EOS (EOS) is a blockchain platform for creating and deploying decentralized applications (dApps), similar to Ethereum (ETH) or TRON (TRX).

The project has certainly garnered a great deal of controversy in its relatively short lifetime.

EOS’s one-year initial coin offering (ICO) period raised more than $4 billion, making it the biggest ICO in history and left investors skeptical to the reasons the team needed to raise so much money. The chain also has a questionably centralized governance model which many believe disqualifies EOS from being an actual cryptocurrency.

EOS reached an all-time high of $23 in May of this year as hype built up to its mainnet launch which was scheduled for early June 2018.

Despite having a five-month head start, EOS still succumbed to the bear market and lost more than 92 percent from its high, trading last week at a 2018 low of just $1.80. At the time of writing, EOS is trading for $2.68 and recently overtook Stellar (XLM) and Bitcoin Cash (BCH) to settle in the rank-four position with a total market cap of $2.4 billion.

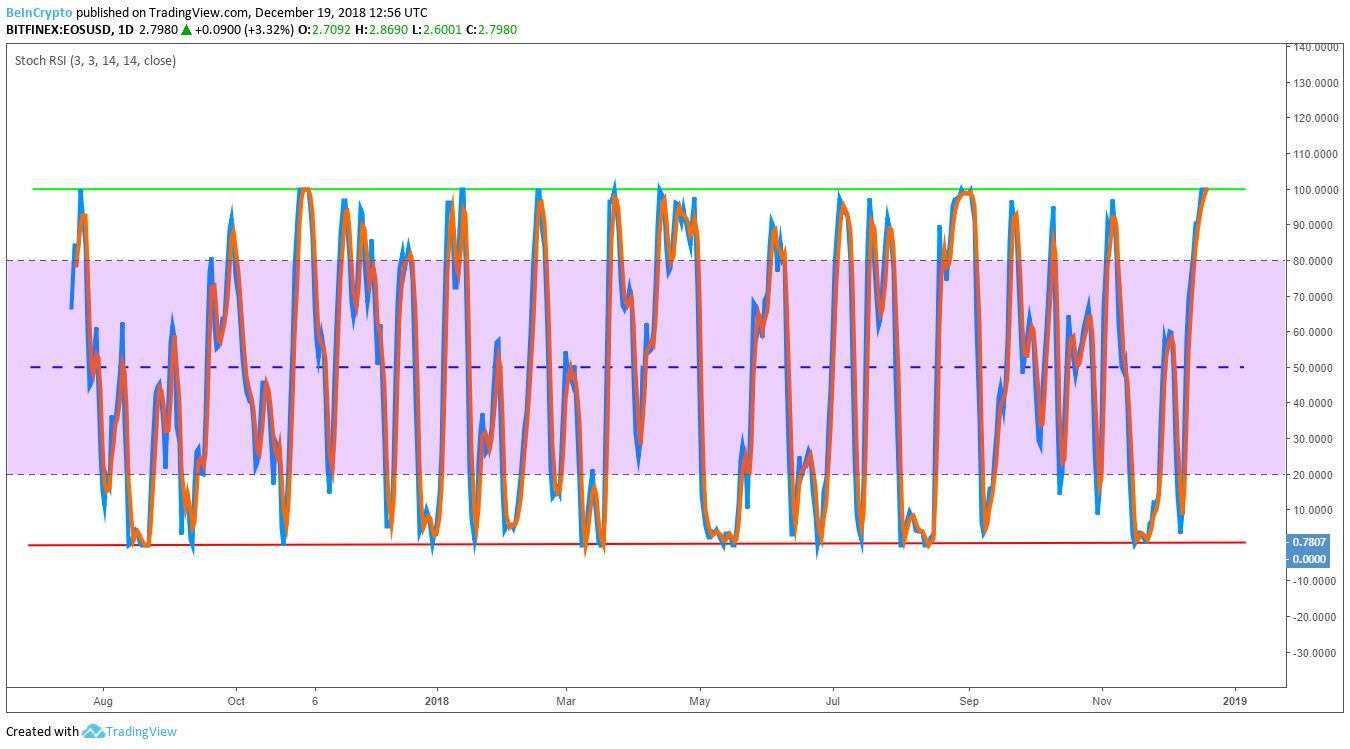

Stochastic RSI

The stochastic relative strength index (RSI) shows that EOS’s recent pump has brought the value far into the overbought territory. With a stochastic RSI of 100, a slight sell-off is almost guaranteed in the next few days to allow for some consolidation and time for EOS to cool off and recharge for another surge.

