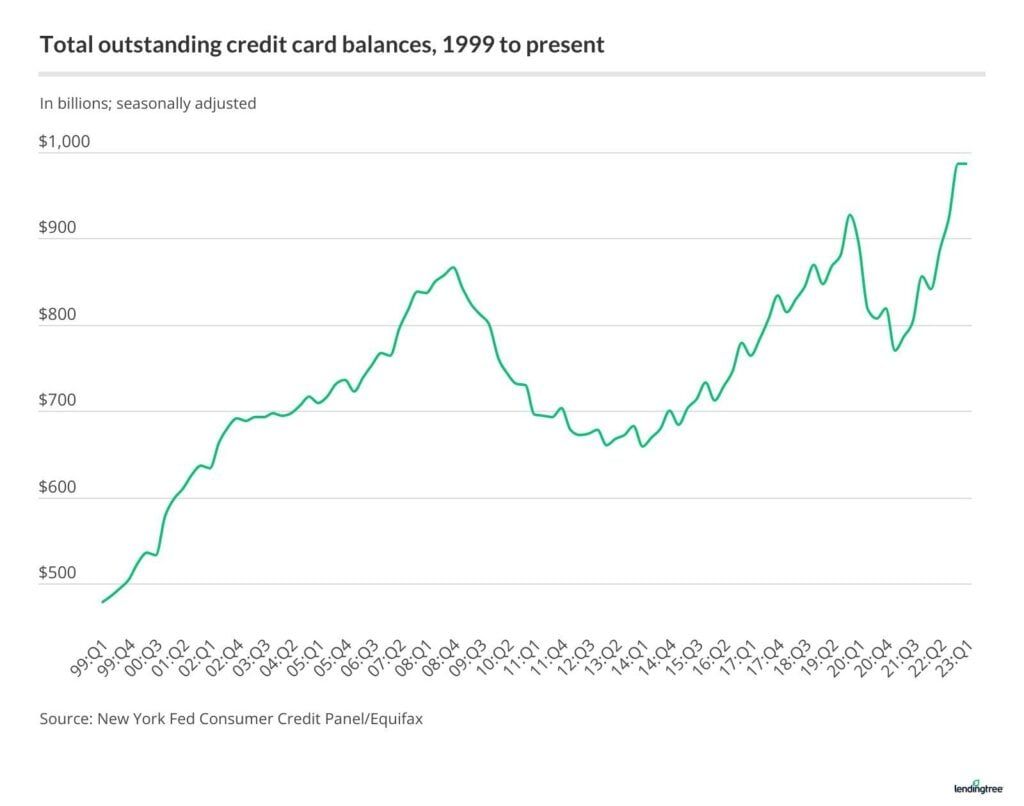

In addition to an ongoing banking crisis, the United States is currently drowning in debt. The latest barrage of bad news to emerge from the flailing economy regards record levels of credit card debts.

On Aug. 9, it was reported that Americans borrowed more than ever on their credit cards in the last quarter. This has caused balances to surpass $1 trillion for the first time in history.

US Debt Mountain Grows

According to the New York Federal Reserve Bank, credit card balances rose by $45 billion to $1.03 trillion in the second quarter.

However, overall household debt loads were largely unchanged at $17.01 trillion, according to Reuters. Furthermore, credit card delinquencies are at an 11-year high.

New York Fed researchers were upbeat, stating:

“Despite the many headwinds American consumers have faced over the last year – higher interest rates, post-pandemic inflationary pressures, and the recent banking failures – there is little evidence of widespread financial distress for consumers.”

Nevertheless, the figures are frightening.

There is about $5,000 of debt per credit card holder and average card interest rates at 20%, said IBC Group CEO Mario Nawfal.

He added that polls have revealed that most Americans are living paycheck to paycheck. Additionally, they are using credit cards to pay for everyday expenses, further impacted by high inflation.

To learn more about how the brewing banking crisis in the United States, read our explainer here: 2023 US Banking Crisis Explained: Causes, Impact, and Solutions

“Credit card debt was $736 billion in April 2021, which means it has increased by 36% in just 2 years,” Nawfal revealed.

While bankers and politicians usually harp on about how robust the economy is, the reality appears to be a little different.

There are signs that consumers could be maxed out and consumption may slow in the second half of the year, said Nawfal before adding:

“High levels of debt, coupled with rising interest rates, could make it difficult for consumers to make their payments and could lead to a slowdown in the economy.”

Inflation Leading to More Debt

With the Fed continuing to increase interest rates, this could lead to higher borrowing costs for consumers. The US interest rate is currently at a two-decade high of 5.5%.

Inflation is falling and is currently 3%. However, inflation is still present and prices are still increasing, just not as fast as before.

“If people are unable to reduce costs or increase their income, they will be hit hard by increases in mortgage and finance repayments,” Nawfal concluded.

Furthermore, US banks suffered almost $19 billion of losses on soured loans in the second quarter. This is due to rising defaults among credit card and commercial real estate borrowers, reported the FT on Aug. 9.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.