Some researchers say that over 40% of all bitcoin (BTC) transactions are linked to crime. Owning “dirty” coins can get you in serious trouble, even if you didn’t participate in any illegal activity. Is this something you personally should be worried about, and if so, how can you conduct an anti-money laundering (AML) check on your crypto?

What is a dirty bitcoin?

A coin is considered “dirty” if it’s been involved in any illicit activity such as:

- Crypto crimes like wallet or exchange hacks;

- Money laundering, which includes criminals trying to hide the proceeds of their illegal activities by converting them into crypto (spoiler: it doesn’t work);

- Scams such as fraudulent schemes and projects;

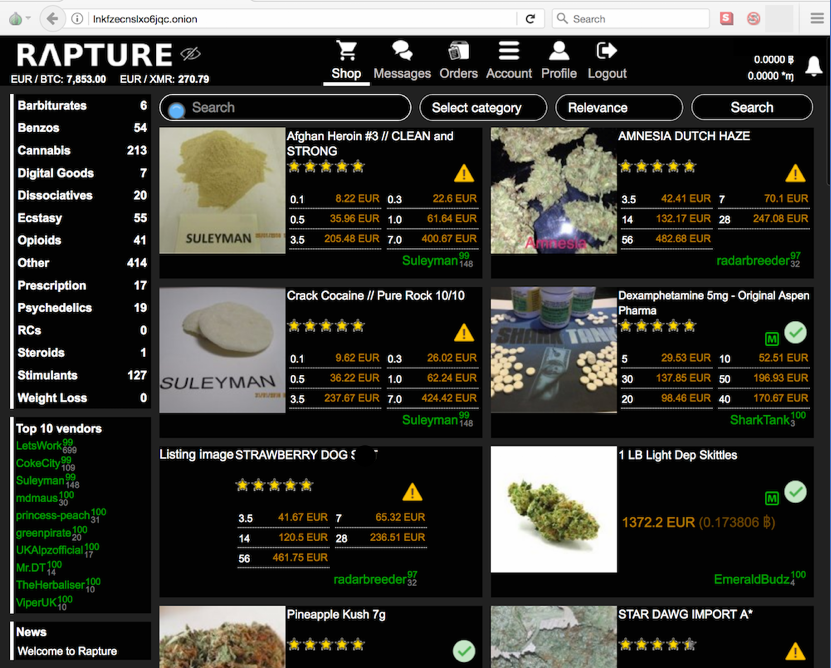

- Darknet marketplaces, or hidden sites where users buy and sell drugs, stolen credit card details, and other illegal goods for crypto.

Dirty coins can be identified through AML checks. Note that a coin can be considered dirty even if it doesn’t come directly from an illegal or fraudulent source. For instance, BTC coming from unregistered exchanges or mixing services will be flagged by any established crypto AML program.

What are the risks?

The bad news is that even if you have no idea that some of your coins are dirty, you can still suffer some losses. Here are some possible consequences of not running an AML check:

- Not being able to sell your coins at current market prices. Reputable exchanges won’t convert suspicious coins into USD and other fiat currency. To sell dirty tokens, you’ll have to use a peer-to-peer (P2P) platform or a minor exchanger that will charge a higher commission. Sometimes dirty bitcoins are even sold at a discount of 10% to 20%, or more.

- Getting blocked on an exchange. Most major exchanges – and all regulated ones – use special tracing software to detect dirty crypto. Once you try to deposit suspicious coins, the exchange will stop you from making any new transactions until you can prove the origins of the crypto. This is a real problem that is often discussed on Reddit:

- Losing your crypto. If you can’t provide any supporting documentation in relation to your source of funds, the exchange will not only block the account permanently, but also won’t let you withdraw any of the coins on your balance. Say goodbye to your satoshis!

- Dealing with law enforcement. Exchanges can report any evidence of a crime to the financial police that will probably want to question you. Even if you can prove that you didn’t commit whichever crime your bitcoins were involved in, you’ll still lose the coins because normally proceeds of crime are forfeited.

- Serious legal trouble. In the worst-case scenario, you may be prosecuted as an accomplice or accessory to a financial crime.

How does AML software detect dirty bitcoins?

Anonymity and privacy are the two advantages of crypto that people usually get excited about. Indeed, bitcoin is anonymous in the sense that you don’t have to enter your personal information when you create a wallet.

