The United States dollar’s unchallenged reign as the global reserve currency is under scrutiny. Former US President Donald Trump issued a dire warning about America’s future, highlighting the perceived weakening status of the US dollar.

Against this backdrop of potential decline, a new contender is emerging: Bitcoin. With its decentralized nature, could this digital currency be poised to challenge the mighty dollar?

The US Dollar Is Losing Dominance

In a recent interview, former US President Donald Trump painted a bleak picture of America’s future. He asserted a flagging influence of the United States on the world stage.

Central to this prognosis is what Trump perceives as the dwindling status of the US dollar as the world’s reserve currency. A loss he described as “bigger than losing any war.”

“Our country is going to hell, and we’re not going to be the big boy,” Trump declared, employing vivid imagery to convey America’s weakening global position. He continued:

“We have power, but it’s waning. In fact, it’s waning in terms of our currency. And I’m not just talking about the value of our currency, I’m talking about our currency being used throughout the world.”

Read more: American Senator Bets Against the US Economy

Trump did not mince words when he spotlighted the vital role of the US dollar in global commerce and politics. “We have something that’s very powerful, and that’s our dollar,” he emphasized.

Acknowledging China’s ambitions to replace the US dollar with the yuan, Trump added, “and it was unthinkable with us. Unthinkable. It would never have happened. Now people are thinking about it.”

The narrative Trump weaves implicates domestic policy decisions as key drivers of this purported decline. The former president lays significant blame on the nation’s energy policy. “Inflation was caused, in my opinion, by energy because it’s so big,” Trump argued, noting how integral energy costs are to the entire economy.

Trump lamented the Biden administration’s moratorium on federal land and offshore oil drilling as “so sad.” In his view, aggressive domestic energy production underpins national strength:

“We were a bigger force than Russia and Saudi Arabia individually,” he said. “In a year and a half, we would have been a bigger force than them combined… We would have been paying off debt.”

Read more: Debt Disaster: US Credit Card Debt Hits Record $1 Trillion

Trump highlighted the catastrophic consequences of inaction regarding the growing issue of US debt. “If you don’t address the debt, it’s a ticking time bomb,” he warned.

Also, he decried recent fiscal policies as the catalyst, lamenting that “they are borrowing money like there’s no tomorrow.”

Bitcoin as the World Reserve Currency

For a century, the US dollar has enjoyed its status as the world’s unchallenged reserve currency. Before the dollar, five powers — Portugal, Spain, the Netherlands, France, and Britain — held this status for nearly a century. Hitting this 100-year mark naturally raises questions about the future of the dollar’s global dominance.

While traditional contenders like the euro and China’s yuan have their respective challenges, a new class of contenders is emerging, Bitcoin.

Read more: How to Protect Yourself From Inflation Using Bitcoin

Operating on decentralized, peer-to-peer networks, Bitcoin is attractive as any single government does not control it. Amid fears that central banks, particularly the US Federal Reserve, are undermining their currencies, Bitcoin has received significant attention, nearly doubling in value since the beginning of the year.

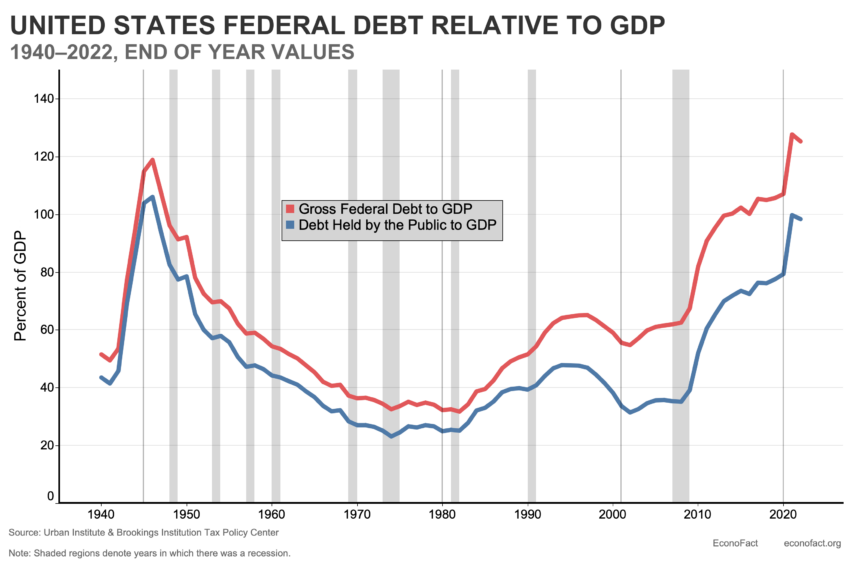

The ascent of Bitcoin, with its unique features as a decentralized and secure digital currency, coincides with mounting US debt — forecasted to surpass 100% of the country’s Gross Domestic Product (GDP). For Trump, this is not mere coincidence but symptomatic of broader fiscal and political malaise.

Recent moves by major payment platforms like PayPal to integrate Bitcoin and create a stablecoin indicate the growing confidence in crypto as an asset and a feasible medium of exchange.

With the US debts continuing to rise, the steadfast position of the dollar appears increasingly uncertain. But Bitcoin is progressively viewed as a plausible alternative. While it remains too early to declare Bitcoin the successor to the dollar’s throne, change is palpably in the air.

Read more: Top 11 Public Companies Investing in Bitcoin

As stark as they are, Donald Trump’s vivid comments resonate as a significant signal. As the 45th President noted, “people are thinking about it” — and in the financial system, thought is a precursor to action.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.