Chainlink has marked a significant milestone in blockchain interoperability with its Cross-Chain Interoperability Protocol (CCIP), which now supports a wider array of blockchains.

According to a press release sent to BeInCrypto, Chainlink has expanded CCIP’s reach to include nine prominent blockchains. These are Arbitrum, Avalanche, Base, BNB Chain, Ethereum, Kroma, Optimism, Polygon, and WEMIX.

Chainlink’s LINK on the Verge of Breakout

The protocol’s general availability enables developers to transfer tokens and send messages to smart contracts on different blockchains. It also lets developers execute programmable token transfers.

Consequently, these capabilities facilitate a seamless exchange of data and value. This enhancement significantly improves the efficiency and scope of decentralized applications.

Sergey Nazarov, co-founder of Chainlink, highlighted the growing adoption of CCIP.

“The mainnet general availability of CCIP is something that makes it even easier for developers to quickly adopt CCIP as a secure mechanism for cross-chain connectivity,” Nazarov told BeInCrypto.

Read more: How To Buy Chainlink (LINK) and Everything You Need To Know

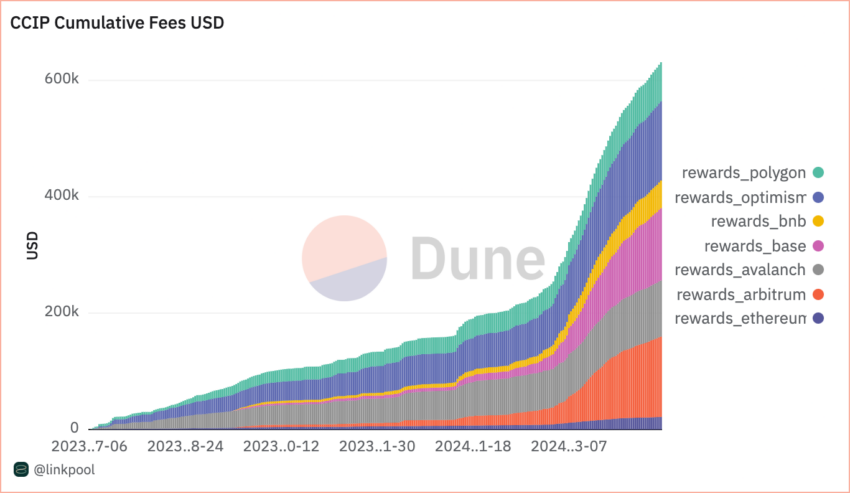

Moreover, the introduction of new features such as Transporter—a bridging application—and enhanced token transfer capabilities, have propelled CCIP’s growth. In the first quarter of 2024 alone, the protocol saw a more than 900% increase in cross-chain transactions and a remarkable 4,000% increase in transfer volume compared to the previous quarter.

Additionally, the expansion of CCIP is pivotal in creating interconnected markets for tokenized real-world assets (RWA). As part of the broader Chainlink platform, CCIP provides essential data and computational resources needed for the functioning of tokenized asset markets.

Despite these technological advancements and growing adoption, Chainlink’s native token, LINK, has experienced a price decline, trading over 30% down from its March highs. However, recent chart patterns suggest a potential bullish reversal.

For a successful reversal, LINK needs to breach the $15.63 neckline. If LINK sustains this breakout, it could surge approximately 17% to $18.26.

Read more: Chainlink (LINK) Price Prediction 2024/2025/2030

Conversely, if LINK fails to maintain this breakout level, the bullish pattern could be invalidated. Such a scenario could lead to a retest of lower support levels around $14.52.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.