The changing market conditions creating a bearish atmosphere are harming the potential of an altcoin season.

Bitcoin has been receiving market support owing to the increasing demand generated by a successful spot BTC ETF run.

Is Altcoin Season Over?

Altcoin season, also known as “altseason,” is a period in the cryptocurrency market where altcoins significantly outperform Bitcoin. This phenomenon is primarily identified by observing two key indicators: Bitcoin’s dominance and altcoins’ price performance.

Bitcoin’s dominance refers to the percentage of total cryptocurrency market capitalization held by Bitcoin. During the altseason, this dominance decreases as investors shift their capital from Bitcoin into various altcoins. A noticeable decline in Bitcoin dominance indicates that altcoins are gaining a larger market share.

This decline was last noted in January this year when BTC’s dominance fell sharply from 54% to 50%. However, since then, the dominance has noted an uptrend, reaching 55% in the past month.

This is the most BTC has dominated the crypto market since the March 2021 crash, when the same dominance fell from 70% to 40% in a few days.

Read More: What Is Altcoin Season? A Comprehensive Guide

Alongside the decrease in Bitcoin’s dominance, altcoins typically experience substantial price increases. This surge in altcoin prices, often outpacing Bitcoin’s growth, is a clear signal of altseason. Investors seek higher returns by diversifying their portfolios into altcoins, driving up their prices.

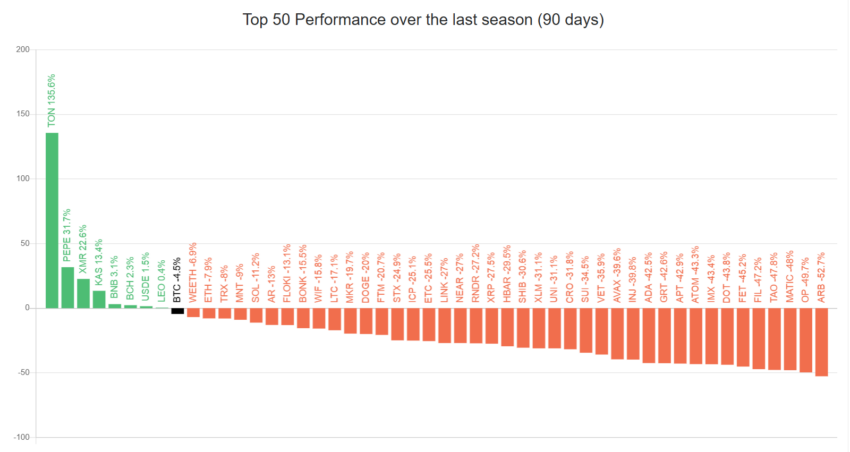

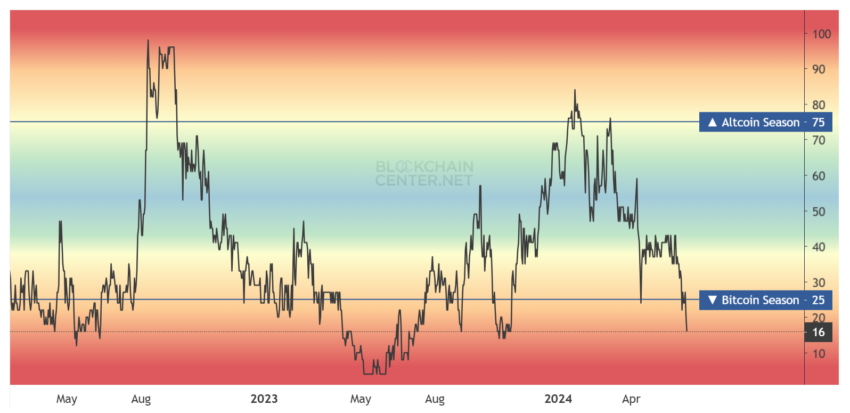

Generally, when 75% of the top 50 altcoins, excluding stablecoins, perform better than BTC over a period of three months, the altcoin season is considered active and successful.

However, over the last 90 days, only eight cryptocurrencies have managed to outperform Bitcoin. Even the meme coin craze and the hype surrounding spot Ethereum ETF approval failed to pull up alts.

This points to a disappointing answer to the above question: The altcoin season ended before it could even begin.

When Is the Next Altcoin Season?

The answer to this question is not straightforward since the volatility of the crypto market makes everything very uncertain. In addition, developments in the macro-financial markets have also impacted the direction of cryptocurrencies.

However, a pattern has emerged since 2022. August 2022 marked the second-to-last altseason, after which it took six months for Bitcoin season to begin. The next and most recent altcoin season began eight months after this, in January this year. Now, five months later, we are witnessing Bitcoin season again.

Read More: 11 Cryptos To Add To Your Portfolio Before Altcoin Season

Thus, if this pattern continues, investors can expect the altcoin season to begin in approximately seven to eight months. This puts the potential timeline for the next altseason in February 2025.

Nevertheless, it is wise to be wary of the broader market and macro-financial markets’ cues.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.