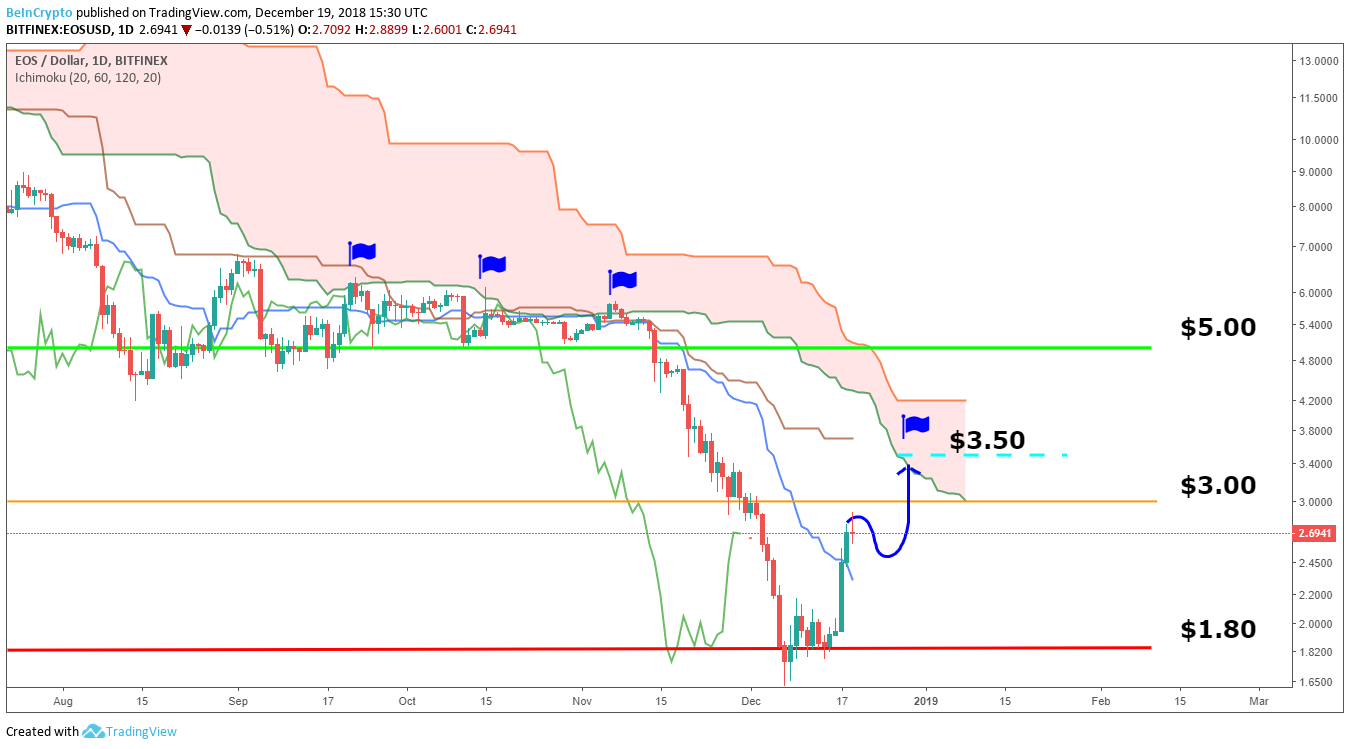

Ichimoku Cloud

The Ichimoku Cloud is a great indicator to help determine areas of resistance and support and can be seen below in pink. The lower level of the cloud normally acts as an area of heavy resistance. In the past three months, the EOS price has been caught between the $5 support and the bottom of the cloud, shown as blue flags below. After the third rejection, the $5 support fell apart causing the price to plummet back below $2. It is likely that, after some consolidation, the next run will target the bottom of the cloud in the range of $3.50 to $3.75.

Making Gains

Since this past Saturday, EOS has been in the green, blasting off by 56 percent before coming under resistance at the 0.236 Fibonacci level. Considering the stochastic RSI and the resistance levels above, EOS looks to be quickly losing steam. After some cooling off, EOS should be ready to smash through the $3 resistance to test the 0.382 or 0.5 Fibonacci level just under the descending resistance (diagonal pink). Traders should be cautious with entering positions after a 56 percent pump. A long position may be considered after confirmation of correction, depending on each individual’s risk allowance and trading strategy. Do you think EOS will ever make a new all-time high? Will the altcoin close below $1.80 again? Let us know your thoughts in the comments below!

Disclaimer: The contents of this article are not intended as financial advice, and should not be taken as such. BeInCrypto and the author are not responsible for any financial gains or losses made after reading this article. Readers are always encouraged to do their own research before investing in cryptocurrency, as the market is particularly volatile. The author of this article does hold EOS.

Do you think EOS will ever make a new all-time high? Will the altcoin close below $1.80 again? Let us know your thoughts in the comments below!

Disclaimer: The contents of this article are not intended as financial advice, and should not be taken as such. BeInCrypto and the author are not responsible for any financial gains or losses made after reading this article. Readers are always encouraged to do their own research before investing in cryptocurrency, as the market is particularly volatile. The author of this article does hold EOS.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.

Kyle Baird

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

Kyle migrated from the East Coast USA to South-East Asia after graduating from Pennsylvania's East Stroudsburg University with a Bachelor of Science degree in 2010. Following in the footsteps of his grandfather, Kyle got his start buying stocks and precious metals in his teens. This sparked his interest in learning and writing about cryptocurrencies. He started as a copywriter for Bitcoinist in 2016 before taking on an editor's role at BeInCrypto at the beginning of 2018.

READ FULL BIO

Sponsored

Sponsored