Crypto industry review: It is survival of the fittest in the crypto world, says Celia Zeng, DeFi Asset Manager at Cabital.

This week saw a decline in the price of a major cryptocurrency that was purportedly pegged to national currencies like the US dollar. This reiterated calls for the U.S. Congress to authorize regulation of stablecoins.

Volatility has been the keyword in the crypto industry over the past few months. The short-term factors have overpowered the long-term expectations. This is causing optimization amongst the key players and instruments. The survival of the fittest continues to strengthen the industry by weeding out unreliable or unethical players.

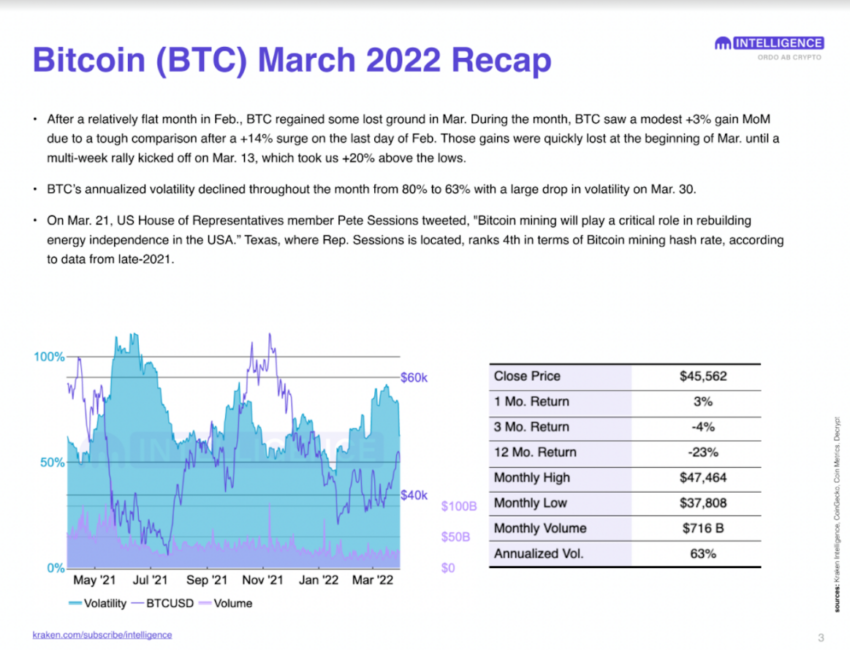

The crypto prices hit their year lows in January and February of 2022. This was followed by a spike in March and a rollback in April and May. The NFTs sub-segment has seen a reduction in prices and liquidity with a substantial decline in the user base. On the other hand, household names have strengthened their presence from legal and practical standpoints.

Crypto industry: Widening adoption

The Metaverse sector, represented by Decentraland (MANA), Sandbox (SAND), and Axis Infinity (AXS), delivered a stellar performance in February with an annual return of 1851%. BTC and ETH improved their performance in February and March, followed by another slump in April. The safe-haven role of the largest cryptocurrencies continued strengthening the market leaders.

Curve, MakerDAO, and Lido Finance held their top-3 positions amongst the DeFi protocols based on the total value locked. Lido Finance remained among the most undervalued protocols based on the market capitalization to total value locked. The DeFi sector has seen sell-offs but continued outperforming the traditional cryptocurrencies.

The entrance of the largest corporations into the crypto sector has become more evident. McDonald’s filed at least 10 trademark applications following its metaverse plans. JPMorgan became the first bank to enter the metaverse by opening the Onyx Lounge in Decentraland. The Super Bowl LVI will receive commemorative NFTs with their tickets. Corporate presence in the crypto industry means a broader user base and more significant capital inflows with increasing demand.

GameFi

GameFi is trending, too, and some tech giants like Facebook have shown their intentions to participate in the metaverse and gaming sector. Traditional gaming platforms such as UniSoft are planning to integrate blockchain technology in their business and technical models, including the usage of NFTs. The NFT market was nearly $25 billion in 2021, and this year, it is expected to reach as much as $35 billion in net sales volume. Based on the current growth rate, observers forecast the NFT market to grow up to $80 billion by 2025.

