Ethereum (ETH) price has traded above $1,750 since May 12, 2023, making a series of higher lows along the way. With ETH price volatility rising in the past week, can the bulls push the rally into a new gear to break above the critical $2,000 milestone?

Ethereum has struggled to break above the critical $2,000 milestone since the eventful week that followed the Shappela Upgrade in April. However, on-chain metrics suggest crypto investors are now making bullish moves to prepare for the next rally.

Here’s how the persistent decline in ETH Supply on Exchanges and the accumulation trend among crypto whales could impact Ethereum price in the coming days.

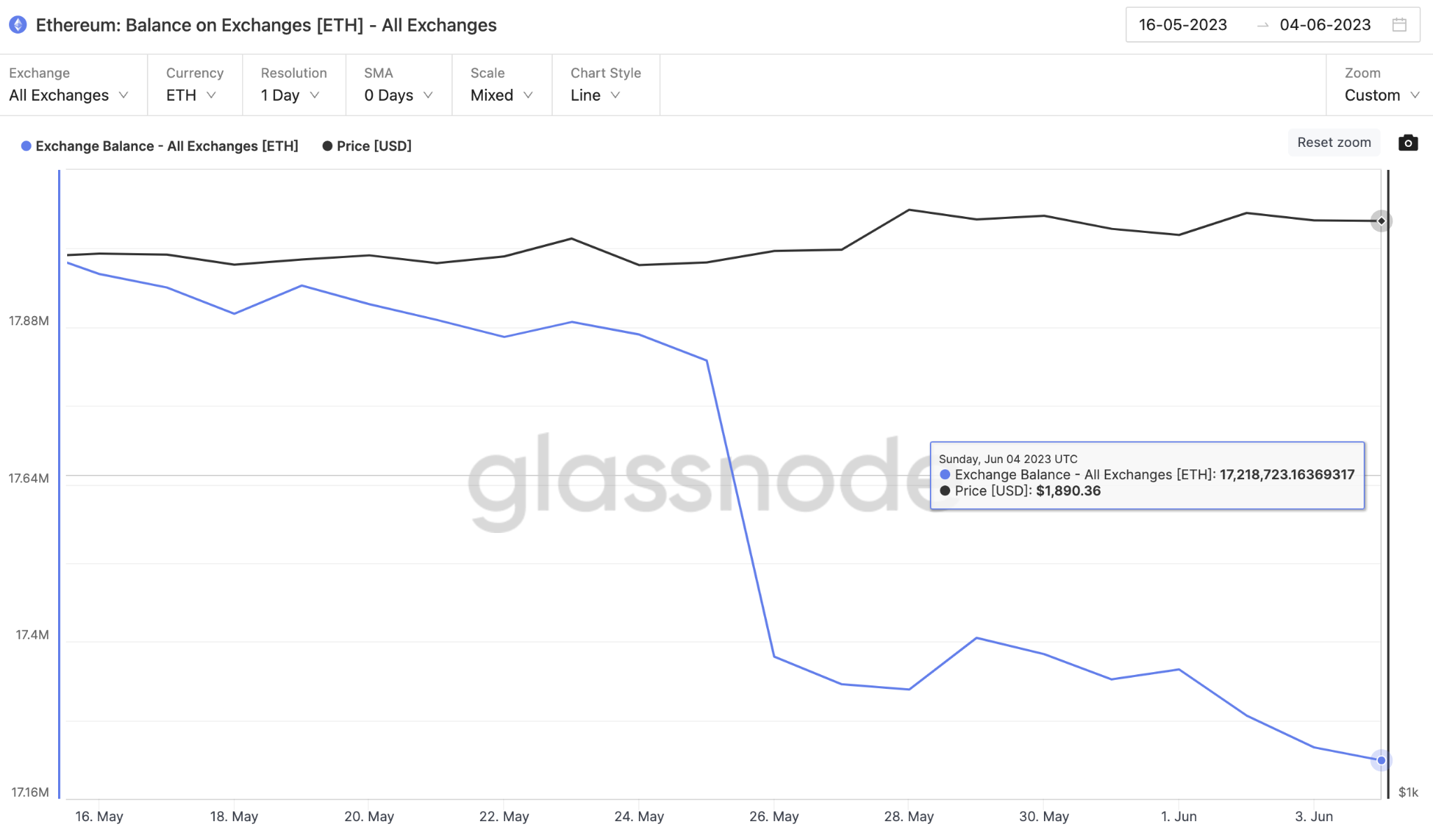

Ethereum Supply on Exchanges Hits 5-year Low

Since the successful completion of the Merge, ETH investors have been increasingly moving their coins off exchanges. While some are of opting for long-term self-custody options, a large percentage are seeking passive income opportunities that ETH now offers as a full-fledged staking platform,

This trend appears to have been exacerbated in the past week as investor withdrawals have seen ETH balance on exchanges plummet to new lows.

