When it comes to covering Wall Street on television, CNBC was the one that started it all. But as far as the cryptocurrency market is concerned, the mainstream business network should probably stick to its knitting. That’s because CNBC doesn’t have such a great track record for keeping the momentum going once it tweets about the Bitcoin price.

Let’s get something out of the way. CNBC’s tweeting track record is not a refection of the network’s go-to cryptocurrency investor, Brian Kelly. He runs a digital currency investment firm dubbed BKCM whose strategy is “focused on global macro and currency investing, including investing in digital currencies,” according to the website.

The halvening is coming. With only 11 out until a major bitcoin supply cut, @BKBrianKelly breaks down why there could be a big breakout ahead for the cryptocurrency. pic.twitter.com/w9bzhbjNej

— CNBC's Fast Money (@CNBCFastMoney) May 1, 2020

Kelly was touting BTC on the network before it was cool to do so. He talks the same language as the network’s guests like CoinShares’ Meltem Demirors and follows the fundamentals when it comes to Bitcoin catalysts. In other words, he’s not the problem. As the crypto community might say —

CNBC’s bullish tweet came in response to Kelly’s explanation of the upcoming Bitcoin halving event, in which he said,

“In the past, this has been a catalyst for very big — very, very big run-ups. We’ve had a tremendous run-up coming up to this. It’s got some wood to chop around $9,000. But i think in the medium to long term, you now have an asset that’s going to be more scarce than gold based on the stock-to-flow ratio in an environment where the entire world is printing money.”

Tweet Heard Round Crypto Land

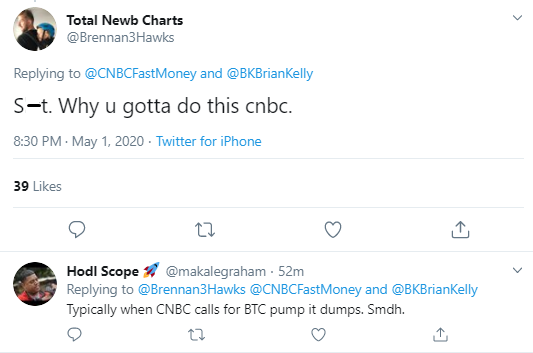

In fact, much of Crypto Land would cheer Kelly’s analysis. But when the business network tweeted about the upcoming Bitcoin halving event, suggesting there could be a “big breakout ahead,” a collective sigh of disappointment could be heard throughout Crypto Twitter. That’s because CNBC’s tweets have a way of predicting the reversal of a cycle — whether it’s bullish or bearish. In this case, if the theory proves true, the bullish tweet suggests that the bears are about to come out of of hibernation.

Numbers Don’t Lie

As BeInCrypto previously reported, tech entrepreneur and Bitcoin and stock trader Jacob Canfield tested the mettle of what he refers to as the “CNBC Bitcoin -0.78% Indicator” in a chart dubbed “CNBC Is the Perfect Contraindicator.” The chart goes through August 2018, but the accuracy in which his theory proved right suggests that not much has changed when it comes to CNBC’s ability to read the cryptocurrency market. Canfield said at the time,

“Almost every single bullish tweet we’ve seen has been at the top of nearly every single rally, giving us a very strong sell signal. With every bearish tweet we see, it has been a clear indicator of a short reversal and end of a rally….With every bearish tweet, we typically see on average a 30% return.”

Bullish Catalysts

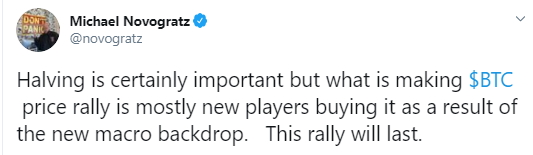

A lot would have to go wrong for the CNBC indicator to be dependable this time around. After all, the bullish catalysts are hard to ignore, including both the upcoming Bitcoin halving and green shoots of cryptocurrency adoption.

Cryptocurrency market data site CryptoCompare recently reminded its followers on Twitter of how Bitcoin reacted to the last halving event, which took place in 2016.

Meanwhile, signs are also pointing to greater Bitcoin adoption.

So perhaps this time around, the Bitcoin halving event coupled with wide-scale adoption will override CNBC’s tweeting track record. Crypto Land can only hope.