Crypto markets are experiencing a refreshing morning pump as more than $170 billion flows back into the total market capitalization.

Building upon solid weekend momentum, cryptocurrency markets are in the green today as the total market cap increases by more than 11%. That total is currently at its highest level in nearly three weeks at $1.6 trillion according to CoinGecko.

Bitcoin has been the catalyst of the move, breaking to the upside with a 13% gain on the day to reach a local high of $39,500. It has since pulled back slightly but is still trading for $38,850 at the time of press.

This BTC move wiped out more than a month’s worth of losses in just a few hours. Local crypto outlet Wu Blockchain attributed the pump to Chinese FOMO:

“Bitcoin rose by 12% in one hour, leading the increase. Because Chinese have just gotten up. It is obvious that the price of Bitcoin has started to rise after this rumor about Amazon spread in the Chinese community.”

Liquidations across the boards

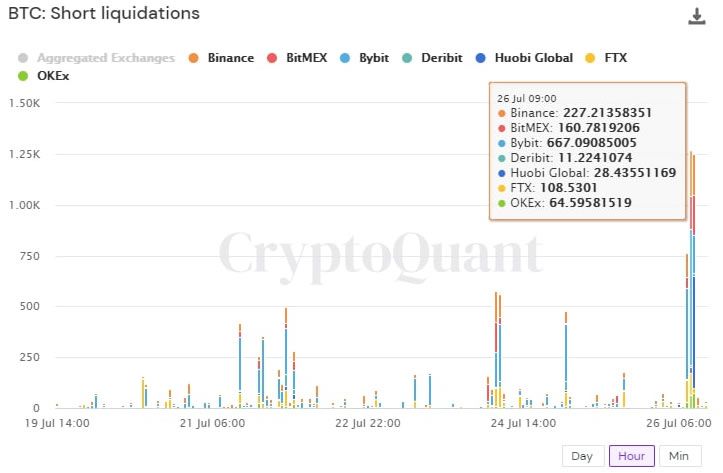

On-chain analytics platform CryptoQuant recorded the mass liquidation of short positions across major exchanges reporting that 3,280 BTC shorts were liquidated in just three hours. The amount was equivalent to around $111 million at prices just before the big surge.

Bitcoin prices have now moved above the 50-day moving average and are targeting resistance at just over $40,000 where the previous highs have been made on the way down. A break above this could see prices move higher very quickly, though the 200-day moving average is still trending downwards.

DeFi related tokens have also been given a massive boost following weeks of bearish selling. The top-performing assets at the moment include AMP surging 40%, SUSHI making 19%, and RUNE adding 17% following two THORChain exploits this month.

Others doing well include Polkastarter (POLS), Aave (AAVE), Terra (LUNA), Kava (KAVA), 1Inch (1INCH), and Ren (REN) all gaining double digits. Ethereum has managed a gain of 10% to reach $2,390.

DeFi TVL closes in on $100B

The amount of collateral locked (TVL) into various DeFi protocols has also surged along with token prices. According to DappRadar, TVL has gained 7% over the weekend surging to $98.4 billion. Since this time last week, TVL has increased by 23% and is at its highest level since mid-June.

Uniswap, which has recently delisted a bunch of tokens, is the top protocol in terms of TVL with $10.8 billion.