The Supply on Exchanges metric, otherwise called Balance on Exchanges, tracks the total amount of a particular cryptocurrency deposited in recognized crypto exchange wallets.

As of June 5, 2023, it sits at 17.2 million ETH, its lowest since March 2018. The chart below shows how crypto investors moved about 700,000 ETH out of exchanges between May 22 and June 5.

When investors withdraw coins from exchanges, it is expected to impact the price for a few reasons positively. Firstly, it reduces the number of coins available on exchanges to fulfill market orders.

This drastic drop in market supply across crypto exchanges often forces buyers to offer higher prices as they compete for the fewer available coins.

Secondly, when investors move tokens from exchange wallets into DeFi Staking smart contracts, they help secure the network and provide much-need liquidity to projects built on the blockchain.

The drop in market supply caused by this drastic drop in exchange balances will likely amplify Ethereum’s next price rally.

Bigger Whales Are Buying Out The Smaller Whales

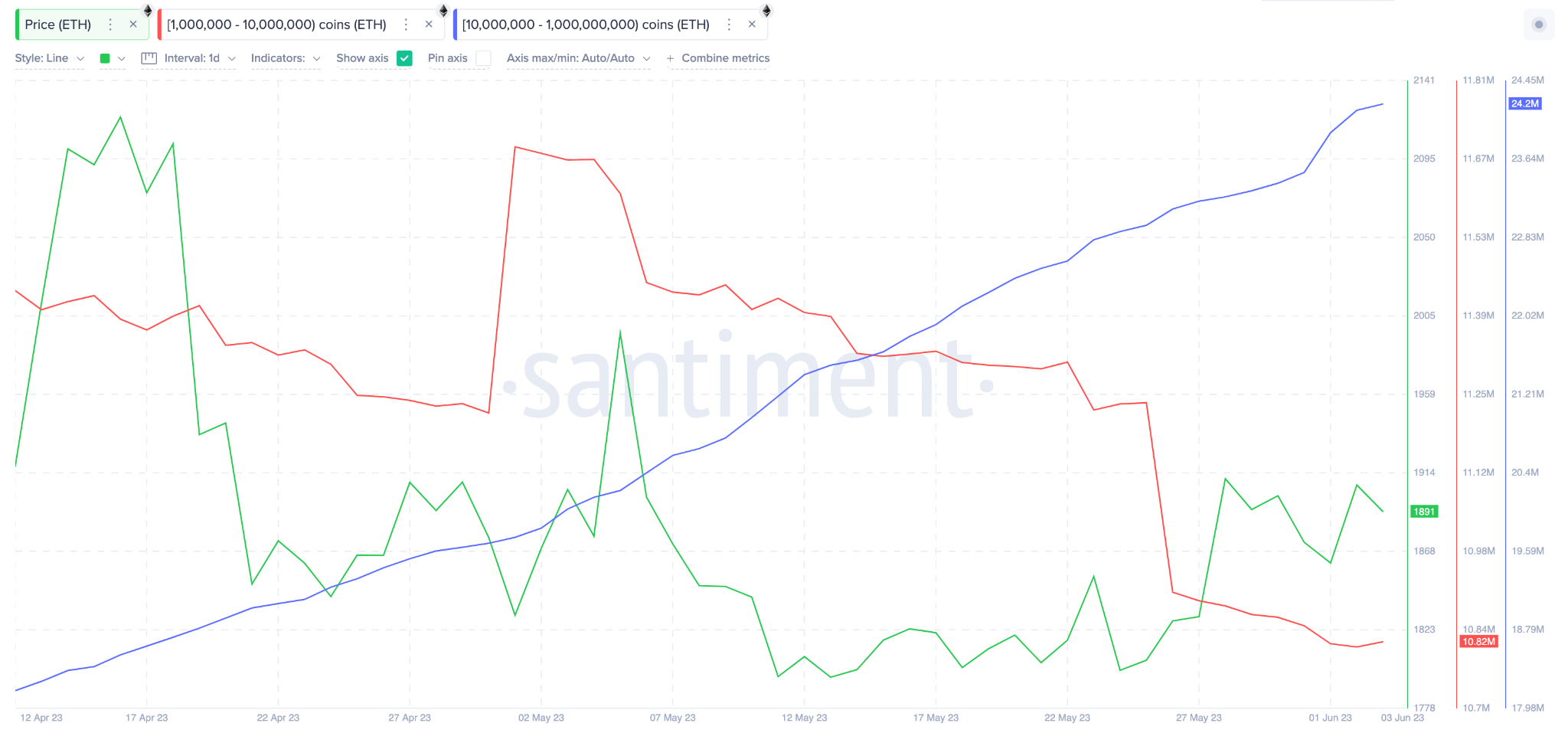

On a more bullish note, on-chain data depicts that while smaller institutional investors have sold, ETH coins seem to be flowing into the hands of the largest investors.

