In the upcoming week, the crypto market may witness significant sell-offs in digital assets, with notable bankrupt entities like Celsius, FTX, and Alameda Research resuming fund movement.

Moreover, the impending release of an additional $400 million worth of new tokens during the week adds to the potential market turbulence that could further contribute to an anticipated sell-off.

Watch Out for Celsius, FTX, and Alameda

During the past week, Celsius Network transferred over $125 million in Ethereum to various exchanges. Around $95.5 million in ETH was sent to Coinbase and another $29.73 million to FalconX.

Despite these transfers, Celsius retains a substantial reserve of 539,000 ETH, equivalent to $1.40 billion. On-chain data from Arkham Intelligence reveals the lending platform holds additional assets, including 9,799 BTC valued at $420.46 million in its wallet.

Meanwhile, the two firms in Sam Bankman-Fried’s failed crypto empire — FTX and Alameda Research — have also resumed transferring funds to centralized exchanges. Last week, these entities executed transfers of $28.2 million in digital assets, including 402.6 Wrapped Bitcoin, 3,200 Ethereum, 602,000 Pendle, and 9.03 million People. Like Celsius, FTX and Alameda retain approximately $1.2 billion in EVM assets.

Read more: Why These 5 Altcoins Could Drop Due to a Spike in Profit-Taking

Still, observers have suggested that these asset movements potentially signal impending sales by these firms as part of their commitment to making affected customers whole.

$400 Million in Tokens to be Unlocked

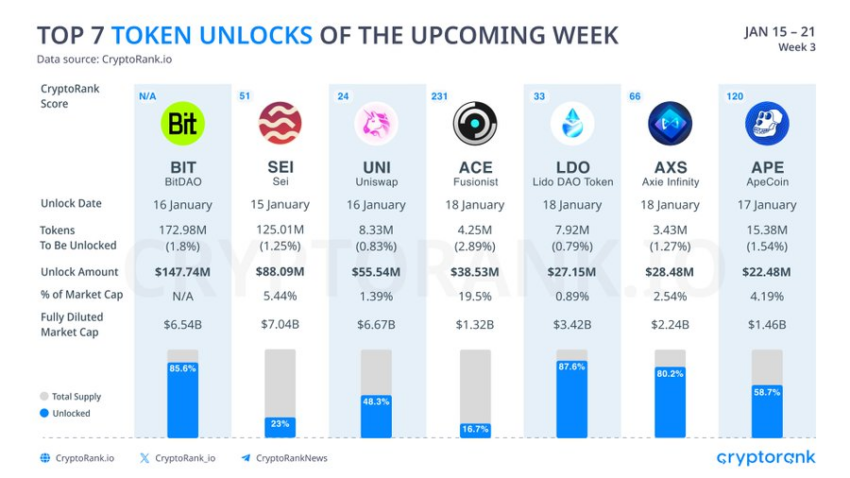

Separately, crypto analytical platform CryptoRank noted that seven projects, including BitDAO, Sei, Uniswap, Fusionist, Lido DAO Token, Axie Infinity, and ApeCoin, will unlock $407.7 million worth of digital assets.

Leading the lineup is BitDAO, set to unlock 172.98 million tokens valued at $147.74 million. Remarkably, this release accounts for 1.8% of its total token supply.

Read more: Top 10 Cheapest Cryptocurrencies to Invest in January 2024

Among the other notable tokens scheduled for release are SEI with a value of $88.09 million, UNI tokens at $55.54 million, ACE at $38.53 million, LDO at $28.48 million, AXS at $27.15 million, and APE at $22.48 million. This planned development in token unlocking will further influence the crypto market in the coming week.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.