Cardano (ADA) price has stretched its losing streak to 15% in the last 30 days. The bears look firmly in control, according to on-chain data findings. With investors making bearish Cardano price predictions, here are some of the leading drivers of the current ADA downtrend.

Layer-1 coins like BTC and ETH made marginal gains this week. However, Cardano has not shown any major signs of a price recovery. With long-term investors showing weak hands, will it convince the whales to start selling off ADA again?

Cardano Long-Term Holders Are Showing Weak Hands

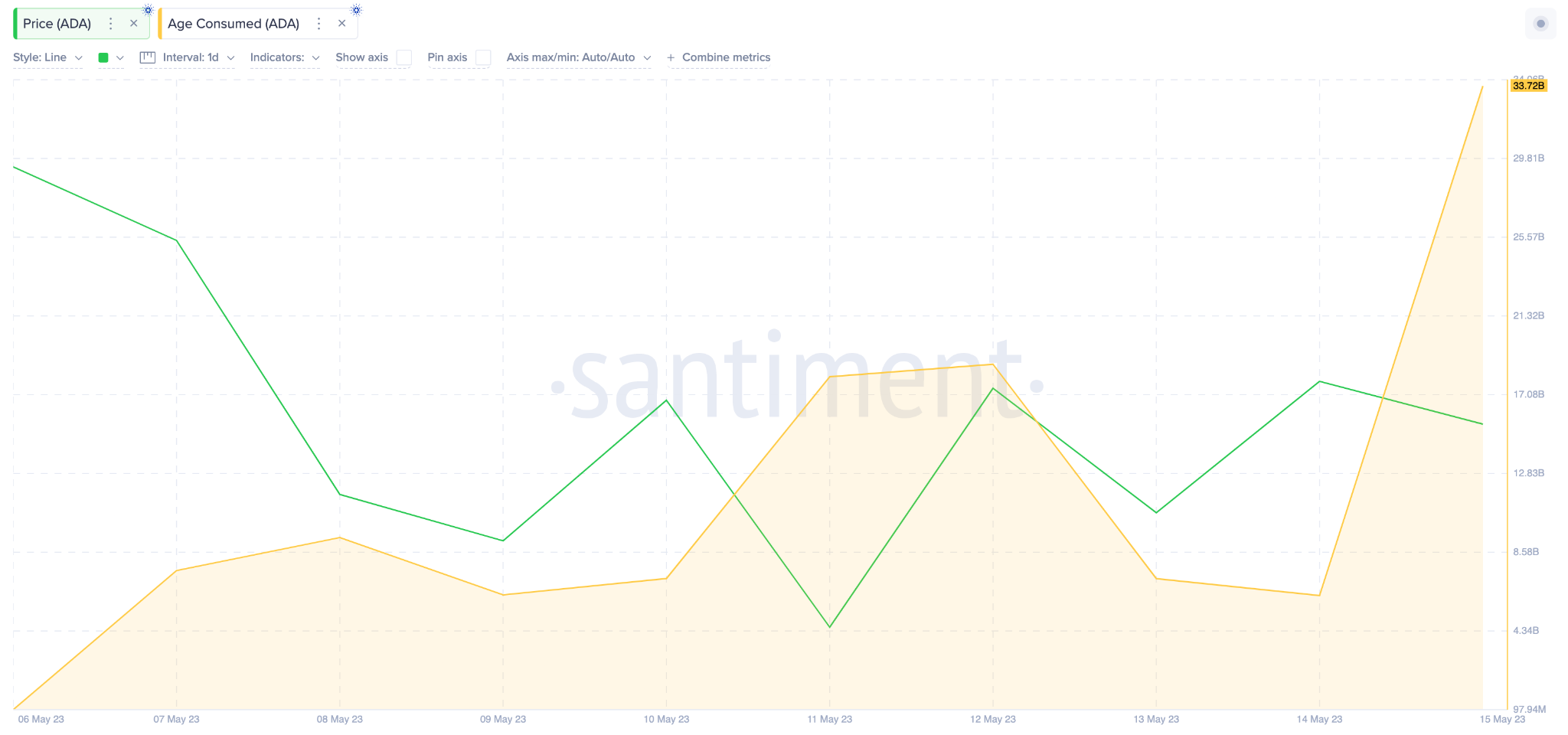

Cardano long-term investors appear to have started selling more of their long-held coins this week. According to on-chain data, ADA Age Consumed has increased since May 6.

Age Consumed tracks the trading activity of long-term holders by evaluating the total number of coins traded daily, multiplied by the number of days since each coin was last moved.

Between May 6 and May 16, it jumped from 98.9 million to 33.7 billion, as the chart below illustrates.

As observed above, a sharp increase in Age Consumed suggests that long-held coins are now increasingly being sold off.

