If you want to read a summary of our most recent short-term EOS (EOS) price analysis and predictions click here.

If you’ve stumbled upon this page, you’re probably wondering whether or not the price of EOS is going up or down. This is difficult to assess because EOS is still a relatively new digital asset—its mainnet was initially released in June 2018.

Despite having a relatively limited data set from which to assess future price patterns, EOS does appear like it’s here to last. It raised over $4 billion in its ICO sale—the largest in history—and seen impressive growth in a very short period.

In this article, we perform a fundamental analysis of EOS. to assess the overall strengths, weaknesses, and competitive advantage compared to other digital assets. A technical analysis is also conducted to help isolate past EOS price patterns—which we apply in an attempt to predict future prices.

Lastly, we perform regular price analyses of many digital assets including EOS. We begin with our summary of our latest analysis:

Regular Price Analysis of EOS

At BeInCrypto, we offer regular price analyses and predictions of the most popular and relevant cryptoassets. We completed an analysis of EOS’s price fluctuations throughout March here. In addition, we predicted prices throughout April at the beginning of the month here. Below is a summary of our most recent short-term price analysis and predictions for EOS published on Apr 26, 2019:

After reaching highs of over $6 on Apr 10, the price of EOS trading inside a symmetrical triangle. At the time our last analysis was performed on Apr 24, the price of EOS was trading near the support line as seen below:

We predicted that EOS would begin moving toward the resistance line. Over the next several days, it has done so. AT 00:00 UTC on Apr 29, EOS was trading at nearly $4.90.

If price continues moving toward the resistance, $5 may be reached by May 1.

To read our full Apr 26 analysis of EOS/USD and EOS/EUR, click on the green button below:

We predicted that EOS would begin moving toward the resistance line. Over the next several days, it has done so. AT 00:00 UTC on Apr 29, EOS was trading at nearly $4.90.

If price continues moving toward the resistance, $5 may be reached by May 1.

To read our full Apr 26 analysis of EOS/USD and EOS/EUR, click on the green button below:

Fundamental Analysis

The EOS.IO platform is developed by block.one—a private blockchain company. Between June 26, 2017 and June 1, 2018, Block.one hosted an Initial Coin Offering (ICO) for the EOS token. This was an unusually long period for an ICO. Another unusual aspect was the amount of funds raised: During this period, EOS existed as an ERC-20 token. Following the sale, the EOS mainnet was launched. ERC-20 EOS tokens were converted to EOS coins and transferred to EOS.IO. The EOS platform is still in its infancy stage but has seen considerable adoption by dApp developers migrating their applications from the Ethereum blockchain and creating new applications specifically tailored to the EOS network.

However, EOS has also faced quite a bit of controversy despite its short existence. The centralized governance model has been highly criticized by proponents of decentralization. Furthermore, allegations of collusion have surfaced.

While EOS has grown tremendously in a short period, long-term growth is still to be determined.

The EOS platform is still in its infancy stage but has seen considerable adoption by dApp developers migrating their applications from the Ethereum blockchain and creating new applications specifically tailored to the EOS network.

However, EOS has also faced quite a bit of controversy despite its short existence. The centralized governance model has been highly criticized by proponents of decentralization. Furthermore, allegations of collusion have surfaced.

While EOS has grown tremendously in a short period, long-term growth is still to be determined.

A Controversial Consensus Protocol

Bitcoin (BTC) was designed with the theory of decentralization in mind. However, EOS is not Bitcoin. EOS is a cryptocurrency deployed on the EOS.IO network. The network, itself, is not decentralized like Bitcoin’s. On the contrary, the production of EOS, governance of the network, development of the protocol, and maintenance of the platform have been centralized by the EOS Foundation and its associates.

Second Generation EOS

EOS.IO is a second generation cryptoasset. This means that EOS.IO integrates smart contract functionality into the network to allow the development of decentralized applications (dApps). Other second generation digital assets include Ethereum (ETH), TRON (TRX), Cardano (ADA), NEO (NEO), Steem (STEEM), Waves (WAVES), NEM (NEM), and several others.Delegated Proof-of-Stake

Bitcoin’s novelty is that it allows peer-to-peer (P2P) financial transactions without the need for banks, financial institutions, or third-party intermediaries. To do this, Bitcoin’s blockchain uses a consensus protocol called Proof-of-Work. Problems with Proof-of-Work (PoW) led to the development of other consensus algorithms including Proof-of-Stake (PoS). EOS implements an amended form of PoS called delegated PoS (DPoS). In this system, individuals who own EOS tokens are able to stake their tokens for the ability to cast votes for up to 30 different block producers. The 21 highest voted block producers on the EOS network are the ones who act as consensus representatives and have the responsibility of verifying on-chain transactions. These block producers are then rewarded in a weighted percentage of EOS tokens based on their position.