The chart below shows that the cluster of whales (red line) holding 1 million to 10 million ETH sold 500,000 coins between May 22 and June 5.

Meanwhile, investors (blue line) with 10 million to 1 billion ETH in their balances have increased their holdings by 1.62 million ETH during the same period.

Concisely put, Whales are large investors holding at least $100,000 worth of cryptocurrency. Due to their disproportionately high financial clout, their trading patterns significantly impact price movements.

The chart above shows two clusters of whale investors taking opposite trading positions on ETH. But as things stand, the cluster with the higher financial power appears to be buying up all the coins put up for sale and more.

Quite remarkably, the whale cluster gaining the upper hand is currently the largest in the Ethereum ecosystem. They could influence other retail and strategic investors to become bullish themselves.

In conclusion, considering the drastic drop in ETH market supply across exchanges, and the bullish trading activity among the largest whale cohort, Ethereum investors can anticipate more price gains in the coming weeks.

ETH Price Prediction: Clear Path to $2,000?

Considering the bullish activity among the whale investors, ETH price will likely head toward $2,000 in the coming weeks.

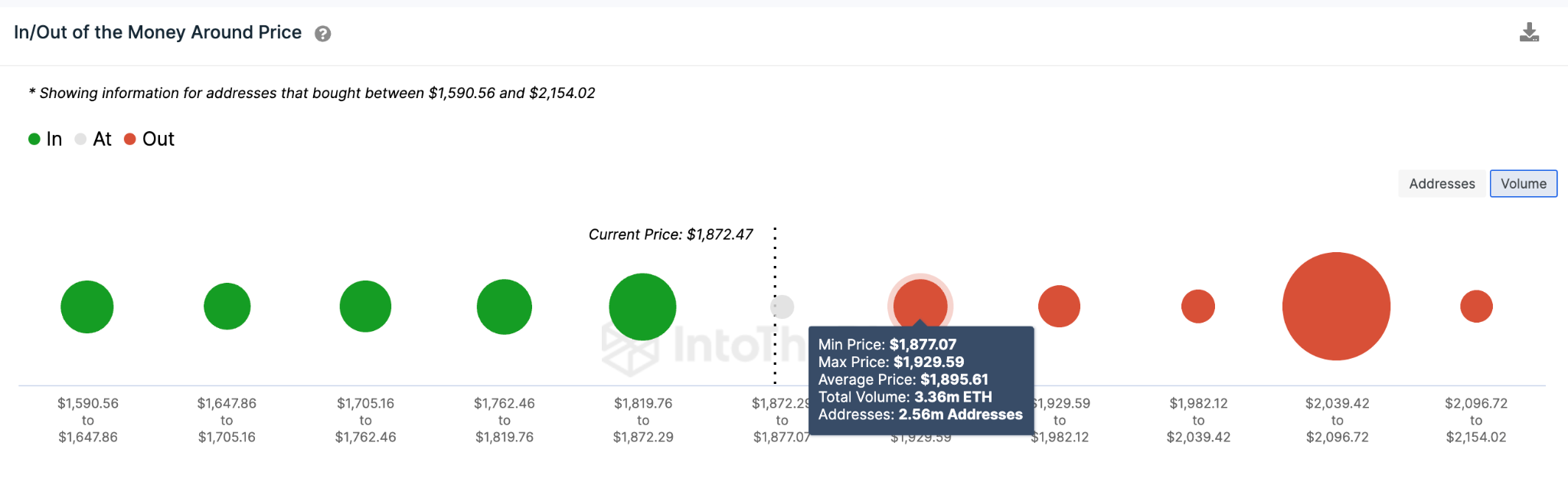

However, IntoTheBlock’s Global In/Out of The Money Around Price (IOMAP) data suggests that ETH will face an initial resistance of around $1,900.

As highlighted below, 2.56 million investors that bought 3.36 million ETH at an average price of $1,895 could sell when they break even.

However, if the bulls prevail, the price could rise further toward $2,050, as expected.

On the other hand, the bears could invalidate the bullish stance if Ethereum’s price unexpectedly drops below the critical $1,800 support zone.

But, the 3.76 million investors that purchased 3.55 million ETH at an average price of $1,797 will likely prevent that. Although unlikely, ETH could retrace further toward $1,700 if that support level does not hold.