The U.S. economy is in for a rocky road ahead if the national debt skyrockets as predicted. Such a move could follow the lifting the debt ceiling, which has just been tentatively agreed upon.

Alarm bells have started ringing for economists and analysts following an agreement to suspend the U.S. federal debt ceiling.

U.S. National Debt Crisis Deepens

On May 29, professional trader and market analyst Mati Greenspan commented on the removal of the debt limit:

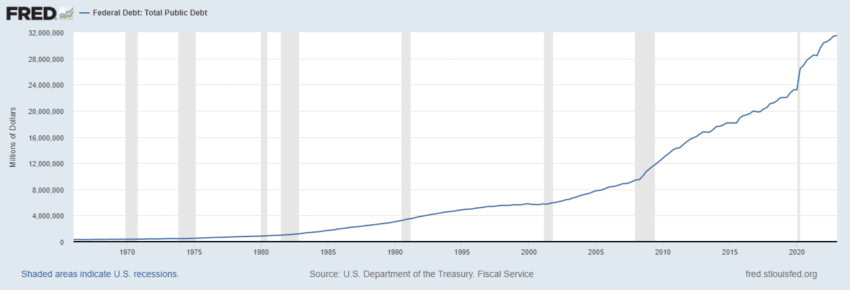

“If this bill passes, the US government will have unlimited spending power for the next year and a half. This chart is about to go parabolic!!”

The chart refers to the rise in U.S. national debt, which has surged 425% since the turn of the century. According to US Debt Clock.org, the frightening figure currently stands at $31.8 trillion.

Furthermore, it has predicted a rise to $42.8 trillion by 2027. However, that figure could be much higher with unlimited spending powers for the federal government.

Over the weekend, U.S. President Joe Biden and congressional Republican Kevin McCarthy reached a deal to suspend the debt ceiling until January 2025. However, the deal has yet to pass Congress and was made at the last minute to avoid a default.

Last week, Treasury Secretary Janet Yellen warned that the money would run out by early June.

The U.S. government has been running a deficit since 2002. This means it is spending more than it earns and borrowing larger amounts to make payments.

Louise Sheiner, policy director of the Brookings Institution’s Hutchins Center on Fiscal and Monetary Policy, told Fortune:

“The trajectory for the debt is clearly a problem, and I think everybody agrees, because if you look at the forecast, we have debt increasing with no end in sight,”

There is also a big difference in how each side wants to tackle the problem. Democrats focus on higher taxes to reduce the deficit, while Republicans argue for spending cuts. There appears to be very little in the way of compromise at the moment.

Money Printing the Answer?

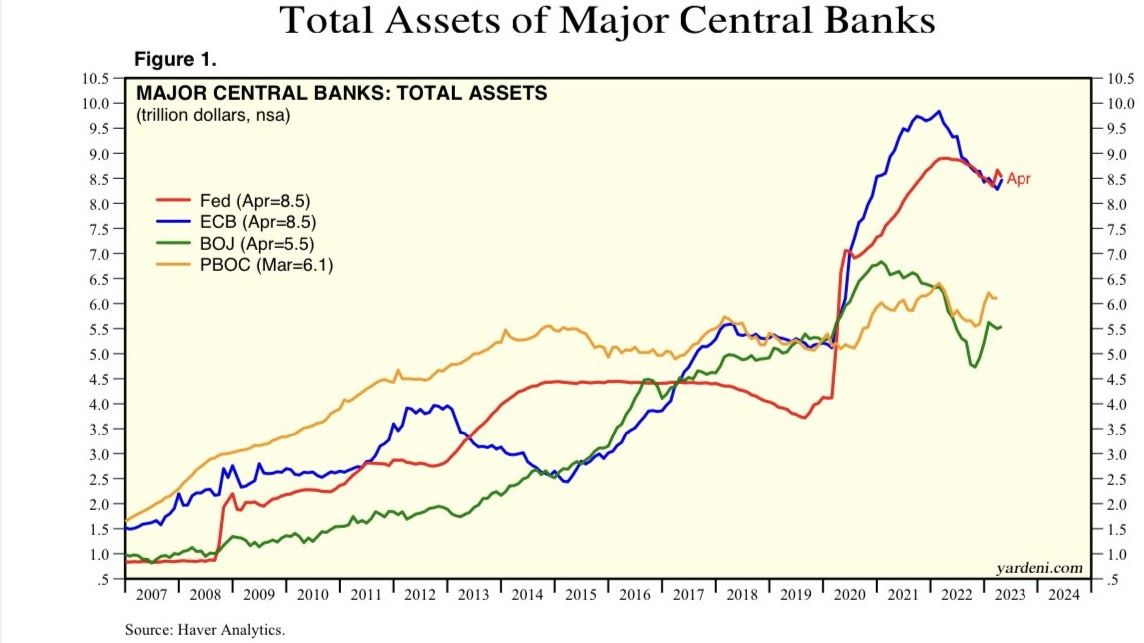

Crypto market analyst ‘PlanB’ posted a reminder about central bank money printing on May 29. The trend is clear for all major central banks though it is steeper for the Federal Reserve despite a recent decline in monetary supply.

Printing money to pay debts has one major long-term drawback—the devaluation of the local fiat currency. This has been one of the primary drivers of decentralized cryptocurrency adoption, and it is unlikely to change anytime soon.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.