Tether seems to be emerging as king in the stablecoin race, largely influenced by geography and regulations. As the United States puts further pressure on crypto companies, the rest of the world has decided which stablecoin it wants to use for dollar transactions.

Tether’s USDT is becoming the global standard dollar-pegged stablecoin primarily due to US regulators pushing it overseas.

Heavyweight Battle for Stablecoin King: Tether vs Circle

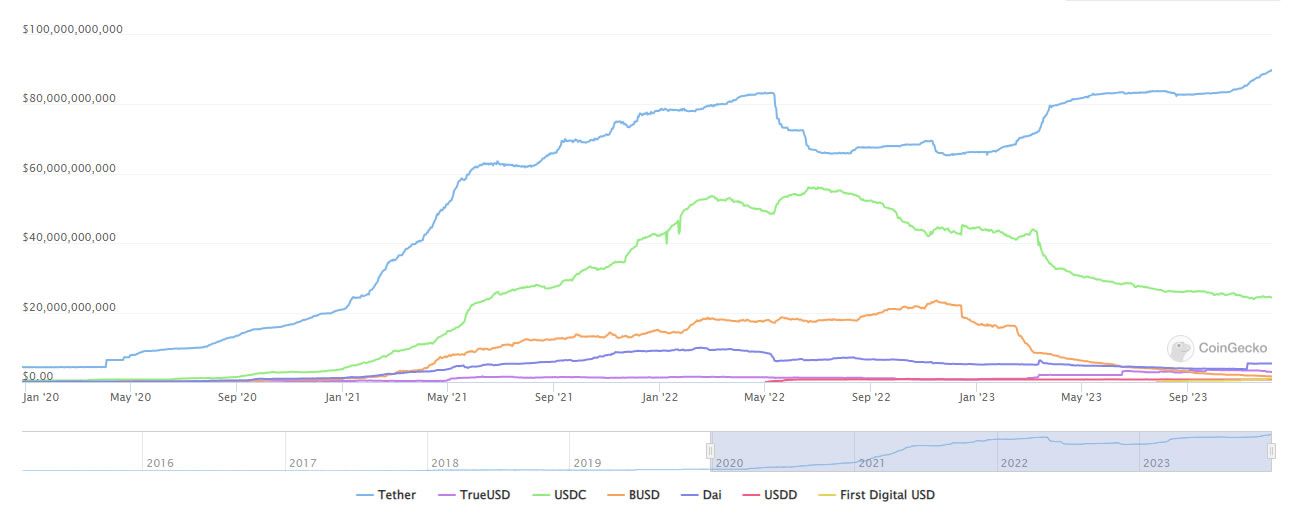

Since mid-2022, a divergence has been widening between the top two leading stablecoins, USDT and Circle’s USDC. In June of that year, there was just a $10 billion difference between their circulating supplies.

Today, the difference is more than $65 billion, and the divergence is growing. So what has happened?

Tether’s market capitalization has surged to a record $90 billion, while Circle’s has dumped to just over $24 billion. Tether now commands a stablecoin market share of almost 70%, whereas Circle’s has shrunk to just 18%.

On December 5, General Partner at Dragonfly Rob Hadick commented on this divergence, including trading volumes.

He noted that USDT volumes are nine times more than those for USDC, which “makes it clear how these tokens are just serving different use cases today.”

“Traders outside of the regulated US/UK firms and increasingly retail in emerging markets are actually using USDT as a mechanism to transact.”

USDC’s primary use case today looks to be far more about holding value or flight to safety for US-based firms, he said

Read more: Crypto Portfolio Management: A Beginner’s Guide

This is a “significantly more bullish story for USDT,” which is being used across the world for dollar transactions, he added.

Circle has made several moves into Asian markets such as Singapore and Japan. However, it is still viewed as a US institutional stablecoin, and usage is restricted as such. On the other hand, Tether has become the retail stablecoin for emerging markets wanting dollar liquidity.

As Uncle Sam tightens the screws on crypto companies, the winners will be the ones that shift objectives abroad. The loser will be the United States itself.

Stablecoin Ecosystem Outlook

The leading two stablecoins command a combined market share of 88%, leaving little room for alternatives.

The once competitive Binance USD (BUSD) was crushed by US regulators and now has 1.2% of the market as it gets phased out.

Decentralized DAI is the third largest stablecoin, with 5.3 billion in circulation and a market share of 4%.

Coming in fourth place is True USD (TUSD), with 2.8 billion circulating, giving it a share of just over 2%. The rest are minnows in comparison with under a billion in market capitalization.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.