Bitcoin (BTC) price volatility heightened this week as the bulls made several attempts to break the critical $27,500 resistance. While the broader macroeconomic climate remains uncertain, on-chain data flashes multiple green signals for a positive BTC price prediction.

This week, Bitcoin’s large transaction count recovered after the BRC-20 Ordinals triggered a fee hike. With Bitcoin Supply on Exchanges now at the 60-day low, here’s how the bulls could flip the BTC price trend in the coming days.

Large Transactions are Back on the Bitcoin Network

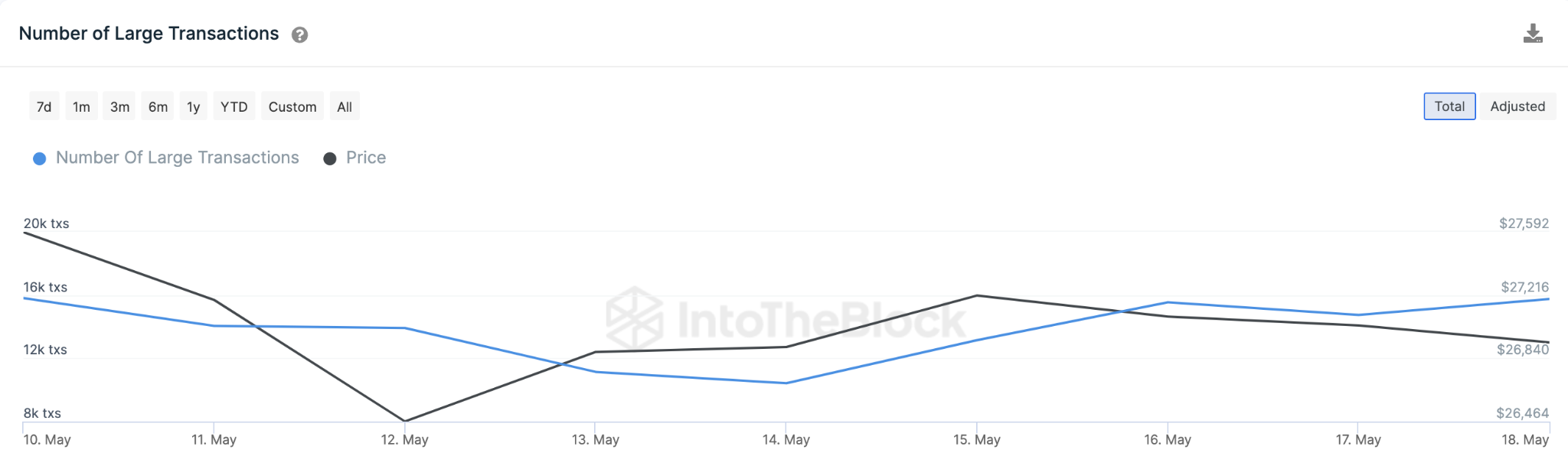

Last week, a sudden hike in gas fees caused by BRC-20 Ordinals saw investors turn to alternatives like Litecoin for peer-to-peer transactions. The downtrend in large transactions contributed to the recent BTC price retracement below $26,000.

However, the controversy cooled off this week as on-chain data shows a resurgence in the volume of Large transactions on the Bitcoin network.

The chart below shows how BTC transactions exceeding $100,000 surged 51% from 10,420 on May 14 to 15,750 transactions recorded on May 18.

The Large Transaction metric evaluates whale activity on a network by tracking daily transactions exceeding $100,000.

Due to the demand pressure and liquidity they provide, these whale transactions are critical to a cryptocurrency’s price prospects.

As the whales return to the Bitcoin network, the bulls could garner greater momentum to challenge the $27,000 resistance.

