Bitcoin (BTC) was developed as a decentralized digital currency. Using a Proof-of-Work (POW) consensus algorithm, BTC theoretically was supposed to remove the need for financial institutions to act as intermediaries between peer-to-peer transactions.

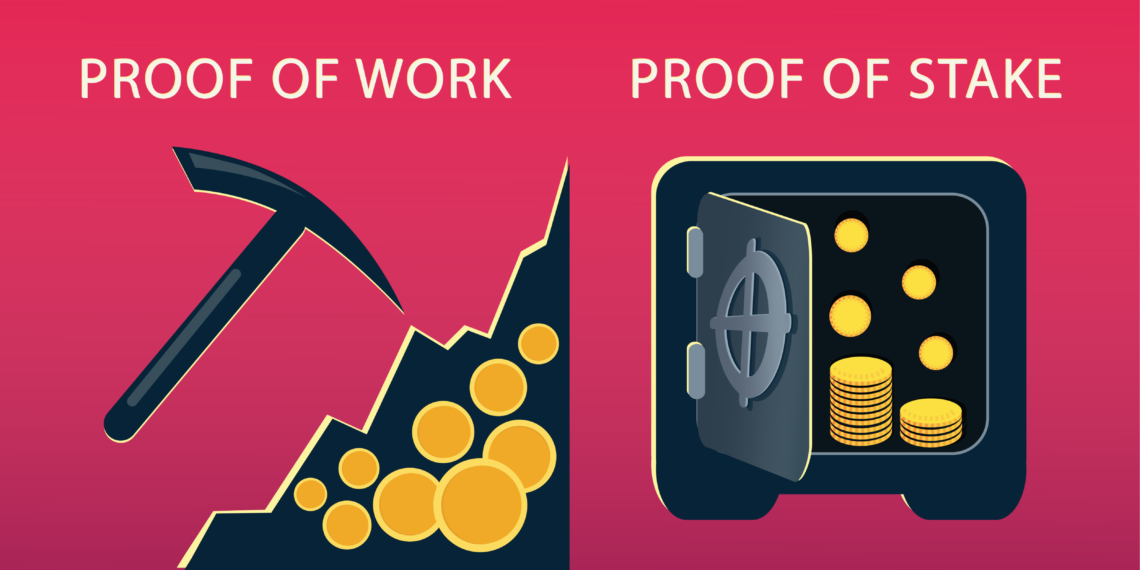

Over time, however, mining led to forms of centralization which began to favor the rich. Alternatives to PoW have been sought, but many of them, including Proof-of-Stake (PoS) and Proof-of-Importance (PoI), have the same problem, in that they offer rewards to users based on their overall level of wealth on the network in question.

What is a Consensus Algorithm?

Cryptocurrency and other cryptoassets use consensus algorithms to function. A consensus algorithm contains two components:- Algorithm: A mathematical equation that must be properly solved to add transactions to distributed ledgers like blockchains.

- Consensus: A certain threshold of nodes on a network must confirm that an algorithm is solved correctly before transactions can be added to the ledger.

Proof-of-Work (PoW)

PoW was the first consensus algorithm developed. It is used by BTC and many other major cryptocurrencies and cryptoassets. Litecoin (LTC), for example, uses an amended form of PoW. There are multiple ways in which PoW can be integrated into a cryptocurrency, but the basic functioning of PoW remains essentially the same in each. A transaction is made on a network. It is gathered together with a series of other transactions. Nodes on the network compete against each other as miners. To mine means to properly solve the algorithm. Solving the equation hashes the transactions together as a single block onto the blockchain. Before the block can be hashed, however, a certain portion of the users on the network must confirm that the algorithm was solved correctly. The total number or percentage which is required to confirm a correctly solved algorithm differs based on the cryptocurrency. Whichever miner is able to solve the algorithm the fastest earns a reward. Currently, every successfully mined BTC block carries a reward of 12.5 bitcoins. Such a reward system inevitably privileges the rich and helps them grow richer.

Rich Miners Grow Richer

In order to for a miner to win a reward, they must mine faster than other miners. This means solving the algorithm first. After the birth of BTC, new technologies like application-specific integrated circuits (ASICs) developed specifically for mining BTC. They increased the speed at which algorithms could be solved so that mining with traditional CPUs became unfeasible. For some, the cost of mining would be greater than the total reward earned. The only people able to receive rewards for mining BTC were the rich, who were able to buy the technology needed for mining. As ASICS spread, industrial mining rigs were created which made solo mining on a personal computer nearly impossible. Furthermore, as the number of miners increased, centralized pools emerged. Miners incapable of mining at the rate needed to earn steady rewards alone began mining with others to increase their chances of successfully mining a block. Eventually, only the largest pools could successfully mine BTC. Some required large fees to join, while others were owned or sponsored by ASIC manufacturers like Bitmain. Amended PoW protocols have been developed by other cryptocurrencies to prevent ASIC operators, centralized pools, and mining rigs the power to gain centralized authority over the network. BTC, however, maintains the highest market capitalization and still appears the leader in the digital asset market. [bctt tweet=”While alternative and more egalitarian forms of PoW are emerging that might not favor the rich as heavily as BTC, none have yet attained BTC’s dominance.” username=”beincrypto”]Proof-of-Stake (PoS)

