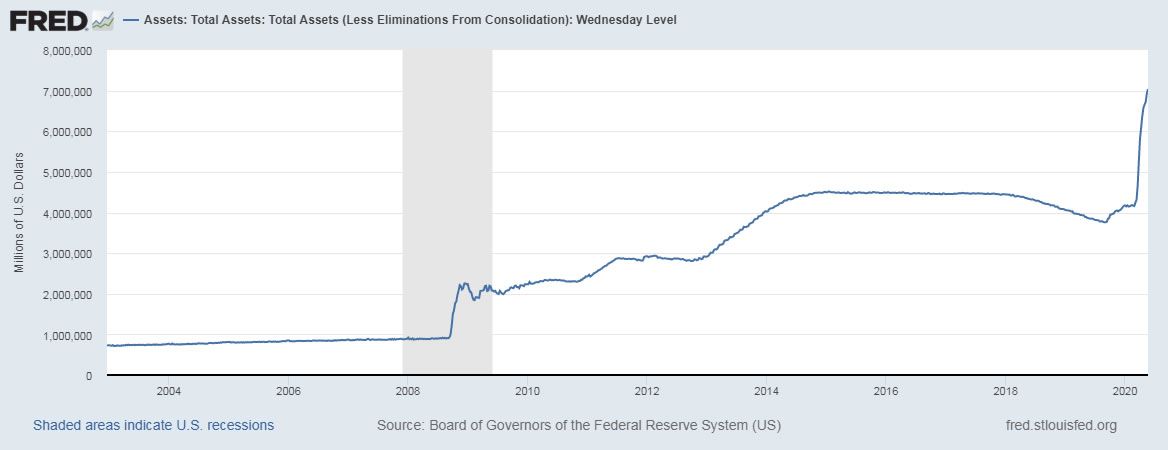

In its ongoing battle against economic collapse, the U.S. central bank has been taking more extreme measures. These have caused its balance sheet to exceed $7 trillion as financial stimulus packages keep rolling out.

Just like a regular business, the Fed’s balance sheet consists of assets and liabilities. According to data provided by the Federal Reserve Bank of St. Louis, that balance sheet has risen to a new record high of $7.03 trillion this week.

Of the $100 billion in asset purchases this week, just under 80% were mortgage backed securities.According to reports, JPMorgan and Goldman Sachs analysts suggest that this unprecedented balance sheet expansion is likely to continue. [FXStreet] This is primarily because the bond market will face a demand shortage, and the FED will need to step up purchases to keep yields depressed. It was also noted that this will be bullish for safe-haven assets such as gold, which is already up over 13% this year. Unprecedented fiscal stimulus measures could also be very bullish for Bitcoin, as recently reported by Electric Capital.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Martin Young

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

Martin Young is a seasoned cryptocurrency journalist and editor with over 7 years of experience covering the latest news and trends in the digital asset space. He is passionate about making complex blockchain, fintech, and macroeconomics concepts understandable for mainstream audiences.

Martin has been featured in top finance, technology, and crypto publications including BeInCrypto, CoinTelegraph, NewsBTC, FX Empire, and Asia Times. His articles provide an in-depth analysis of...

READ FULL BIO

Sponsored

Sponsored