Investors are Moving Coins Off Exchanges

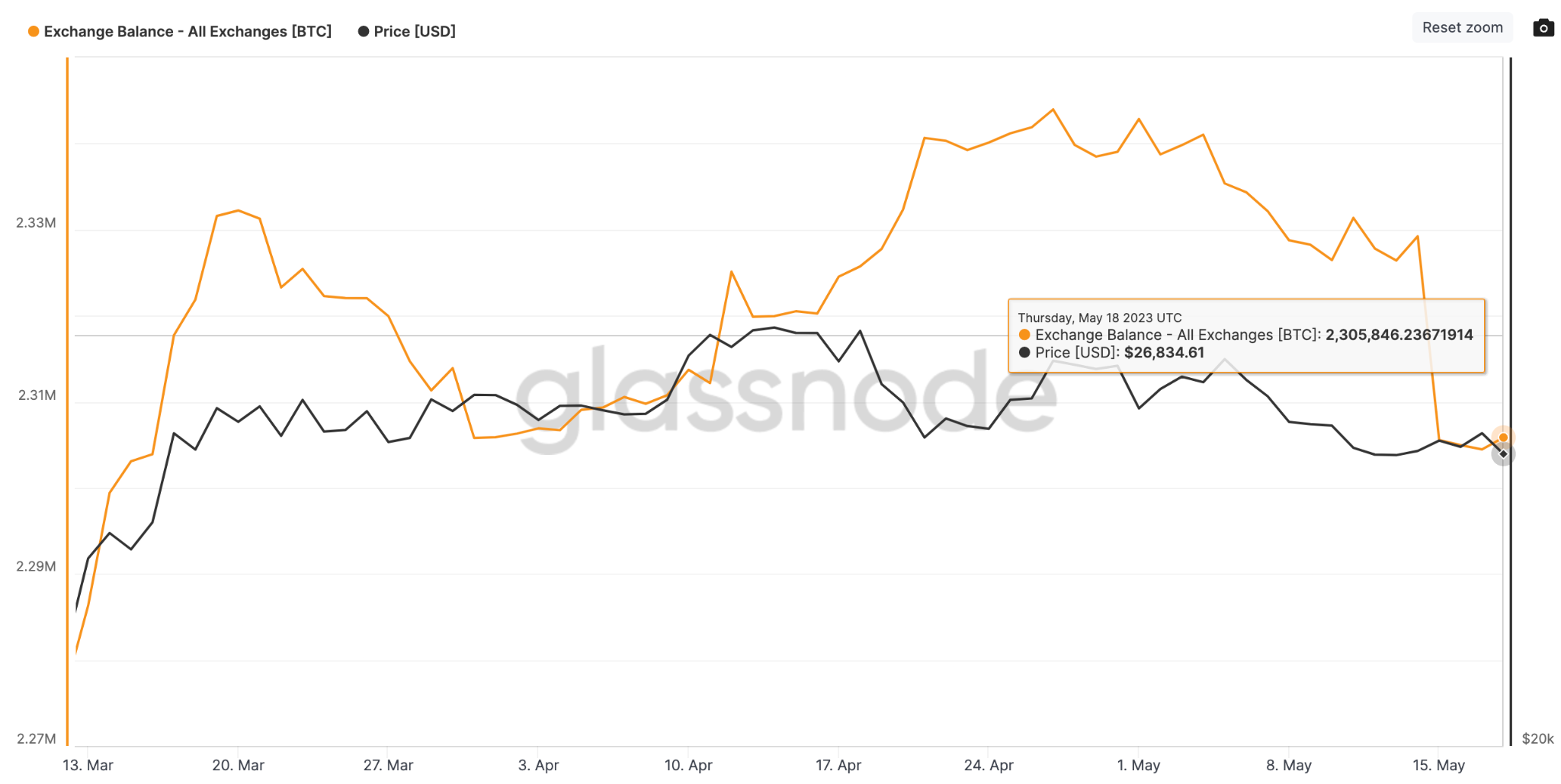

At the close of May 18, 2023, Bitcoin Balance on Exchanges sat at 2.3 million BTC. According to historical on-chain data from Glassnode, this is the lowest since mid-March 2023.

The Supply on Exchanges metric evaluates the number of Bitcoin currently deposited in recognized exchange wallets.