Looking beyond PoW for a more equitable consensus algorithm began shortly when Peercoin (PPC) merged PoW with PoS to create the first PoW/PoS protocol. Several attempts at a pure PoS system were attempted with NXT (NXT) often considered most successfully. [bctt tweet=”While PoS did correct for some problems associated with PoW, it continued to favor the rich.” username=”beincrypto”] PoS uses staking instead of mining. The stake is based on the total amount of coins an individual has. For example, if Jack owned 10 million NXT tokens when NXT reaches its maximum supply of 1 billion tokens, he would have a 1 percent stake. Jane, however, might own 100 million NXT Tokens, which would give her a 10 percent stake. The stake one has in the cryptocurrency is the probability they will be selected to discover the next block. While Jack will have a 1 percent chance to mine a block, Jill will have a 10 percent chance. This means that Jane will have a better chance of winning the reward because she is richer than Jack. Just as with PoW, the rich get richer because they have more resources, to begin with. There are many amended versions of PoS that are being suggested to overcome this problem. Proof-of-Authority (PoA) uses a person’s identity as authority to be staked. The person with the highest authority has the highest chance of discovering a block. How exactly authority is determined is based on a number of factors other than wealth. PoA is one of several amended versions of PoS. While some of these may help transform PoS into a more egalitarian protocol, standard PoS is developed as if to inherently privilege the rich.

Proof-of-Importance (PoI)

NEM (XEM) noticed this problem and introduced PoI as an alternative to PoW and PoS. Like PoA, PoI attempts to draw from a number of sources other than wealth. Nonetheless, wealth appears to be the most important criterion to successfully harvest blocks and receive rewards. Harvesting could be considered the PoI alternative to mining and staking. Every node’s total XEM is divided into two categories. Unvested XEM includes all newly purchased XEM. Every day, 10 percent of a node’s unvested XEM will become vested. As well, 10 percent of a user’s total unvested balance will become vested every 1,440 blocks. In order to harvest, a node must have a minimum of 10,000 vested nodes. This means that accounts with more unvested NEM will become vested more quickly than accounts with less XEM. Furthermore, whenever 1,440 blocks are reached, users with more unvested XEM will receive a greater amount of vested XEM. Those who have the wealth to purchase greater amounts of XEM remain privileged using PoI because they will be able to garner the largest amount of vested XEM the fastest in at least two ways. For example, if Jack purchases 100,000 XEM, he will have 10,000 vested XEM a day after it is sent to his account. However, if Jill is only able to purchase 10,000 XEM, she is at a disadvantage. After one day, she will have 1,000 XEM and be unable to harvest XEM. Jack, on the other hand, may already be receiving rewards because he was able to buy more XEM than Jill. A day later, Jill will have 9,000 unvested XEM. 10 percent of this new total, not the original purchase, will become vested. She will have 1,900 vested XEM and 8,100 unvested XEM. Jack will still be receiving possible rewards from which Jill is excluded. Jack gets richer because he was already rich, while Jill will never be able to receive rewards unless she buys more XEM. The balance of unvested XEM will never reach 0, which means that if anyone wants to harvest XEM, they must be able to buy more than 10,000 XEM. Even if this occurs, however, the highest investors will continue to receive the largest rewards over the longest period.Conclusion

One benefit of PoI is that it allows an individual to determine how much money is required in order to begin receiving rewards. Nonetheless, NEM’s PoI still favors the rich just as PoW and standard PoS. Amended forms of these algorithms may be able to create more egalitarian reward-systems. Other consensus algorithms may need to be developed with the purposeful intention of removing rewards offered to the rich because of their wealth. What alternatives to PoW, PoS, or PoI do you think could possibly create a reward system that is equal to both rich and poor alike?

What alternatives to PoW, PoS, or PoI do you think could possibly create a reward system that is equal to both rich and poor alike?

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Alexander Fred

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

Global AI, Data Science, and Blockchain expert. Alexander writes for BeInCrypto where he completes technical analyses of various alt-coins and qualitative commentary and analysis about various cryptoassets and their potential for social integration.

READ FULL BIO

Sponsored

Sponsored