The decline in Cardano’s (ADA) price in the past few weeks has caused many of its holders to lose money.

On-chain data has shown that the count of daily transactions in losses exceeds those that return a profit.

Cardano Holders Look For a Way Out

At press time, ADA traded at $0.45. In the last month, the altcoin has shed almost 10% of its value. In fact, during that period, ADA cratered to a low of $0.42 before rebounding.

Due to a steady decline in the coin’s value in the past few weeks, most of its holders have booked losses on their transactions. An assessment of the ratio of ADA’s daily transaction volume in profit to loss (observed using a 30-day moving average) was 0.94 at press time.

This means that for every ADA transaction that ended in a loss, only 0.94 transactions returned a profit.

When this metric returns a value below 1, it suggests a tendency for more selling pressure than buying pressure during the period under review.

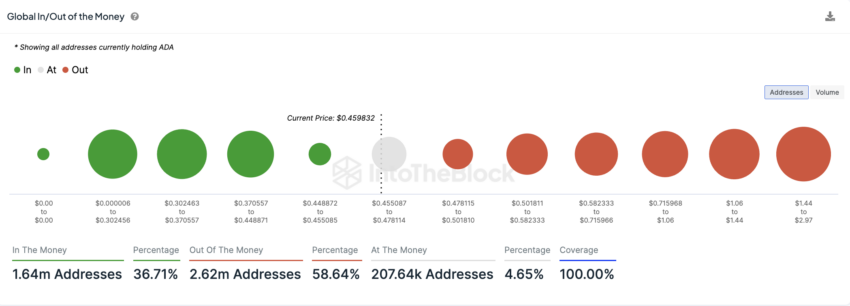

As the coin’s price plunges, many of its holders continue to sit on unrealized losses. As of this writing, 2.62 million addresses, which make up 59% of all ADA holders, are “out of the money.”

An address is considered out of the money if the current market price of an asset is lower than the average cost at which the address purchased (or received) the tokens it currently holds.

Read more: Cardano (ADA) Price Prediction 2024/2025/2030

Conversely, 1.64 million addresses, representing 37% of all ADA holders, hold their coins at a profit.

ADA Price Prediction: To Buy the Dip or Not

Readings from ADA’s Elder-Ray Index suggested that ADA investments may continue to lose their value in the short term.

This indicator measures the relationship between the strength of buyers and sellers in the market. When its value is negative, it means that bear power is dominant in the market. As of this writing, the value of ADA’s Elder-Ray Index was -0.038.

Also the coin’s Relative Strength Index (RSI) was in a downtrend at 41.94. At this value, ADA’s RSI signaled that its selling pressure exceeded its buying activity.

Cardano Analysis. Source: TradingView

If coin sell-offs continue, ADA may fall under its support at $0.42 to exchange hands at $0.416.

However, if market participants heed ADA’s Market Value to Realised Value (MVRV) ratio, which currently flashes a buy signal, and “buy the dip,” the coin’s price might rally toward $0.479.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.