The 21 highest voted block producers on the EOS network are the ones who act as consensus representatives and have the responsibility of verifying on-chain transactions. These block producers are then rewarded in a weighted percentage of EOS tokens based on their position.

The Rich Grow Richer

The production of EOS becomes centralized around a limited number of wealthy stakeholders. In short, the rich grow richer just like in PoW and other versions of PoS including Proof-of-Importance. The POA Network has introduced Proof-of-Authority (PoA) to possibly solve this problem.Accusations of Collusion

In late Sept 2018, accusations of collusion between EOS block producers was reignited. A spreadsheet on Eosauthority.com documents the co-relation of each of the block producer’s votes based on voting weight. It suggests that Chinese producers regularly voted for one another—further centralizing the production of EOS into the hands of a few, wealthy whales. Block.one (EOS’ parent company) CEO Brendan Blumer has neither confirmed nor denied these allegations at the time of writing this article.

All of this negative attention came only days after news that several founding Block.one executives and software developers had left the company to form a new venture called StrongBlock.

Block.one (EOS’ parent company) CEO Brendan Blumer has neither confirmed nor denied these allegations at the time of writing this article.

All of this negative attention came only days after news that several founding Block.one executives and software developers had left the company to form a new venture called StrongBlock.

Buying Accounts

EOS has also created a barrier to entry which may impede usage. In order to hold and use EOS tokens, users must purchase an EOS account. However, users who had an account prior to the launch of the EOS mainnet are spared this cost. The cost is not high, however, and has dropped over time. Furthermore, the reason for the account of had not purchased any EOS before the mainnet launch needs to purchase an account to be able to hold their tokens — and only an existing member can create a new account.Airdrops Galore

Despite these apparent weaknesses, EOS offers a number of strengths. For example, EOS.IO includes a protocol which allows dApps developed on the network to airdrop tokens to EOS users.About Airdrops

Airdrops emerged as part of the ICO model. At first, entities developing dApps would offer users tokens for completing certain tasks like sharing posts on social media, writing blog articles, or joining a Telegram group. These tokens would be distributed—or airdropped—on a future date. The earliest ICOs to implement airdrops were for dApps built on the Ethereum network. Thus, the earliest airdropped tokens were ERC-20 tokens. Theoretically, once the ERC-20 token was listed on an exchange, the airdropped tokens could be sold. For completing relatively simple tasks, users were offered a possible reward.

Of course, there were also many scams during this period, and many airdropped tokens never made it to an exchange. Some that have are now worthless.

Theoretically, once the ERC-20 token was listed on an exchange, the airdropped tokens could be sold. For completing relatively simple tasks, users were offered a possible reward.

Of course, there were also many scams during this period, and many airdropped tokens never made it to an exchange. Some that have are now worthless.

