Crypto asset manager CoinShares has launched a new hedge fund division to court American investors. The business will cater to accredited investors and complement the company’s portfolio of exchange-traded products (ETPs).

According to CoinShares’ Chief Executive Officer, Jean-Marie Mognetti said that high interest rates provide interesting opportunities to outperform markets.

Sponsored“The market, the macro environment is very fertile for this because of monetary policy, lots of volatility, macro uncertainty,” he said.

CoinShares’ Filing Follows SEC Rulemaking Blitz

While it has not revealed details about the new division, CoinShares filed paperwork with the US Securities and Exchange Commission (SEC) over the summer to launch two feeder funds focused on Bitcoin (BTC) and Ethereum (ETH). The company has not publicized the new hedge fund’s investment approach.

In August, the SEC voted to compel the $27 trillion private fund industry, including private equity, venture capital, and hedge funds, to release quarterly performance and expense reports. The move was designed to protect investors from potentially unfair and harmful practices by fund managers.

According to Elizabeth Shea Fries, a partner specializing in investment funds at law firm Sidley Austin LLP, the move would significantly increase fund costs. The SEC later pegged annual compliance costs for its new rules at around $961 million.

Accredited Investors Struggle to Invest in Crypto Funds

Wall Street’s attempt to package crypto in exchange-traded funds (ETFs) for American investors has not yet borne fruit. The SEC has demanded spot ETF applicants improve market surveillance to combat manipulation but subsequently delayed ruling on revised filings.

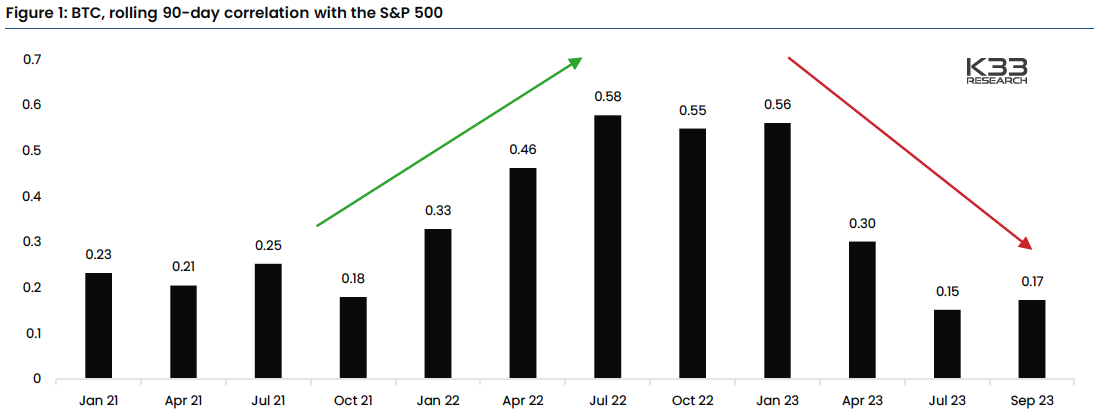

SponsoredMoreover, K33 senior analyst Vetle Lunde said major crypto funds tracking futures and other crypto derivatives experienced their fifth week of outflows. Lunde says the correlation between crypto assets and equities has fallen from their bear market highs.

Learn more about the banking crisis that shook the US in March here.

As a result, it is unlikely that future Fed decisions and other macro events will significantly impact crypto markets as they did in 2022, Lunde notes.

“What we have seen throughout the year is that correlations between Bitcoin, the Dollar Strength Index, and US equities have fallen. So correlations are now effectively nearly zero. We are about to reach an area similar to where we were before COVID-19,” he said.

Understand the differences between crypto and stocks here.

Higher Federal Reserve rates appear to be pushing American investors away from crypto toward lower-risk investments like long-term government treasuries. The move has sparked concerns the US government’s monthly rate of debt accrual has spiraled out of control.

Do you have something to say about CoinShares launching a new crypto fund in this macro climate or anything else? Please write to us or join the discussion on our Telegram channel. You can also catch us on TikTok, Facebook, or X (Twitter).