While Cardano (ADA) price movement has been underwhelming, the Total Value Locked (TVL) on its native DeFi ecosystem has nearly tripled in 2023. A comprehensive on-chain analysis dissects how the TVL growth could impact future ADA price action.

Cardano (ADA) price made a promising start to 2023, peaking at $0.45 in mid-April. But, from Q2 onwards, the Cardano price has been plagued by intense FUD from regulatory squabbles.

However, on-chain data reveals that it’s not all doom and gloom for Cardano.

Despite Cardano Price Doom, DeFi TVL has Continued to Boom

With prices currently sitting at $0.29, ADA has now declined 36% from its 2023 peak recorded on April 17. Meanwhile, the Cardano DeFi ecosystem has experienced a much different fate.

According to DeFillama, despite recent regulatory squabbles, Cardano TVL has continued to boom in H2 2023. As of August 15, Cardano TVL currently stands at $177.83 million, representing 250% growth in 2023.

TVL stands for “Total Value Locked.” It essentially refers to the total amount of assets that are currently being held and utilized within a decentralized finance (DeFi) ecosystem.

TVL is a prime indicator of the overall economic activity and the underlying value of projects built on top of the Cardano blockchain network.

While it may not directly impact the native token’s short-term price action, an uptrend in TVL indicates fundamental growth in adoption.

For proper context, the price sank 42% toward $0.26 in June 2023, when the SEC listed ADA as a security in its lawsuits against Binance and Coinbase.

But, as shown above, Cardano TVL has continued to boom since that landmark event. This positive divergence between price and TVL indicates a sustained network demand and affirms the fundamental utility of the Cardano ecosystem.

More importantly, if the TVL continues to grow, it could assure investors of ADA’s long-term viability as the regulatory battle continues.

ADA Long-Term Investors Have Remained Resilient

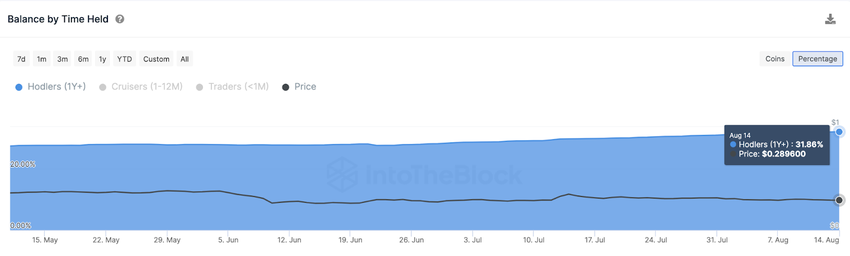

Furthermore, on-chain ownership metrics reveal Cardano’s long-term investors have remained positive. Indicatively, IntoTheBlock’s Balances By Time Held data shows that, before the SEC filed charges against Binance on June 5.

Long-term Investors held 27.71% of the total ADA coins in circulation. And at the time of writing, on August 15, their holdings now stand at 31.86%.

This shows that Cardano’s long-term investors have increased their stake in ADA by 4% since the regulatory FUD ensued.

Wallet addresses that have held their coins for at least 1 year are regarded as long-term holders. Since they sell off their holdings less frequently, an increase in the balances of long-term investors is often a bullish signal.

In conclusion, the TVL growth and increase in long-held coins during a prolonged price downtrend signals Cardano investors’ intent to consolidate and diversify within the ecosystem rather than bail out.

Hence, the positive impacts from the Cardano TVL growth could help the ADA price hold the critical $0.25 support level in the coming weeks and months.

ADA Price Prediction: Consolidation above $0.25 Before Lawsuit

While the Cardano team and community continue to remain hopeful of a favorable court verdict, the residual demand from the TVL growth will likely help ADA hold the $0.25 support.

The In/Out of Money (IOMAP) data shows the distribution of current Cardano holders within the 20% price boundaries. It validates the prediction that ADA Price will consolidate above $0.25 in the coming weeks.

Evidently, 40,920 holders had bought 1.9 billion ADA coins at a minimum price of $0.27. They could trigger an instant price rebound if they hold firm as predicted.

But, even if that support level fails to hold, the next supply wall at $0.26 could help prevent a panic sell-off.

Still, if the regulatory pressure subsides, the TLV growth propel ADA price toward $0.35. However, as seen above, the cluster of 121,000 addresses had bought 1.14 billion Cardano coins at the maximum price of $0.32. The bears could mount a sell-wall at that territory in attempts to force a downswing.

But if that resistance level cannot hold, ADA could head toward $0.35.

Check Out the Top 11 Crypto Communities To Join in 2023