The Bitcoin (BTC) price has bounced sharply since reaching its local bottom on June 15. It is close to breaking out from a nearly three-month-long pattern.

Despite this upward movement, the wave count suggests that more downside is expected. Thus, another sharp fall could ensue once the relief rally is complete.

Bitcoin Price Bounces but Is Not Out of the Woods Yet

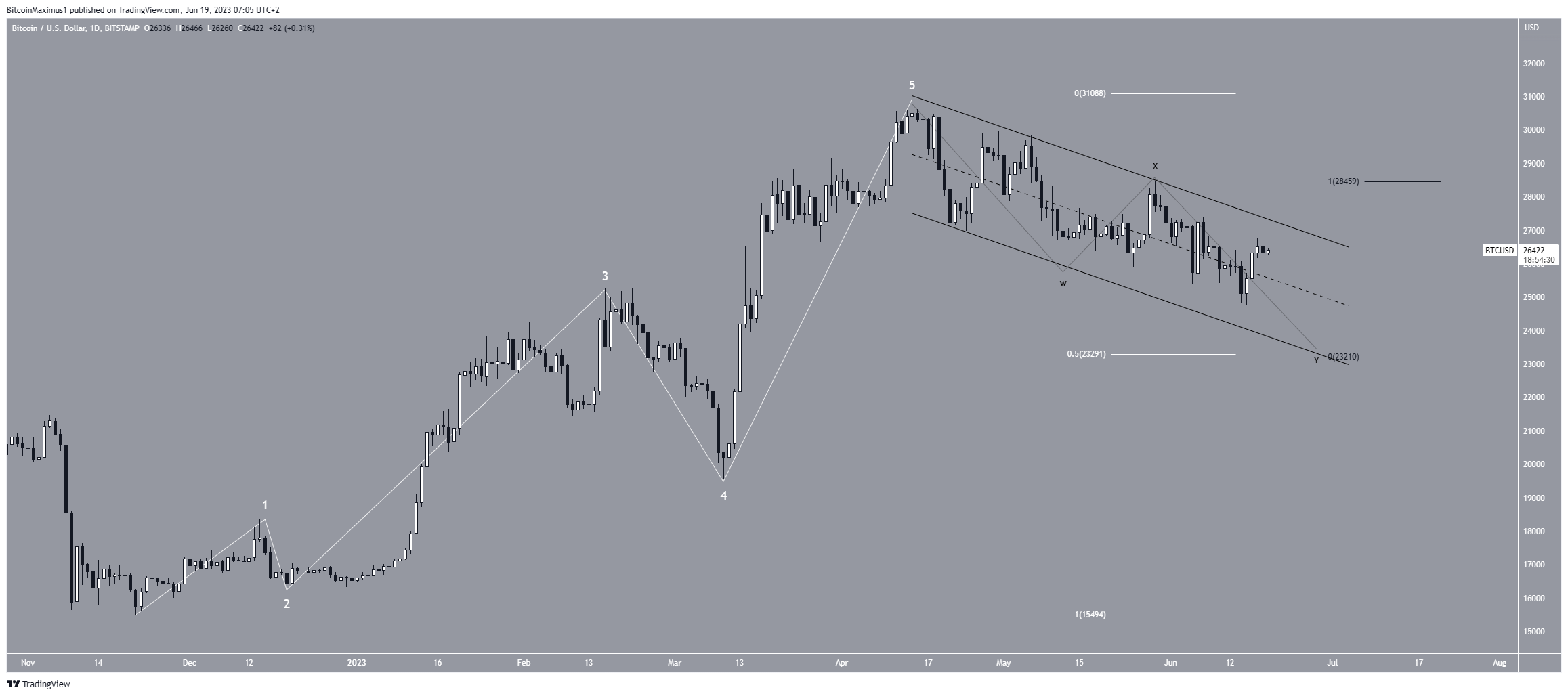

The daily time frame technical analysis shows that the BTC price has fallen inside a descending parallel channel since the beginning of April. Such channels are considered corrective patterns. As a result, a breakout from the channel is the most likely future price scenario.

On June 15, the BTC price bounced (green icon) at a confluence of support levels at $25,000. The area is created by the 0.382 Fib retracement support level and a horizontal support area. Due to this confluence, it is a crucial support area. Since the bounce, the BTC price has moved upward to the channel’s resistance line.

The RSI is a momentum indicator used by traders to evaluate whether a market is overbought or oversold and to determine whether to accumulate or sell an asset. Readings above 50 and an upward trend suggest that bulls still have an advantage, while readings below 50 indicate the opposite. While the RSI is below 50, it is increasing, a sign of a neutral trend.

Moreover, the indicator has moved above and below 50 freely since April 20 (highlighted). This is also considered a sign of an undetermined trend.

BTC Price Prediction: Is the Wave Count Bullish or Bearish?

A closer look at the movement shows that Elliott Wave theory and Fib levels suggest that more downside is likely. While there are still two possible counts in play, both suggest that the price has not reached a low yet.

