The selling pressure on Polygon (MATIC) increases as Celsius moves over 25.76 million tokens to Binance and Crypto.com.

MATIC became the center of attention when it crossed $1 in December 2023. However, the price has since struggled, and it’s down over 25% from the local top.

Large Entity Causes MATIC Deposit Surplus on Centralized Exchange

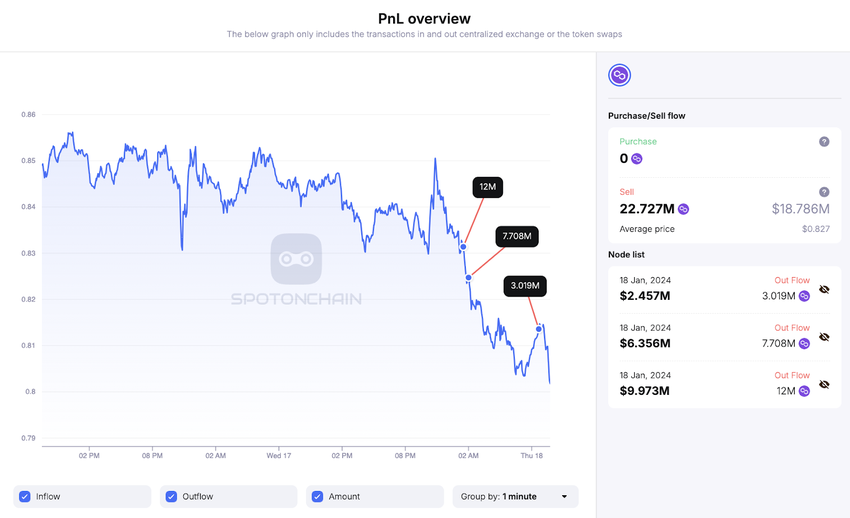

The on-chain analysis platform Spotonchain shows that Celsius has been depositing funds to centralized exchanges such as Binance and Crypto.com. Specifically, the entity address deposited 22.73 MATIC worth $18.79 million to Binance and 3.02 coins worth $2.47 million to Crypto.com.

Read more: How To Buy Polygon (MATIC) and Everything You Need To Know.

After the deposit to centralized exchanges, the Celsius addresses still hold 34.08 million MATIC, worth $27.88 million based on the current market price.

The screenshot below shows that the MATIC price has dropped after each deposit from Celsium. This indicates the probability of Celsius selling the tokens after sending them to centralized exchanges.

Moreover, on Wednesday, BeInCrypto reported that an on-chain analysis platform has raised concerns about Polygon Foundation’s allocation of MATIC tokens. Amidst these controversies, the token’s price is down by over 25% from its local top of $1.09.

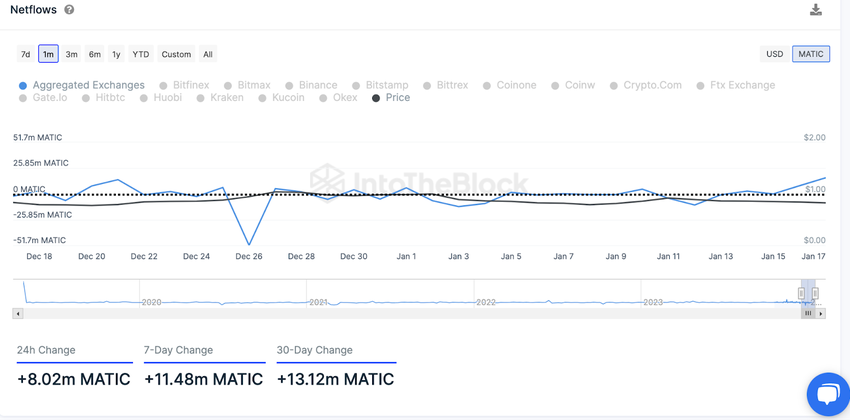

The screenshot below shows that there has been a MATIC deposit surplus on centralized exchanges lately. In the past seven days, the balance of MATIC tokens in centralized exchanges increased by 11.48 million.

Nonetheless, technical analysts anticipate that MATIC is strong in the higher time frames. Analyst @Moneytaur_ believes the $0.55 price range is a higher time frame (HTF) buy opportunity.

“HTF structure isn’t broken yet, so it’s a level to consider for later (set alerts near & chill) rather than short-term unless BTC closes HTF < level, which would increase the probability for $0,55 on MATIC quite a bit,” elaborated @Moneytaur_.

Read more: A Comprehensive Guide on Tracking Smart Money in the Crypto Market

In conclusion, MATIC transfers to exchanges from Celsius entity wallets may increase selling pressure. Meanwhile, concerns over Polygon Foundation’s token allocation persist. Analysts cautiously eye $0.55 for a potential MATIC buying opportunity amidst ongoing market intricacies.