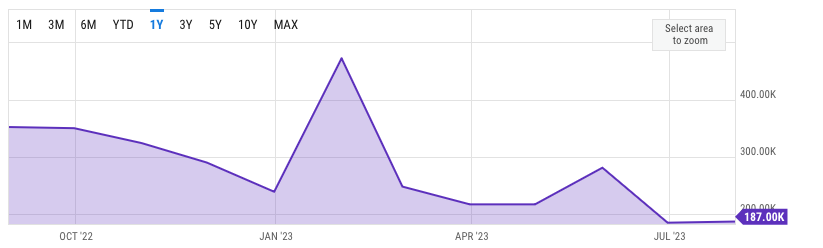

US nonfarm payrolls came in lower than expectations at 187,000 for July, a signal the Federal Reserve (Fed) could soon ease tightening and induce a soft landing.

Market commentators expected the US to add 205,000 jobs in July, with unemployment remaining unchanged month-on-month at 3.6%

US Labor Market Softens as Wage Growth Stabilizes

However, the US added 187,000 jobs and recorded lower-than-expected unemployment of 3.5%. Hourly wage growth also slowed amid reduced employer demand.

The healthcare sector led job gains with 63,000, up 12,000 from last month, followed by social assistance (24,000), financial activities (19,000), and wholesale trade (18,000). In July, nonfarm employees earned 14 cents more per hour than in June, but fewer working hours reduced average weekly wages.

The number of weekly hours worked fell 0.4% to 34.3, the lowest since the spring of 2020 and a sign of a softening labor market. Economists see fewer hours as an alternative to layoffs amid declining employer demand.

Bitcoin (BTC) reacted positively to the nonfarm payrolls report, with the world’s largest crypto rising to $29,216 from $29,121 shortly after the announcement, according to market data aggregator CoinGecko. Most other cryptos in the top 10 remained flat, along with US equities.

Soft Landing Scenario Possible if July CPI Falls

The lower nonfarm payrolls, almost-flat unemployment, and slowing wage growth were positive for the Fed’s fight against inflation. They suggest that job supply and demand are reaching equilibrium.

According to George Mateyo, CIO of Key Private Bank,

“The labor market continues to cool as hiring plans modestly fade. At the same time, companies are not letting workers go and, if anything, are continuing to offer enticements to keep them,” he says.

Fed chair Jerome Powell previously emphasized that the bank’s goal in increasing interest rates was “maximum employment” with 2% inflation. In June, the Bureau of Labor Statistics reported an annual increase of 3% in US inflation.

Tired of being at the mercy of unpredictable inflation? Find out here how crypto can help.

Financial and crypto markets await the release of July’s consumer price index (CPI) in six days for further clues on when the Fed will pause rate hikes. The Federal funds rate is currently at 5.5%.

Got something to say about the latest US nonfarm payrolls report or anything else? Write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.