The orange line in the chart below depicts how the number of BTC Balance on Exchanges has entered a sharp decline as the price dropped below $27,000 on May 14.

Since then, Bitcoin investors have moved 240,000 coins off exchanges.

Typically, when the balance of a cryptocurrency available on exchanges declines considerably, it causes a relative scarcity across the markets. This relative scarcity often triggers a price surge.

Interestingly, Ethereum (ETH) exchange supply also dropped to an all-time low this week. This rare coincidence could mean the global crypto industry is preferably playing it safe, as on-exchange coins continue decline.

Investors continue to move coins off exchanges, the positive BTC price prediction could be validated once the market sentiment shifts.

BTC Price Prediction: Upward Momentum Could Push to $28,000

The bullish on-chain signals suggest that Bitcoin might rally toward $28,000 in the coming days.

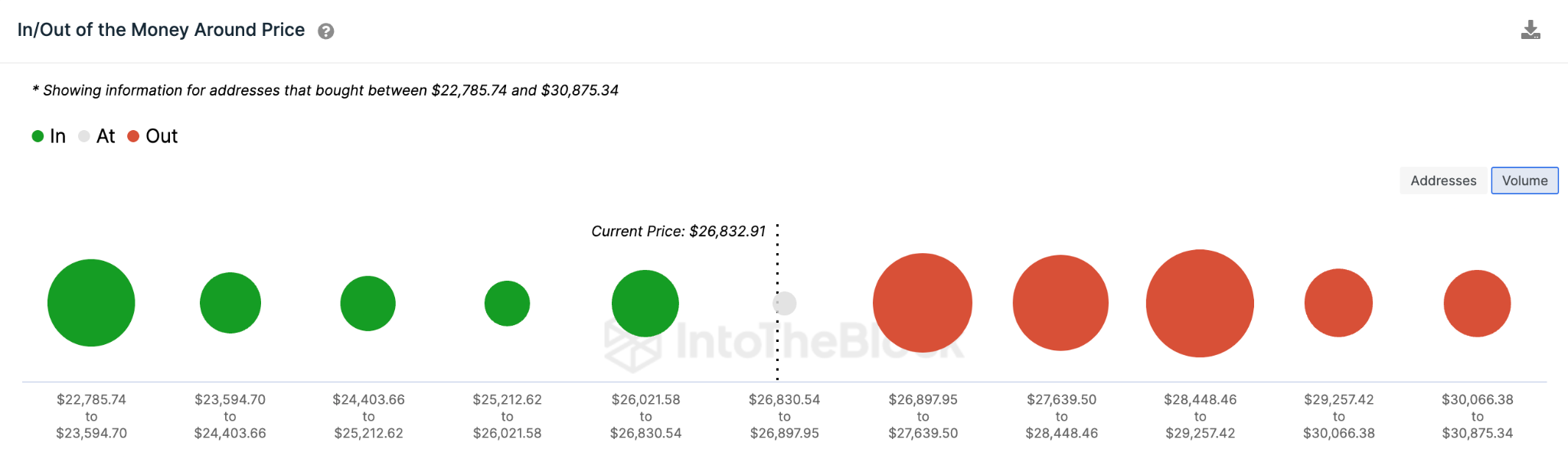

However, IntoTheBlock’ IOMAP chart below shows that 1.82 million addresses purchased 723,000 BTC at an average price of $27,100. This can form resistance if holders want to sell at break even.

However, if there is strong bullish momentum, as predicted, it can serve as a demand zone. Since historically, $27,000 is a level where traders would ideally like to buy, BTC can break out and rally toward $28,000.

However key clusters include 650,000 BTC at an average purchase price of $28,000, as well as 890,000 BTC at an average purchase price of $28,800.

These levels represent large areas of resistance for bulls to tackle should the Bitcoin price shift bullish.

Still, if the $27,100 level forms a resistance, the bears can invalidate the bullish BTC price prediction. However, the 267,000 investors that bought 246,000 BTC at the average price of $26,481 can offer some support.

But failure to hold that key support level could see Bitcoin price decline further toward $25,000.