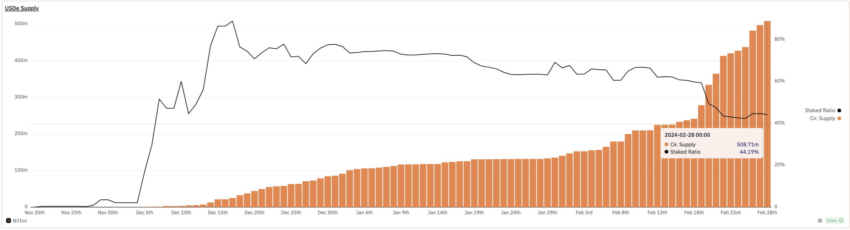

Ethena Lab’s stablecoin USDe has surged to a market capitalization of half a billion dollars, as nearly half of the tokens are committed to staking, enhancing the project’s resilience.

Amidst the cryptocurrency bull run, Bitcoin, with a market cap of $62,000, has surged by almost 40% over the last month. Similarly, Ethereum, valued at $3,402, has experienced a 47% increase during the same period.

USDe Experiences Huge Growth in Market Cap

In a post on X (formerly Twitter), on-chain data researcher Tom Wan informed his 9,585 followers that USDe has reached a $500 million market cap. He also highlighted the substantial yield returns available for investors who lock up their tokens in the project, thus increasing liquidity.

“With the crazy funding % on perps, 39% on average, Ethena is paying out a 24% yield on sUSDe.”

Wan presented a graph illustrating the rapid growth in the USDe market cap since late November 2023, with the staked tokens gradually stabilizing around the 44% mark.

However, Wan elaborated that the reserve for the insurance fund would undergo a tenfold increase, causing confusion among other X users on social media.

“Good news is they are able to also increase the reserve for the insurance fund from $1M to $10M.”

Meanwhile, one X user asked if the insurance fund was enough “assuming a 30% daily drawdown.”

Read more: 8 Best Crypto Platforms for Futures Copy Trading

Wan clarified that the staking yield would decrease proportionately in response to the funding rate.

“The staking yield will drop accordingly based on the funding rate. The insurance fund tries to mitigate funding risk and will be triggered when funding rates go negative and larger than stETH yield.”

After a Long-Term Decline, Stablecoins Stage a Resurgence

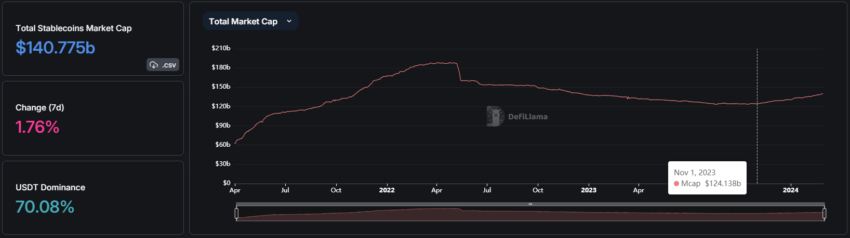

In 2023, the stablecoin market took a huge plunge. In October last year, BeInCrypto reported that stablecoins endured an 18-month-long decline.

Since then, however, the stablecoin market has been slowly recovering. It went from around $124 billion in market cap in November 2023 to a long-term high of $140 billion today. The last time the stablecoin market cap was at this level was December 2022.

Read more: 10 Best Crypto Exchanges And Apps For Beginners In 2024

Many anticipate that stablecoin regulations will come into effect this year in the United States.

On January 15, Circle chief executive Jeremy Allaire said there was a “very good chance” that stablecoin regulations would be passed in the US in 2024.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.