EOS Airdrops

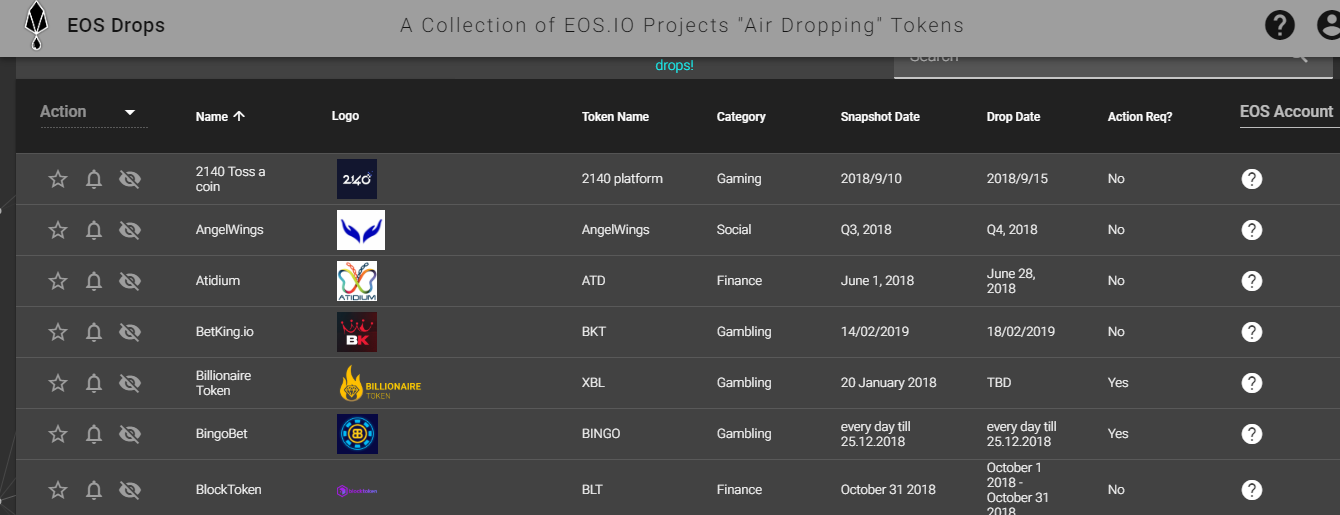

EOS.IO has continued this model. Many airdrops having been completed since the launch of the network in June 2018. A number of sites track EOS airdrops including eosairdrops.io: While there may be a small cost for opening an EOS account, the airdrops promise rewards that may do more than just recoup the cost. These airdrops could lead to heavy profits for those who participate.

While there may be a small cost for opening an EOS account, the airdrops promise rewards that may do more than just recoup the cost. These airdrops could lead to heavy profits for those who participate.

Winning the dApp Race?

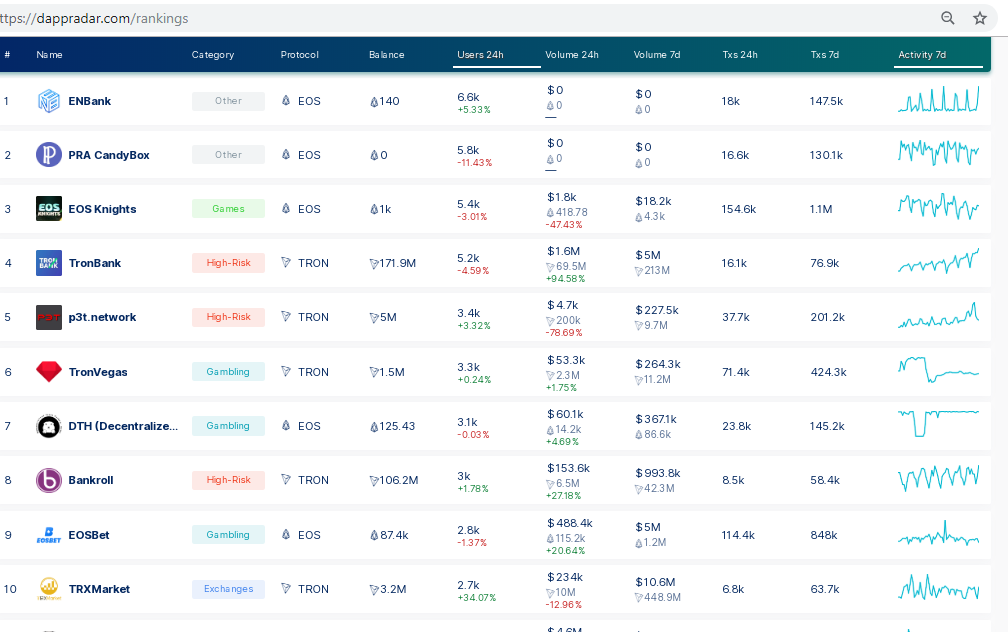

The usage of dApps is measured by several different sources. Typically, these sources focus on dApps deployed on a few specific second-generation cryptoasset platforms. For example, Dapp Radar ranks dApps deployed on Ethereum (ETH), Tron (TRX), and EOS. At the time of writing on Mar 31, three of the top ten dApps listed on Dapp Radar were deployed on EOS. Tron (TRX) appears as a possible contender, but Ethereum has only one dApps in the top twenty-five It appears that EOS is a current leader in the dApp race.

