Ethereum staking has been the talk of the crypto world over the past week. However, staking levels are relatively low compared to other networks, but this might not be a bad thing.

The amount of Ethereum staked represents around 14.3% of the entire supply. Furthermore, this figure has dipped over the past week following the Shapella upgrade and staking withdrawals opening.

On April 16, Web3 investor Ryan Berckmans opined that Ethereum staking would not reach the high levels seen on other layer-1 networks.

“Ethereum is too bullish, issuance is too low, and ETH is too useful for people to care to stake.”

Staking involves locking the asset up, akin to a bank’s fixed deposit account. This is done for low by steady yields when there isn’t much else to do with the asset.

Ethereum Staking Ratio Bullish

Berckmans thinks that Ethereum’s low staking levels are actually a good thing.

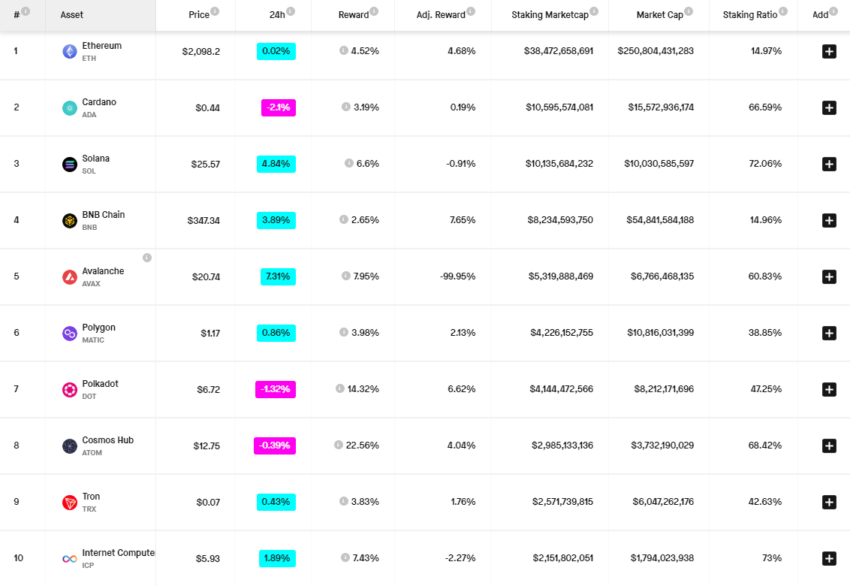

By comparison, the Cardano (ADA) staking ratio is a whopping 66%, according to Staking Rewards. The amount of Solana (SOL) staked is even higher at 72%. Other networks, such as TRON, Cosmos, and Polkadot, all have staking ratios that are more than 40%.

One factor behind this could be the Ethereum minimum viable issuance or dilution. “[This] is a key factor here versus other chains intentionally over-diluting to manufacture a high proportion of staking,” he said.

If the issuance of Ethereum was 50% per year, “obviously everyone is going to stake,” he added.

Ethereum use cases and demand can be measured by network fees, among other things. As reported by BeInCrypto, Ethereum has trounced the competition in terms of fees generated over the past six months. And that is in a bear market!

Berckmans concluded that his recent change of mind is in line with the consensus in the Ethereum research and development communities.

“In short, I think the fact that Ethereum has low staking levels is actually very bullish and that our low staking levels were always mostly attributable to this bullishness and good monetary policy and not to the lack of withdrawals.”

LSD Narratives

He concluded that even with the proliferation of liquid staking tokens, Ethereum staking is not likely to reach the level of other networks.

According to Token Unlocks, just over one million ETH has already been withdrawn from the Beacon Chain.

Furthermore, there are around 877,000 in the pending withdrawal queue, but much of that is due to the Kraken staking crackdown.

However, with around 373,000 in ETH deposits, the staking balance has only declined by 646,700 since Shapella last week.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.