The recent overnight success of the Compound DeFi platform, along with its associated token launch, has attracted a number of crypto critics that are labeling it as nothing more than a pump and dump or a Bitconnect-like Ponzi scheme.

It’s been just over a week now since Compound Finance began its token distribution. Before the event, the DeFi liquidity platform was relatively unknown in wider crypto circles, but the huge surge in token prices last week certainly changed that.

In that short space of time, COMP became the first DeFi unicorn with over a billion dollars in market capitalization and two billion in liquidity. According to Uniswap.info prices peaked on June 21 at $327 but have since corrected 28% to around $235 at the time of press. Daily volume is still over $4 million while liquidity has fallen to around $1.8 million.

Defimarketcap.io lists COMP as the largest DeFi token with a market cap of $2.3 billion, putting it just below EOS. This figure is a little misleading, however, as it uses the entire supply. The real market cap with the current supply is closer to $600 million, which is just below IOTA.

The Coinbase Connection

Industry observers have been quick to point out the connection between COMP and Coinbase, which recently listed the token causing it to surge even higher.

On June 18, Coinbase Pro announced that it would be accepting COMP deposits on June 22 and listing the DeFi token the following day, a week after the distribution began. As if to spur the inevitable FOMO that followed, the company included this disclaimer at the bottom of the listing announcement:

Coinbase owns COMP tokens as a result of a 2018 investment in Compound. Coinbase intends to maintain its investment in Compound for the foreseeable future and maintains internal policies that address the timing of permissible disposition of its digital assets, including COMP tokens.

Industry researcher, Larry Cermak [@lawmaster], who has been critical of DeFi from day one, posted a ‘LOL’ as token prices started to correct yesterday.

More interestingly though, Cermak questioned the Coinbase connection and the fact that the U.S. exchange giant had previously invested in Compound. With a lot of COMP tokens on the exchange, Coinbase has a heavy influence over where prices go next.

A good question to ask here would by why did Coinbase have ~5x more COMP on the order book than what’s been distributed through mining? To me, it looks like a nice dump of the investors/team because who else could it be?

Two spurious transactions of COMP tokens yesterday totaling $100 million could have been made with tokens that Compound has lent market makers to provide initial liquidity on Coinbase, as suggested by one observer.

Another address was highlighted by Galois Capital [@Galois_Capital] for parceling out 2,000 COMP deposits to Coinbase and dumping on the first candle the minute it got listed.

More COMP moved to @coinbase than existed from all farming put together.

Whichever way it is viewed, it is starting to reek of market manipulation by whales and it is not the first time something like this has happened in the crypto space, especially involving Coinbase.

Bitconnect Redux?

Liquidity mining is a little different from Bitconnect, which was a direct Ponzi scheme. However, if the end results are a few whales making money and the average Joe getting shafted, then there is little difference between the two.

Bitconnect was labeled as an open-source cryptocurrency that was connected with a ‘high-yield investment program.’ In little over a year, Bitconnect managed to propel itself from an obscure ICO in late 2016, to a cryptocurrency valued at a whopping $2.5 billion. The lending platform launch in 2017 saw the project gain traction, but with ridiculous rates of returns promised, the warning signs were already starting to show.

The pyramid referral system promised massive returns in BCC tokens compounded over a ten year period. Bitconnect essentially took investor’s Bitcoin to buy BCC coins which meant that it could inject BTC buy orders to artificially support the price. A largely unregulated space, and shameless social media shilling, resulted in a surge in token prices which rose from a post ICO price of $0.17 to an all-time high of $463 in December 2017.

Once the Ponzi nature of the scheme started to be realized, exchanges began to delist BCC and legal suits followed throughout 2018. By March 2019, BCC token prices had collapsed to almost zero leaving 1.5 million investors burned.

Even RT’s Max Keiser was quick to make the comparison, tweeting;

The current wave of ‘DeFi’ coins are mostly no different in substance and methodology than BitConnect.

Compound Finance is very different from Bitconnect, but if a few whales can manipulate token prices that much in such a short space of time, its legitimacy must be questioned.

Can Only Whales Profit From DeFi?

While the notion that ‘it takes money to make money’ is still apt, it applies even more so in the crypto scene. The average trader with a few hundred or even a few thousand dollars as a float is unlikely to benefit very much from the bank-busting rates that DeFi offers.

One crypto community observer has already done some math, factoring in spreads, and network fees:

Did you know that if you’re chasing yields and you pay 0.3% fee to go out of an asset and another 0.3% to go into another… It’ll take 1 week to recoup those costs at 32% APR. Throw in network fees and it could take considerably longer depending on how much you have in.

While the interest rates are very appealing, every tiny action on DeFi, from linking Metamask to depositing DAI, requires a network fee in gas. Some are minimal, but others cost more than can be made with smaller deposits, making the entire process an exercise in futility.

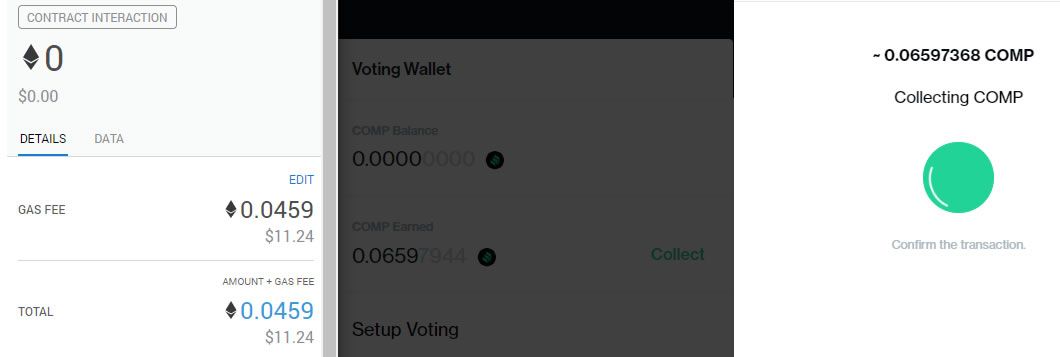

In this example, BeInCrypto demonstrates how collecting just $15.5 worth of COMP, accrued in just under a week with $9,000 in digital asset collateral deposited, would cost $11.24 in gas. Withdrawing 20 ETH from Compound after a week of making nothing will cost $2 in gas fees.

At these transfer rates, using the Ethereum network for small amounts is simply unfeasible. Token swaps are another problem as there are network fees at every turn. Converting 1,000 USDT to DAI, for example, results in a loss of around $27 on Uniswap since it goes from Tether to USDC to ETH to DAI, taking a fee at each stage.

That said, stablecoins are not precisely dollar-pegged, and some float above and below their $1 mark which may attribute to some of the conversion losses. Additionally, it has been widely reported that Ethereum network fees are now higher than Bitcoin’s and gas usage has soared recently.

This is just one example of how using smaller sums does not always result in profits and careful research must be undertaken. It appears that unless large sums are being used or arbitraged, DeFi is not as profitable as many have made it out to be. Therefore, it may not be ready for mass adoption until Ethereum’s scalability issues can be addressed and network fees can be reduced.

Further speculation that whales have been manipulating COMP markets is also indicative of the immaturity of the decentralized finance ecosystem.