Smart contract-based decentralized finance markets could be worth trillions of dollars in the next few years, according to investment firm Ark Invest. The findings are part of its latest in-depth research report into the crypto industry.

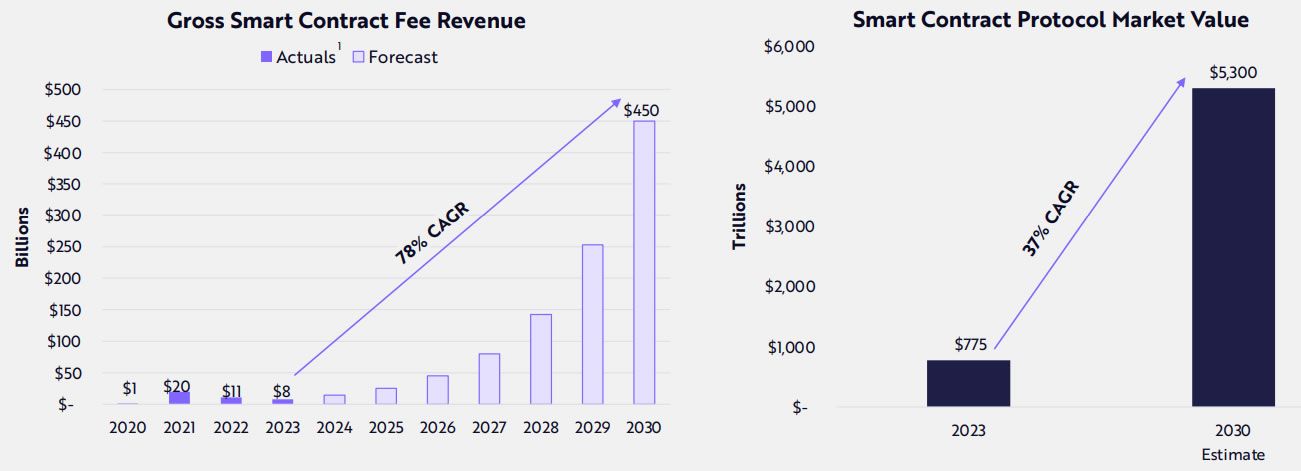

In its “Big Ideas 2024” annual research report, Ark Invest predicted that smart contracts could generate over $450 billion in fees annually by 2030. This could create over $5 trillion in market value for smart contract platforms. This would occur if crypto and blockchain adoption follows an internet-like trajectory, it stated.

Smart Contract Growth Projections

In the aftermath of the 2022 crypto contagion crisis, several digital asset solutions gained traction, including stablecoins, tokenized treasury funds, and scaling technologies. These are all powered by smart contracts.

Ark noted that as the value of on-chain financial assets increases, the market value associated with dApps could scale 32% at an annual rate. This could take it from $775 billion in 2023 to $5.2 trillion in 2030.

“In their infancy, smart contracts are powering a novel financial system that is native to the internet.”

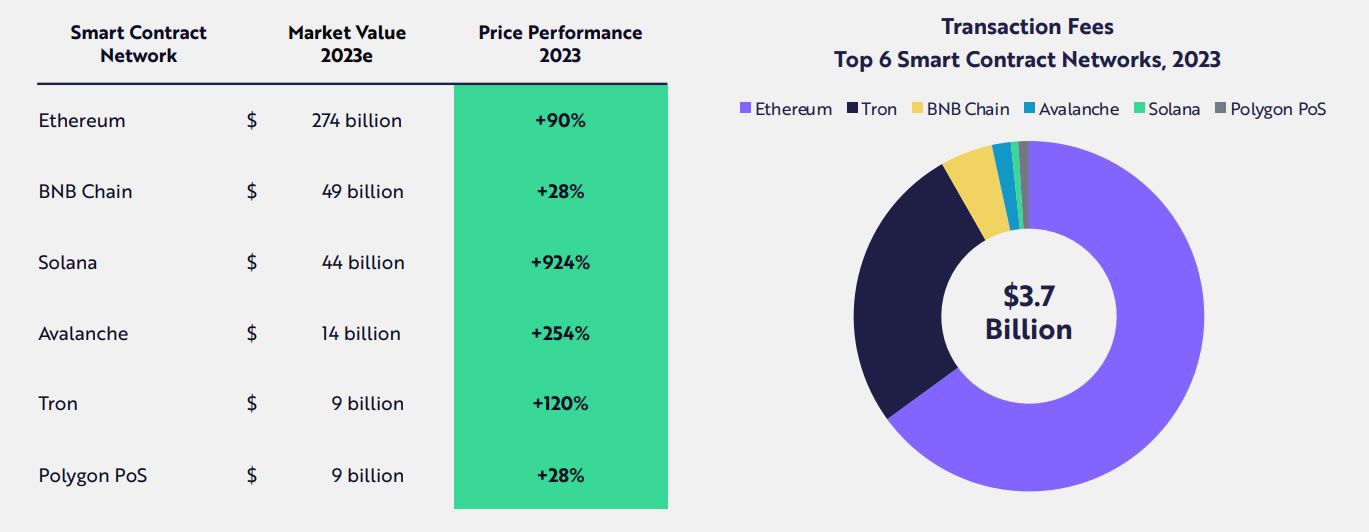

Ethereum is the largest digital contract network, with 68.5% of the market value of the top six networks in 2023. In addition to Ethereum, these were BNB Chain, Solana, Avalanche, Tron, and Polygon.

Moreover, the top six combined generated $3.7 billion in transaction fees in 2023.

Drivers of adoption include stablecoins and real-world asset (RWA) tokenization, the report revealed.

Hyperinflation in emerging markets and an increase in global instability have further pushed demand for dollar-pegged stablecoins to new highs.

During the past three years, the number of daily active stablecoin addresses globally has increased at an annual rate of 93%, it reported. Moreover, stablecoin transfer volumes surpassed those of Mastercard in 2023.

Read more: Understanding Smart Contracts: Read, Write, and Audit

Ark also predicted that smart contracts could collapse the cost of financial services. At $20 trillion in total annual revenue, the aggregate financial services industry’s take rate has been 3.3% relative to the value of all financial assets, it reported.

“Smart contracts could lower this drag on the economy materially.”

The section concluded:

“Smart contracts could facilitate the origination, ownership, and management of on-chain assets for a fraction of traditional financial costs.”

Trusted

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.