct way. By purchasing corporate paper, the Fed can create capital inflow, without direct loans or gifts.

While the practice has been common in other central banks, the Fed did not purchase corporate paper before the pandemic. However, now that they’ve relented, purchases have taken off. In the last week of June, it added $1.33 billion in corporate bond holdings. This brought the overall total to $1.59 billion.

Fed Corporate ETF Balance Sheet Balloons to $8B

The central bank also owns nearly $8 billion in corporate bond ETF shares. Approximately half of those were issued by BlackRock, who waived fees for Fed-related purchases. These purchases include over $25 million in Verizon and AT&T, with Apple joining the ranks of the front-runners. Others, like Ford Motor Co., are closer to $10 million in bond issues but have been downgraded to junk during the crisis. The Fed has responded to the COVID crisis by trying to capitalize the market. As liquidity dried up, the demand for dollars exploded. By purchasing corporate bonds, it is effectively finding another creative way to pump liquidity into the market, albeit in a secondary fashion.

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Jon Buck

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

With a background in science and writing, Jon's cryptophile days started in 2011 when he first heard about Bitcoin. Since then he's been learning, investing, and writing about cryptocurrencies and blockchain technology for some of the biggest publications and ICOs in the industry. After a brief stint in India, he and his family live in southern CA.

READ FULL BIO

Sponsored

Sponsored