It appears that EOS is a current leader in the dApp race.

Technical Analysis

On Apr 30, 2018, the price of EOS reached a high of almost $24. Since then, it has experienced a gradual decrease. Price losses intensified in late 2018. By Dec, EOS was reaching lows around under $2. Over of EOS’s 90% value was lost in less than eight months.

Original Crash

In order to predict possible long-term prices in the future, an analysis of the previous downtrend is necessary. We will be searching for possible patterns that might continue into the future. In order to better visualize large price increases and decreases, all the charts in this analysis will be presented in the logarithmic form. The price of EOS in Bitfinex is analyzed at one-day intervals from Jul 2017 to Mar 2019. The price opened at $1.2 on Jul 1, 2017, before making a high of $5.48 on Jul 3.

A sharp decrease ensued, which took the price down to $0.50 by October 2017. Measuring the drop from the $5.48 high to the $0.50 low amounts to a loss of 91%.

Afterward, a rapid increase ensued, and on Dec 2017, the price reached a high of $12.50. Measuring the move from the $0.50 low to the $12.50 high amounts to a 2160% increase.

An interesting observation of this period is the fact that all three moves took similar lengths (60 days) to materialize.

The 1:1:1 ratio between these three successive moves will be used later to make a prediction about the price of EOS in 2019-2020.

The rate of decrease from the $5.48 high to the $0.5 low is 91%, while the rate of increase from the $0.50 low to the $12.5 high is 2167%.

The price opened at $1.2 on Jul 1, 2017, before making a high of $5.48 on Jul 3.

A sharp decrease ensued, which took the price down to $0.50 by October 2017. Measuring the drop from the $5.48 high to the $0.50 low amounts to a loss of 91%.

Afterward, a rapid increase ensued, and on Dec 2017, the price reached a high of $12.50. Measuring the move from the $0.50 low to the $12.50 high amounts to a 2160% increase.

An interesting observation of this period is the fact that all three moves took similar lengths (60 days) to materialize.

The 1:1:1 ratio between these three successive moves will be used later to make a prediction about the price of EOS in 2019-2020.

The rate of decrease from the $5.48 high to the $0.5 low is 91%, while the rate of increase from the $0.50 low to the $12.5 high is 2167%.

A Closer Look

The price of EOS in Bitfinex is analyzed at one-day intervals from Jul 2017 to Jan 2018. After the Jul 2017 high, the price gradually decreased to $1.25 on Sep 2017. It revisited the same level three times before breaking down. Tracing these lows gives us a horizontal resistance line. The support line can act as a floor to price, preventing further downward movement. It is unlikely that the price will move below this level unless a breakdown occurs.

The price broke down from the $1.25 level of support in September 2017.

It made a bottom of $0.50 in October of the same day

Afterward, the former support area turned to resistance, before the price ultimately broke out.

After the breakout, the price reached a high of $11.50 in December 2017.

The support line can act as a floor to price, preventing further downward movement. It is unlikely that the price will move below this level unless a breakdown occurs.

The price broke down from the $1.25 level of support in September 2017.

It made a bottom of $0.50 in October of the same day

Afterward, the former support area turned to resistance, before the price ultimately broke out.

After the breakout, the price reached a high of $11.50 in December 2017.

Current Crash

The price of EOS in Bitfinex is analyzed at one-day intervals from Jul 2017 to Mar 2019 The price reached a high of $23.5 on April 2018. A gradual drop ensued, which took the price to $5. After a period of stabilization, the price broke down and made a bottom at $1.6 on Dec 2018. Similar to the 2015 crash, the loss measured from the high to the bottom was 91%. Since the high to the low loss was nearly identical, we can make the assumption that the following rate of increase on the upward move will be near the same. However, we are basing this on two correlating events. This does not necessarily indicate a pattern—but it does suggest a pattern is developing.

By applying this pattern to the future, we may not be accurate about future prices if the pattern does not hold true. However, if the prices predicted are validated, then we the pattern identified above will also be validated—meaning it could be consistently applied to predict future price increases.

Therefore, we will apply the 2260% rate of increase to the $1.2 bottom and find a high of $40.

Since the high to the low loss was nearly identical, we can make the assumption that the following rate of increase on the upward move will be near the same. However, we are basing this on two correlating events. This does not necessarily indicate a pattern—but it does suggest a pattern is developing.