The legal aspect of the crypto industry has also shown signs of volatility. The SEC launched an investigation into Mirror Protocol, enabling the trading of synthetic versions of popular U.S. stocks.

The Commission has even issued subpoenas to the CEO of Terraform Labs, as the U.S. District Court judge ordered compliance. The global crypto community fended off the EU and the European parliament’s attempt to block or limit Proof-of-Work assets through its Crypto Assets (MiCA) bill, namely 61 (9c). Ukraine’s parliament adopted the bill legalizing cryptocurrencies in February, with Volodymyr Zelensky signing it into law in March.

Investments and venture capital cases

The investment community saw the temporary decline in the crypto industry market capitalization as a solid investment opportunity. The capital investments in the blockchain and crypto industry reached $14.6 billion in Q1 2022, which was almost half of the $30.5 billion invested over the entire 2021. The early adoption state of the industry continued offering a broad range of investment opportunities. In addition, some saw crypto assets as a defensive asset against the rapidly increasing inflation of U.S. dollar prices.

Largest Investments: Sequoia Capital and Paradigm made a $1.15 billion investment into Citadel Securities, representing the largest deal of Q1 2022 within the crypto industry. The deal marked a shift of Citadel Securities into new asset classes, including crypto. Cross River made a $620 million investment into crypto solutions.

Mergers and Acquisitions: When considering the largest mergers and acquisitions in the crypto industry, it is possible to list Silvergate Capital acquiring Diem in January, Fireblocks acquiring First Digital Trust in February, and Blockchain.com acquiring Altonomy in March. The Web3 sector has drawn the largest share of investments at 26.5% of the total amount in Q1 2022.

Sustainable Development: Crypto industry has also shown how it can mobilize around good causes. Decentralized autonomous organizations stepped up their game amid the war of Russia against Ukraine. Ukraine DAO alone generated $6.75 million from the sale of the NFT featuring the Ukrainian flag. The Crypto fund set up by the Ministry of Digital Transformation of Ukraine has raised over $60 million in donations. These examples show how the crypto industry removes barriers and bureaucratic red tape for good causes.

Risks and hacks

Like any business or bank, the crypto industry remained vulnerable to attacks of hackers. They reveal vulnerabilities of networks and exchanges through reentrancy attacks, lender-board entries, direct hacks, and other tools. The good news is that each episode strengthens its participants and industry overall by removing the mentioned weaknesses and closing the backdoor for future hacking attempts.

Amongst the victims of the recent attacks in March-May 2022 were Agave DAO, Cashio, Revest Finance, Ronin Network, Voltage Finance, Inverse Finance, Elephant Money, and Beanstalk. The attacks usually result in millions of dollars’ worth of losses. For instance, from $181 million stolen from Beanstalk, the attacker managed to keep $76 million.

Crypto industry: What does the future “hodl”?

The fundamentals point toward the future growth of the crypto industry. The temporary short-term volatility presents investment opportunities and a strong base for mergers and acquisitions. Our advice is to “BUIDL” (Build Useful Stuff) by developing strong infrastructure and investing in reliable projects. This would avoid the risk of losing gains during the down cycle and generate new capital flows in the industry.

About the author

Celia Zeng is Cabital’s DeFi asset manager. Cabital simplifies investing in the crypto world while filtering out the noise and unnecessary drama that’s associated with it.

Got something to say about the crypto industry or anything else? Write to us or join the discussion in our Telegram channel. You can also catch us on Tik Tok, Facebook, or Twitter.

Disclaimer

In compliance with the Trust Project guidelines, this opinion article presents the author’s perspective and may not necessarily reflect the views of BeInCrypto. BeInCrypto remains committed to transparent reporting and upholding the highest standards of journalism. Readers are advised to verify information independently and consult with a professional before making decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.