The crypto winter has dealt a severe blow to Changpeng Zhao’s fortune, the founder of Binance, wiping a staggering $11.9 billion from his net worth.

Known as CZ, the 46-year-old crypto magnate’s wealth has plummeted to $17.2 billion, a stark contrast from his peak wealth of $96 billion in January 2022.

Billions Wiped off Binance CEO’s Wealth

The significant decline in the CEO’s wealth can be attributed to a slump in crypto trading volumes at Binance. The Bloomberg Billionaires Index slashed its revenue estimates for Binance by 38% after data revealed a substantial decrease in the firm’s trading volumes this year.

Zhao significantly influenced the legal troubles of fellow crypto leader, Sam Bankman-Fried. The collapse of Bankman-Fried’s FTX exchange was precipitated when Zhao offloaded his holdings of FTT tokens.

Read more: FTX Collapse Explained: How Sam Bankman-Fried’s Empire Fell

Zhao announced the liquidation of a token linked to FTX, following the revelation that Bankman-Fried’s hedge fund, Alameda Research, held a significant stake in it. This led to a rush of withdrawals from FTX, culminating in the exchange declaring bankruptcy within a week.

Binance’s woes are not limited to trading volume declines. The crypto exchange has faced a barrage of lawsuits from US regulators, including the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC).

Both regulatory bodies accuse Binance of a series of violations, ranging from inadequate money-laundering controls to inflated trading volumes. Binance, however, denies these allegations and is currently engaging in a legal battle to clear its name.

Adding to Binance’s challenges, the exchange has seen its standing in the traditional financial system diminish. In June, Bloomberg’s wealth index cut the value of Binance’s US exchange to zero after it announced it would no longer transact in dollars, causing a dramatic shrinkage in volumes.

Despite This, Binance Remains Major Player

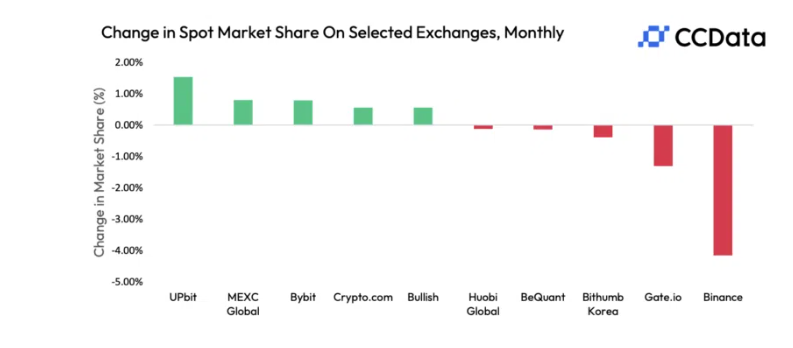

Despite these setbacks, Binance remains a significant player in the crypto market. Research from CCData shows that Binance captured 62% of total on-exchange crypto trades in the first quarter of 2023. Although this figure has since slipped to 51%, the exchange’s market share is still substantial. However, its monthly change in spot market share dropped the most among its competition in September.

Read more: 7 Best Binance Alternatives in 2023

As the third quarter of 2023 concludes, there’s a sense of careful hopefulness. Despite tough fiscal/regulatory conditions, Binance and the broader cryptocurrency sector are showing recovery signs. And the customary market volatility is starting to return.

Zhao himself said of crypto market volatility:

“We have an open democratic market, and the market will self-correct. Too many people are rushing in. The prices will go too high. And then some guys will want to cash out, to take profit. But nobody really knows. So maybe the price is still too low now. So the market takes care of that.”

This article was initially compiled by an advanced AI, engineered to extract, analyze, and organize information from a broad array of sources. It operates devoid of personal beliefs, emotions, or biases, providing data-centric content. To ensure its relevance, accuracy, and adherence to BeInCrypto’s editorial standards, a human editor meticulously reviewed, edited, and approved the article for publication.