Is This the Beginning of the DeFi Bubble?

It’s hard not to compare the current market sentiment with the late 2017 ICO-mania. Back then, a small team with a flashy website and well-edited whitepaper could grab millions through an initial coin offering. Many cryptocurrency and financial analysts are already calling this a DeFi bubble, although the general belief is that total valuation is still too small to cause a major crash. Alex Svanevik, CEO of blockchain analytics company Nansen says:Basically a worst-case scenario for DeFi is the ICO bubble of 2017 combined with the Great Financial Crisis of 2008. It’s also quite different from the 2017 ICO bubble in a few key ways.He added:

It has a much more bottom-up distribution, and in fact, there are signs that retail investors managed to move ahead of the whales on this one, in stark contrast to the ICO boom where whales were getting sweet deals behind the scenes.Crypto seems more mature now after the multi-year bear market, but the euphoria is causing plenty of dubious projects and scams to pop up.

Reminder: you do NOT have to participate in "the latest hot defi thing" to be in ethereum. In fact, unless you *really* understand what's going on, it's likely best to sit out or participate only with very small amounts.

— vitalik.eth (@VitalikButerin) August 14, 2020

There are many other kinds of ETH dapps, explore them!

The High Price of Success

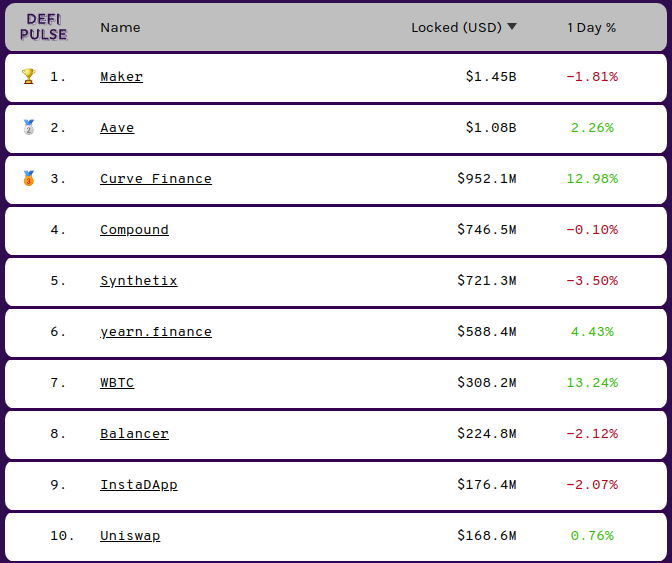

One of the classic symptoms of bull market euphoria is that almost every day we have a new hot project that attracts all eyeballs. Among last week’s big winners were LINK and BAND, as well as experimental DeFi tokens like YAM.

New projects are coming up to challenge Uniswap’s dominance. BeInCrypto recently reported about 1inch exchange and Dharma, both of whose value propositions revolve around cheaper gas fees. This may add fuel to the current uptrend in the crypto market. DeFi is growing, and those projects need oracles and decentralized exchanges. There is still lots of value sitting idle in crypto wallets, especially in Bitcoin, Ripple, Bitcoin Cash, Litecoin, and EOS.Uniswap is starting to become unusable with gas prices at 200+ gwei. The only reason people are still using it is that they think they will outperform the fees from flipping tokens (probably true). But if retail actually comes, Uniswap won't be usable for anyone but whales pic.twitter.com/2Ce01sKasO

— Larry Cermak (@lawmaster) August 12, 2020

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.