Recent price action has sparked fears that Ethereum (ETH) price could lose the $1,600 support for the first time in six months. On-chain analysis examines vital data trends suggesting bullish traders could capitalize on the growing market FUD.

After breaking above the $2,000 mark in mid-July, Ethereum’s (ETH) price has entered its second consecutive month in decline. Despite Grayscale’s recent Spot ETF appeal victory, the prevailing sentiment in the crypto markets has been dominantly bearish. On-chain analysis examines how strategic crypto traders could flip the script by capitalizing on the extreme market Fear, Uncertainty, and Doubt (FUD).

Crypto Investors’ Sentiment is Approaching Extreme FUD Levels

After nearly two months in decline, the majority of crypto investors are now expressing bearish sentiment. According to Santiment – a crypto data analytics firm, bearish takes have dominated the crypto market discourse in September.

But interestingly, historical trends suggest this is a tell-tale sign that the market is approaching a turning point.

The Social Volume chart below illustrates that “Bear Market” mentions have exceeded “Bull Market” on every trading day since August 31.

Social Volume measures the number of times a crypto subject matter is mentioned across relevant social media channels. In this context, mentions of “Bear Market” dominating the social media chatter over an extended period indicate that investors are dysphoric.

Read more: What Is FUD? Exploring Fear, Uncertainty, and Doubt

Typically, as market sentiment approaches extreme fear, strategic investors often interpret it as the perfect time to buy the dip, which advertently triggers a price rally.

Historical trends show that this phenomenon occurred around March 8, when the USDC de-peg and Silicon Valley Bank failure triggered extreme market FUD. In response, Ethereum price skyrocketed 48% from $1,430 to $2,120 between March 11 and April 17.

The recent extreme level of negative opinions is a vital indicator that this phenomenon could rear its head again in the coming days.

Strategic Traders Have Already Placed $584 Million Buy Orders

Optimistic traders have already placed buy orders behind the senses in hopes of a positive momentum swing.

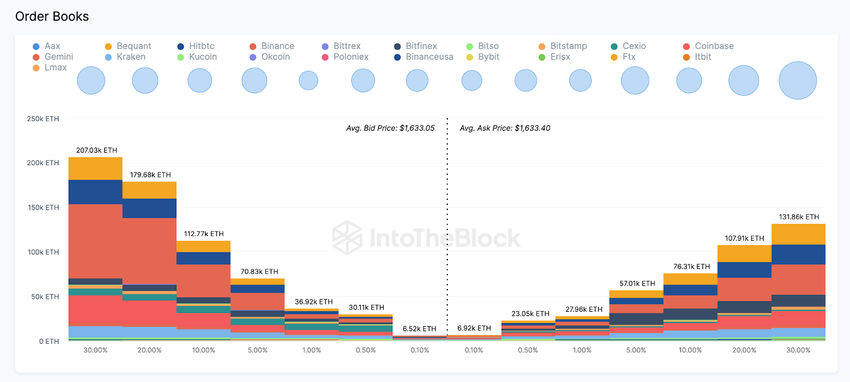

Aggregate order books from 21 crypto exchanges currently show bullish traders have placed active orders to purchase 643,000 ETH for around $584 million. This is nearly 50% higher than existing sell orders of 431,000 ETH.

The Exchange On-chain Market Depth chart depicts the volume of active orders that Ethereum traders have placed across prominent crypto exchanges.

Read more: Order Book: What Is It and How To Use It in Crypto Trading?

The chart above depicts that despite the prevailing bearish sentiment, the current market demand for ETH exceeds supply by 211,500 coins.

This means that within the current market dynamics, Ethereum has formidable support around $1,500 – $1,600 territory. But it is also a vital signal that strategic traders are moving to capitalize on the prevailing bearish sentiment.

ETH Price Prediction: Consolidation Around $1,600 Before Breakout

From an on-chain perspective, the current Spot market demand levels mean Ethereum price will likely enter significant gains if the momentum flips bullish. However, the bulls will face significant difficulty reclaiming the $1,800 territory.

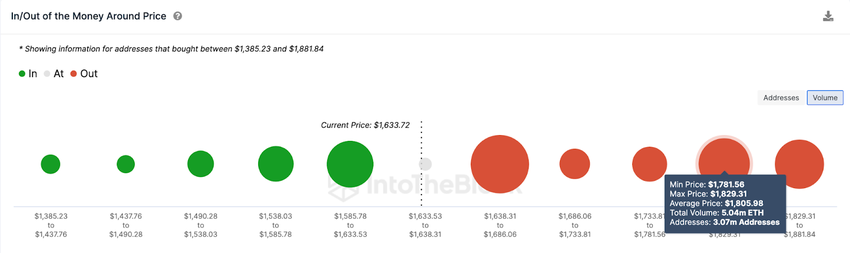

The In/Out of Money Around Price data, which outlines the purchase price distribution of the current Ethereum holders, vividly illustrates this.

It highlights that 3 million investors had bought 5.04 million ETH coins at the maximum price of $1,805. Without a significant shift in the market sentiment, they could sell early and trigger another Ethereum price downswing.

But if the bulls can push past that resistance level, Ethereum price could avoid making another attempt at the $2,000 range.

Read more: A Deeper Look Into The Ethereum Network

But in the unlikely event that the market FUD intensifies, the bears could potentially force a major downswing toward $1,400. However, 2.69 million addresses had bought 4.1 million ETH at the minimum price of $1,585. And if they chose to HODL, Ethereum’s price could rebound again.

But if that support level gives way, the ETH price could begin to edge closer to $1,400.