Ethereum is on fire today, surging more than 10% to tap its highest price for almost a year. Meanwhile, ETH staking withdrawals are not having any negative impact on the market.

Market sentiment for Ethereum has turned bullish as the asset topped the psychological $2,000 barrier.

A successful Shapella upgrade this week has driven momentum for ETH, which has climbed to an eleven-month high.

At the time of writing, ETH was changing hands for $2,115 following a 24-hour surge of 10.4%. Furthermore, it has outperformed Bitcoin, which only added 2% on the day.

As a result, Ethereum’s market dominance has increased to just under 20% at the expense of Bitcoin.

Earlier this week, BeInCrypto predicted that there would not be a major sell-off after Shapella.

Staked Ethereum Withdrawals Update

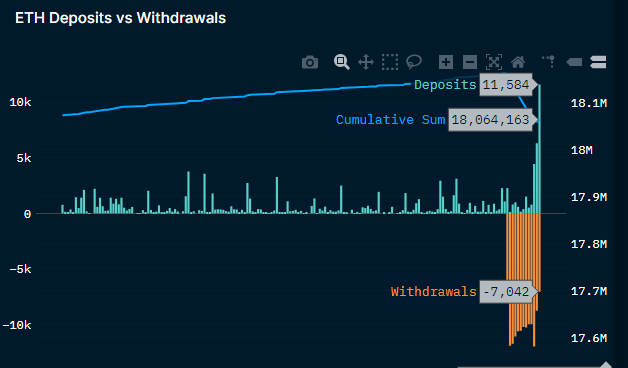

According to industry analyst Colin Wu, almost 240,000 ETH had been withdrawn 30 hours after the upgrade. However, around 100,000 ETH has been deposited, meaning that the net staking balance is -139,000, valued at around $277 million.

Around 1.07 million ETH valued at roughly $2.26 billion was pending withdrawal, according to Token Unlocks.

Wu noted that 63% of this is from Kraken, which had its staking services suspended by the U.S. Securities and Exchange Commission (SEC).

He added that Coinbase accounts for 11% and Huobi accounts for 5.1%. Liquid staking platform Lido has yet to open withdrawals, accounting for 31% of the staked ETH.

Token Unlocks has predicted a decline in the amount of ETH withdrawn going forward.

‘Lookonchain’ confirmed the numbers reporting that 239,882 ETH worth around $504 million has been withdrawn. It added that the Lido address withdrew 152,780 ETH, or around 63.7. However, stakers on the platform cannot withdraw yet.

According to Nansen, there have been a couple of times over the past day when deposits outnumbered withdrawals.

Bullish Future For ETH

On April 13, Cameron Winklevoss commented that the Shapella upgrade is an incredible milestone for the Ethereum network.

“Despite the media FUD and regulatory attack, the brightest minds continue to build cutting edge technology that will decentralize power structures and create a more accessible financial system for all.”

He added that it is clear that the establishment doesn’t want this. “This is why they fight it under the guise of ‘consumer protection,” he said before adding, “Don’t be fooled.”

The markets have reacted positively today with a total capitalization gain of 4.4%, which is around $53 billion.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.