Technical analysts employ the Elliott Wave theory as a means to identify recurring long-term price patterns and investor psychology, which helps them determine the direction of a trend.

The primary count shows that the BTC price has been corrected in a W-X-Y (black) corrective structure since the end of May. If correct, the BTC price is now in the Y wave, which is the final one before a bullish reversal.

There are three confluence levels near $23,300, which make this a likely level for the correction to end.

First, the $23,300 area aligns with the 0.5 Fib retracement support level (white). The principle behind Fibonacci retracement levels suggests that after a considerable price movement in one direction, the price will retrace or go back partially to a previous price level before continuing in its original direction. Next, a low near $23,300 would give waves W:Y an exactly 1:1 ratio. Finally, the area coincides with the channel’s support line.

Due to this confluence, the area is expected to act as the bottom.

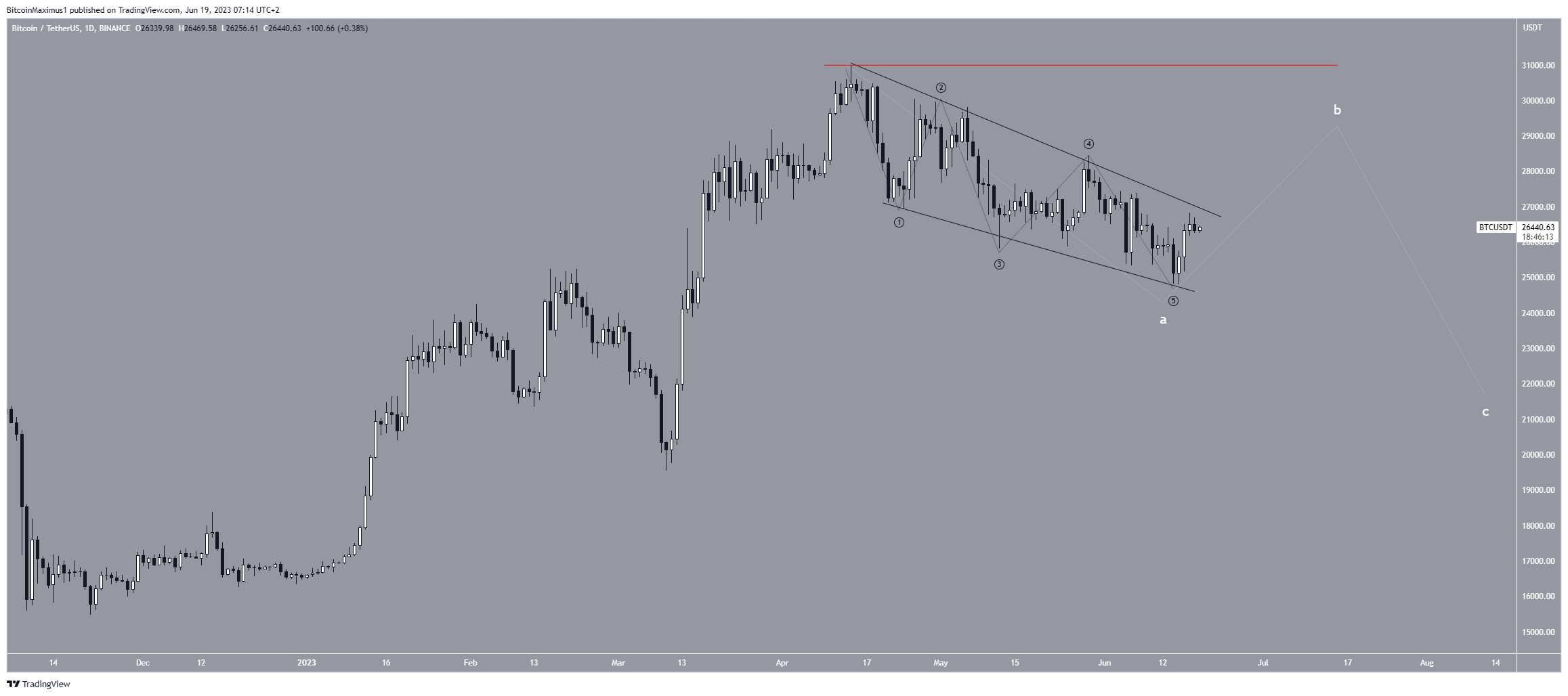

The alternative count suggests that the BTC price has completed a leading diagonal since its April highs. While the pattern is complete, the diagonal is part of a larger structure, either a corrective wave A or a bearish wave 1.

As a result, this count would produce more short-term upside. However, once the bounce is complete, another sharp drop will be expected, taking the price down at least to the $23,300 support area and possibly to $21,000.

Despite this bearish short-term BTC price prediction, a movement above the yearly high of $31,000 (red line) will mean that the trend is bullish. In that case, an upward movement to $40,000 will be the most likely future price scenario.

More From BeInCrypto: