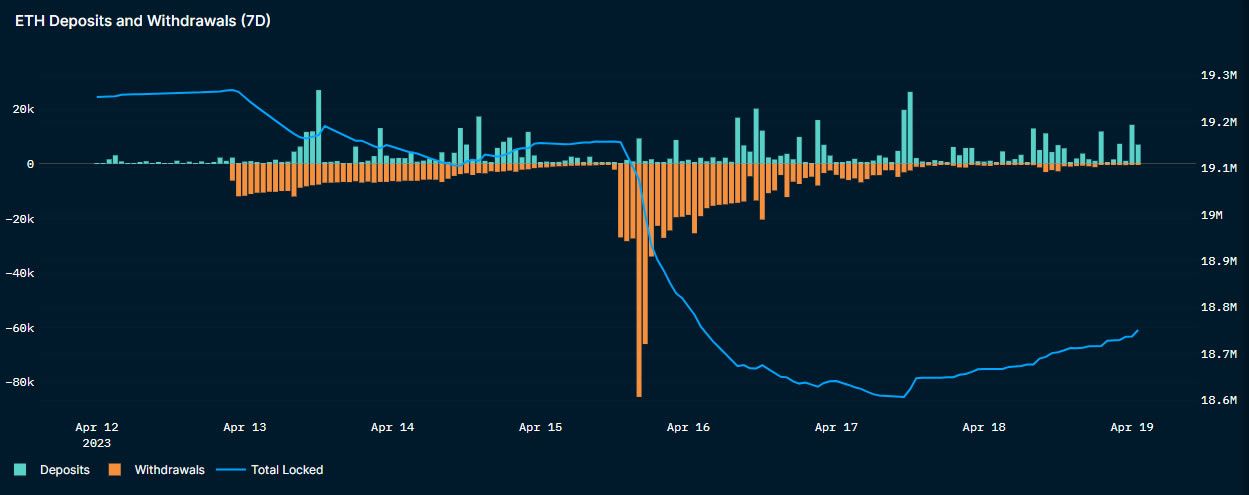

Ethereum staking is gathering pace again, as there are now more deposits than withdrawals. This has resulted in an increase in the amount of staked ETH on the Beacon Chain.

Ethereum staking deposits are now greater than withdrawals, and they have been for the past day or so.

According to the Nansen Shapella dashboard, ETH deposits surpassed withdrawals late on April 17 and have remained above them since. In the past hour, it reported 154 withdrawals and 7,020 deposits.

The figures vary a little depending on which analytics platform is used. Token Unlocks is currently reporting that a total of 1.08 million ETH has been withdrawn so far. It also reports that 575,000 ETH has been staked since the Shapella upgrade a week ago today.

This means that the total staking balance has only fallen by around 500,000 ETH.

Ethereum Staking Balance to Increase

If the trend continues, the total amount of Ethereum staked will actually increase, according to Nansen and Ultrasound.Money, the balance has already increased to between 18.4 and 18.7 million ETH depending on which figure you use.

Token Unlocks is reporting that the staking balance has increased by 26,680 ETH over the past 24 hours.

However, there is still a sizable chunk in the pending withdrawal queue. Nansen claims 5.2% or 979 million ETH is waiting to be withdrawn. A large chunk of this is from Kraken staking services which were shuttered by U.S. regulators earlier this year.

According to some industry experts, a huge increase in Ethereum staking is not necessarily a good thing. Earlier this week, BeInCrypto reported that low levels of ETH staking could be bullish for the asset.

It has been predicted that ETH staking will not reach the high levels of other layer-1 blockchains even with liquid staking incentives. This is due to its extensive use cases.

ETH Price Outlook

ETH prices have held their ground above $2,000 for the past six days. The asset regained minor losses yesterday to trade at $2,095 at the time of writing.

Ethereum has made around 11% over the past week following the Shapella upgrade. However, it is facing strong resistance at current price levels.

A massive move is needed to get it to the next level. However, a downside swing could see support just over $1,900 revisited.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.