However, bitcoin is also highly traceable – every bitcoin transaction leaves a digital trail, which makes it possible to follow. You can easily trace the majority of coins, except for the privacy-oriented ones like Monero (XMR), although even those aren’t immune.

In case you’re wondering whether you can check the origin of the received coins on your own, without using any dedicated AML software, the answer is no. You can conduct some preliminary research using a blockchain explorer like BTC.com or Etherscan to see the list of all the transactions associated with the wallet address that sent you the coins.

Keep in mind that these tools won’t reveal the person behind the addresses. Also, criminals usually use dozens or hundreds of dummy wallets to cover up their tracks, so you’ll need considerable processing power and special algorithms to track them down. In fact, blockchain analysis software is a booming industry!

Latest crime trends involving bitcoin

Some researchers, such as Foley et al., believe that 46% of all transactions with bitcoin are directly or indirectly linked to some illicit activity. However, judging by more recent data, the situation may not be as grim as it seems.

Crypto crime volumes seem to be decreasing. According to CypherTrace, the total value of crypto crimes in the first ten months of 2020 amounted to $1.8 billion, as opposed to $4.5 billion, in 2019. This includes hacks, theft, and darknet transactions. For instance, in September, 2020, hackers stole $150 million from KuCoin alone. A large percentage of these funds likely went to minor unregulated exchanges, where they were bought by unsuspecting users.

Darknet marketplace activity is intensifying. A recent Chainalysis report suggests that almost $790 million in crypto was sent to and from darknet marketplaces, in 2019.

Only a few among the richest bitcoin addresses hold over 1% in dirty or suspicious coins. We’ve conducted a study based on the data from AMLBot, an open crypto tracing software. Instead of trying to go through thousands of random addresses, we looked at the 100 richest BTC addresses, including those belonging to exchanges.

Interestingly, AMLBot flagged only six of the addresses as containing any BTC that came from the darknet. 15 addresses held some coins that came from mixers or scam projects. In total, the software ranked 47 out of the 100 as low-risk, 52 as medium risk, and just one as high risk.

That single very suspicious address is actually a super-whale with over $2 billion in bitcoins.

We concluded that, while quite common, illegal activity involving crypto isn’t something you should lose sleep over. But of course, this doesn’t mean you shouldn’t exercise caution.

How you can protect yourself

There are several efficient ways to avoid legal and other risks associated with dirty and suspicious crypto. Those are:

- Avoid using bitcoin mixers, cleaners, and similar services. While they do conceal the origin of the coins, any established tracing software will mark such transactions as coming from a mixer, which is a red flag for many exchanges.

- Channel all incoming crypto funds into two separate wallets: “clean” and “potentially risky.” The first should contain coins coming from reliable business partners, regulated exchanges, mining pools, and services that have Know-Your-Customer (KYC) checks. Use the “clean” wallet only to send money to large trading platforms. By contrast, all the coins you receive from strangers, unofficial over-the-counter services, gambling sites, small exchanges,and others, should go into the “potentially risky” wallet.

- Use open crypto tracing software or a wallet that lets you buy bitcoin with a card and do an AML check at the same time. Such services are usually premium and charge either on a per-month or per-check basis. They deploy advanced algorithms similar to those utilized by the police and thus, can detect all or almost all suspicious coins.

Authorities take action to fight dirty crypto

With some help from blockchain analysts and powerful tracking software, the police regularly dismantle money-laundering rings and other crypto criminals. For example, in 2019, US law enforcement took down the world’s largest child pornography site, at the time, by tracking some BTC payments down to its founder.

Apart from transaction checks, many countries use ever more advanced AML and KYC laws that oblige crypto platforms to verify their users’ identity and report such information to the authorities. The best example is the Fifth Anti-Money Laundering Directive (5AMLD), which came into effect in the European Union in January 2020.

A combination of blockchain tracing software and AML legislation is making the crypto landscape safer for regular users. If you only use top exchanges and regulated services to buy crypto with a bank card, your risk of stumbling upon dirty BTC is pretty low. Still, it’s not a bad idea to check your crypto holding for “cleanliness:” who knows what you’ll find there?

NOTE: The views expressed here are those of the author’s and do not necessarily represent or reflect the views of BeInCrypto.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.