Bitcoin displayed stability, with prices hovering between $27,260 and $27,000. This calm response came from the Federal Reserve’s decision to maintain the status quo on interest rates.

On Wednesday, the Fed took a breather from its anti-inflationary crusade, keeping interest rates steady within the 5.25% to 5.5% bracket, which is the peak in over two decades.

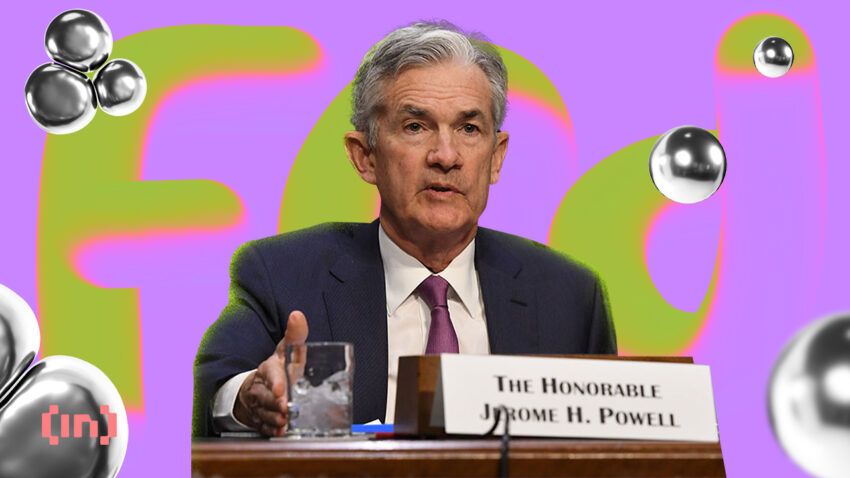

Bitcoin Consolidates as Fed Leaves Rates Unchanged

This week’s decision continues the Federal Reserve’s proactive stance on inflation that began in March 2022. Despite the decision to hold rates, there is still an underlying expectation of another hike before 2023 concludes.

However, the strategic change is evident in the revised forecast for 2024. The Fed plans a decrease to 5.1% rather than the earlier projected 4.6%.

This modification stems from an economy that has defied previous forecasts. By showcasing stronger growth, dwindling unemployment, and moderated inflation by the end of 2023, the Fed’s predictions exude positivity. Such an economic climate, resilient despite increased borrowing costs, negates fears of an imminent recession.

“The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. In support of these goals, the Committee decided to maintain the target range for the federal funds rate at 5-1/4 to 5-1/2 percent. The Committee will continue to assess additional information and its implications for monetary policy,” the Fed said in the policy statement.

Read more: How To Prepare for a Recession: 11 Quick Tips

Furthermore, the Federal Reserve’s public statement sheds light on the nation’s economic heartbeat. It has transitioned from a “moderate” to a “solid” growth phase, with the only exception being a slight deceleration in job gains. Still, the process of “getting inflation sustainably down to 2% has a long way to go,” as Fed Chair Jerome Powell stated.

This evolving narrative of growth, coupled with tamed inflation rates, provides the Federal Reserve with the luxury of patience. Its aim remains to control rising prices without inflicting undue economic strain.

Interestingly, Bitcoin remains stable amid these economic undercurrents. The pioneer cryptocurrency consolidates between $27,260 and $27,000 without clearly indicating where it is going next. On-chain analytics firm Santiment maintains the current price levels are “proving to be polarizing.”

Read more: Analysts Say the S&P 500 Is Oversold While Bitcoin Targets $22,000

Meanwhile, BeInCrypto’s Global Head of News, Ali Martinez, issued a warning about the potential of a price correction. As Bitcoin nears a “descending resistance trendline at $27,440,” Ali maintains a price “correction from here might take BTC to $25,200.”

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.