By applying this pattern to the future, we may not be accurate about future prices if the pattern does not hold true. However, if the prices predicted are validated, then we the pattern identified above will also be validated—meaning it could be consistently applied to predict future price increases.

Therefore, we will apply the 2260% rate of increase to the $1.2 bottom and find a high of $40.

EOS Price Prediction 2019

The price of EOS in Bitfinex is analyzed at one-day intervals from Mar 2018 to Mar 2019 After reaching a high of $23.3 on Apr 2018, the price gradually dropped to $5 on Aug 2018. It has revisited the same level twice since. Tracing these highs gives us a horizontal support line. The support line acts as a floor to price, preventing further downward movement. It is unlikely that the price moves below this line unless a breakdown occurs.

A breakdown for EOS occurred on Nov 2018.

We are going to use the 1:1:1 ratio found from the 2017 crash in order to make an assumption about the duration of the moves in 2019 and beyond.

Since we are operating under the assumption that the price will closely follow the 2017 crash, we predict that the price will move in three phases which will be of the same length. Since the drop from the Apr high of $23.5 to the Oct low of $5 took 200 days, we predict that it will take 200 days to break out from $5 and 200 days to move to a high of $40.

Therefore, a $40 high should occur around December 2019.

The support line acts as a floor to price, preventing further downward movement. It is unlikely that the price moves below this line unless a breakdown occurs.

A breakdown for EOS occurred on Nov 2018.

We are going to use the 1:1:1 ratio found from the 2017 crash in order to make an assumption about the duration of the moves in 2019 and beyond.

Since we are operating under the assumption that the price will closely follow the 2017 crash, we predict that the price will move in three phases which will be of the same length. Since the drop from the Apr high of $23.5 to the Oct low of $5 took 200 days, we predict that it will take 200 days to break out from $5 and 200 days to move to a high of $40.

Therefore, a $40 high should occur around December 2019.

EOS Price Prediction 2020

In order to find the rate of increase of the second upward move, we will measure the difference from the $0.5 bottom to the second high at $23.3, instead of the first one. The entire move amounts to an increase of 4700%. Using the same rate of $4700 applied to the $1.50 bottom, we found a high of $85.

Furthermore, we are operating under the assumption that the moves from the 2017 and this crash will have the same relative length.

Therefore, since the move from the first to the second high, $12.5 to $23.3 took 131 days, the future move from the first to the second high will take 390 days.

So, an $85 high for EOS should occur around the end of 2020—according to this pattern.

Using the same rate of $4700 applied to the $1.50 bottom, we found a high of $85.

Furthermore, we are operating under the assumption that the moves from the 2017 and this crash will have the same relative length.

Therefore, since the move from the first to the second high, $12.5 to $23.3 took 131 days, the future move from the first to the second high will take 390 days.

So, an $85 high for EOS should occur around the end of 2020—according to this pattern.

Summary of Analysis

There are several similarities between the 2017 and current crash, namely the amount of decrease and increase and the length of time it took to generate the downward and upward moves. The following predictions are made with the assumption that price will follow the pattern laid out in the previous crash:- The price will be between $35 and $45 in Dec 2019

- The price will be between $75-$85 in Dec 2020.

Conclusion

EOS has seen some of the largest gains during 2017 and 2018, but past rarely if ever predicts future in the cryptocurrency or traditional markets. EOS’s blockchain has great aspirations and it certainly has a lot of potential, but it is important to keep in mind that its blockchain governance model is experimental and still in the infancy stages of development. EOS could be a great investment for those looking to add higher risk and reward assets to their portfolios, while those looking for safer bets might have greater success elsewhere. The success of EOS as a blockchain and its worth as a cryptocurrency will depend on the success and quality of the dApps built on it as well as the team’s ability to remain transparent and listen to the community’s wants and needs. What do you think of our price prediction for the EOS cryptocurrency in 2019? Let us know your thoughts in the comments below! [Disclaimer: The contents of this article are not intended as financial advice, and should not be taken as such. BeInCrypto and the author are not responsible for any financial gains or losses made after reading this article. Readers are always encouraged to do their own research before investing in cryptocurrency, as the market is particularly volatile. Investing in EOS is risky.]

Top crypto platforms in the US

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Alexander Fred

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

READ FULL BIO

Sponsored

Sponsored