The Polygon Foundation recently found itself at the center of a controversy surrounding the allocation of its MATIC tokens.

Detailed analysis by ChainArgos raised significant questions about the adherence of Polygon’s token distribution to its publicly stated plan, especially regarding the launchpad sale and staking tokens.

Polygon’s Suspicious Activity

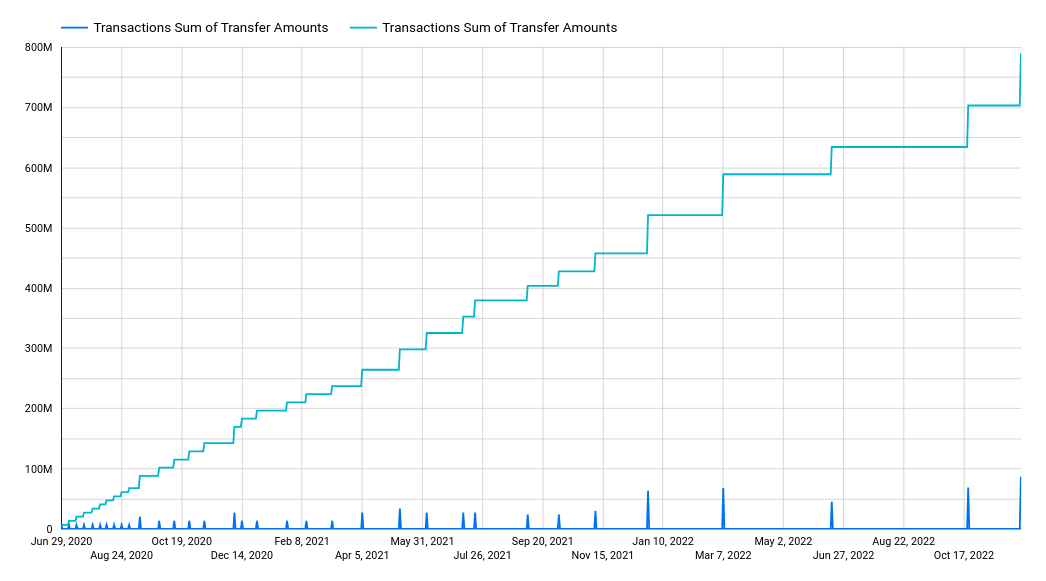

A ChainArgos investigation revealed anomalies in the Polygon Foundation’s token flows. A notable observation was the unusual pattern of outflows from a “vesting contract” responsible for unlocking token flows. Additionally, the foundation’s contract, which ostensibly manages both the foundation’s operations and token allocations, displayed irregular outflows.

The analysis took a deeper dive into the foundation’s outflows, with the top entry of 1.2 billion MATIC tokens seemingly aligning with the launchpad initiative. However, it was the staking contract flows that raised eyebrows.

The allocation table indicated a flow from 400 million to 1.2 billion MATIC, but actual data depicted a different story. The discrepancy of 400 million tokens appeared to be channeled to an address labeled ‘Binance 33’ on Etherscan.

Read more: Tokenomics Explained: The Economics of Cryptocurrency Tokens

Potential MATIC Top Signal

The revelation that 400 million MATIC tokens were missing prompted further scrutiny. ChainArgos traced a flow of 300 million MATIC from the Binance 33 address to another address – 0x2f4ee. Additionally, 0x2f4ee received 467 million MATIC tokens from an address labeled “Matic: Marketing & Ecosystem.”

The involvement of the marketing and ecosystem wallet in these transactions added another layer of complexity as the address transferred a significant amount, 767 million MATIC, to Binance exchange wallets.

These findings represent a transactional volume of nearly a billion dollars, considering MATIC’s price range of $1 to $2. ChainArgos highlighted this as a clear collaboration between the team and Binance, bypassing the standard protocols of token distribution, which could result in a market top.

“This isn’t just some Binance-adjacent thing. The team and Binance are clearly working together to feed these tokens out the back, such as it is. As we are talking about 767 million tokens, this is something like a billion dollars,” analysts at ChainArgos said.

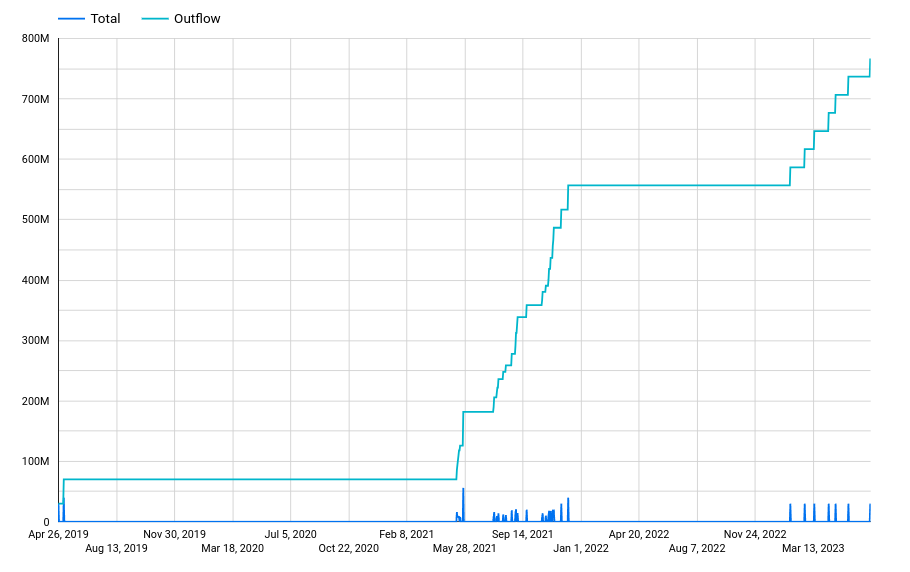

ChainArgos also shared a chart depicting the outflows from 0x2f4ee and asked the readers to compare it with the price action of the MATIC token. The chart shows that outflow from the address increased during March 2023. Interestingly, the price of MATIC hit a local high and plummeted by nearly 60% from March to June 2023.

Amid these revelations, Hermez Network, acquired by Polygon for $250 million in 2021, made a notable move. The protocol unstaked and deposited 4.5 million MATIC, valued at approximately $3.81 million, into the crypto trading platform SwissBorg.

This transaction occurred amidst growing concerns over the transparency of the Polygon Foundation’s MATIC token allocation. Despite this, Hermez Network still retains a substantial stake of approximately 39.92 million MATIC, estimated to be worth around $34 million.

Read more: How To Buy Polygon (MATIC) and Everything You Need To Know

The spotlight on these transactions illustrates the potential risks associated with opaque practices and highlights the necessity for robust mechanisms to ensure that such significant financial movements are conducted with the highest levels of integrity and transparency.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.