Coinbase took another step back in volume during the month of February after the centralized exchange saw a further decline in total liquidity poured into the platform.

February proved to be a difficult month for centralized and decentralized exchanges. Coinbase recorded approximately $93 billion in trading volume in the second month of the year, according to BeInCrypto Research.

Although this statistic may look impressive due to the mileage of Coinbase in the saturated crypto finance market, the total volume of the exchange dipped in February. The total volume for January 2022 was $124 billion and took a staggering 25% hit in February 2022.

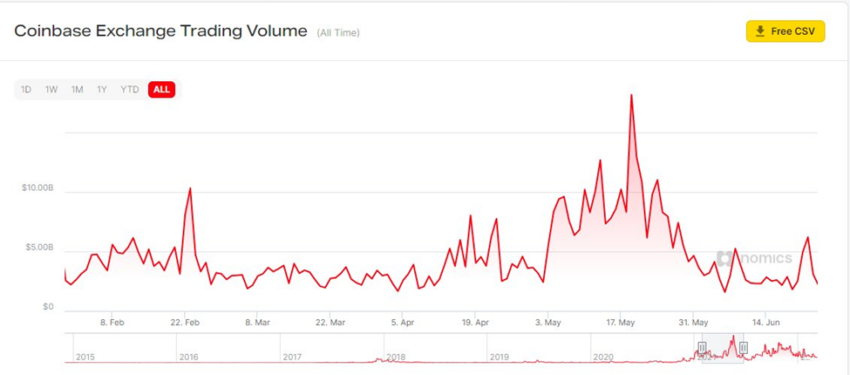

Volume still decreasing from 2021

The decrease in volume over the last two months could have detrimental effects on Coinbase since it competes with centralized exchanges such as Binance, Mandala Exchange, OKX, Hotcoin Global, CoinFLEX, BitMart, IndoEx, Upbit, Deepcoin, MEXC, and HitBTC among others.

Coinbase, unlike other exchanges that saw an increase year-on-year, took a massive hit in its annual performance. Coinbase saw a year-on-year monthly decrease of 27% in February 2022. The total volume recorded for February 2021 was approximately $128 billion.

Aside from that, the exchange did not live up to the milestones it accomplished in the second quarter and final months of 2021. Coinbase recorded approximately $255 billion as its all-time high monthly volume in May 2021. Due to the bearish nature of the market towards the end of 2021 which carried over into the first quarter of 2022, Coinbase shed 42% of its May 2021 high volume to record a total volume of approximately $147 billion on Dec. 31, 2021.

Overall, Coinbase’s total volume by the end of February 2022 was 63% and 36% below the volumes of May and December 2021 respectively.

What caused Coinbase volume to decline?

The total number of coins supported, the total number of markets supported, and the markets traded during the periods are certainly prime factors that contributed to the decline in total trading volume.

For a centralized cryptocurrency exchange, Coinbase has been criticized by numerous experts as supporting a relatively smaller number of coins when compared to competing exchanges. Aside from this, Coinbase does not support as many pairs, and this affected the course of trading patterns on the exchange during a bearish market in February 2022.

As of writing, Coinbase supports less than 150 cryptocurrencies and less than 500 market pairs. For the largest cryptocurrency exchange by volume in the United States, improvements are needed to see a transformation in the fortunes of the exchange.

The top markets of Coinbase in 2022 are crypto-to-fiat pairings and crypto-to-crypto pairings. Among others are USD pairings for Solana (SOL), Bitcoin (BTC), Ethereum (ETH), Avalanche (AVAX), Wrapped Luna (WLUNA), Cardano (ADA), Shiba Inu (SHIB), Dogecoin (DOGE), and Origin (ORG).

In a bear market where traders and investors watch out for large percentage losses, the top pairings are crypto-to-stablecoins such as BTC/USDT or ETH/USDT. The highest stablecoin market on Coinbase is BTC/USDT which does not fall into the top-10 markets and as of writing had a volume below $30 million.

This is in contrast to competing exchanges where stablecoin markets continue to record more than $100 million in daily volume.

This sums up why there is a consistent decline in volume over the last two months.

The trading volume for March stands at more than $33 billion at the time of press.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.