If it continues to rise, it may cause a significant increase in selling pressure and validate the bearish ADA price prediction.

Whales Look Set to Continue Selling

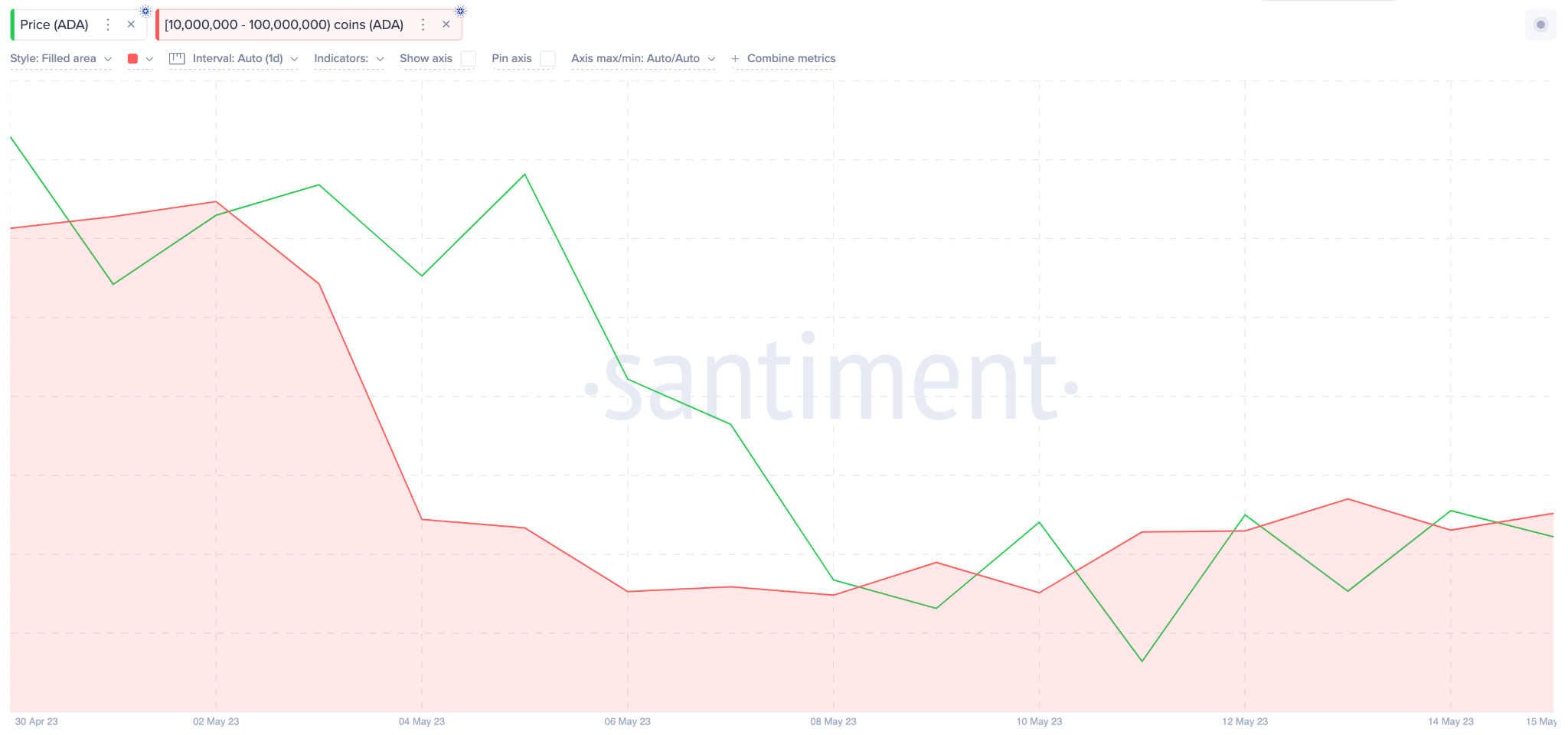

Crypto whales holding Cardano have also been showing bearish trading activity since the start of May. When Cardano lost the critical $0.40 price on April 30, Cardano’s largest whale cohort, holding between 10 million to 100 million ADA, began to sell.

Between May 1 and May 16, they offloaded roughly 300 million coins worth approximately $133 million.

Despite their mild accumulation last week, they are still far from reclaiming their April 2023 balances. Considering that they are the largest whale cohort on the Cardano network, their buy/sell patterns considerably impact the price of ADA.

Hence, in the coming weeks, strategic investors will be keeping an on the buy/sell patterns of Cardano whales and the long-term holders. The pessimistic ADA price predictions could soon be validated if their bearish trading activities continue.

ADA Price Prediction: Bears Pushing for $0.3

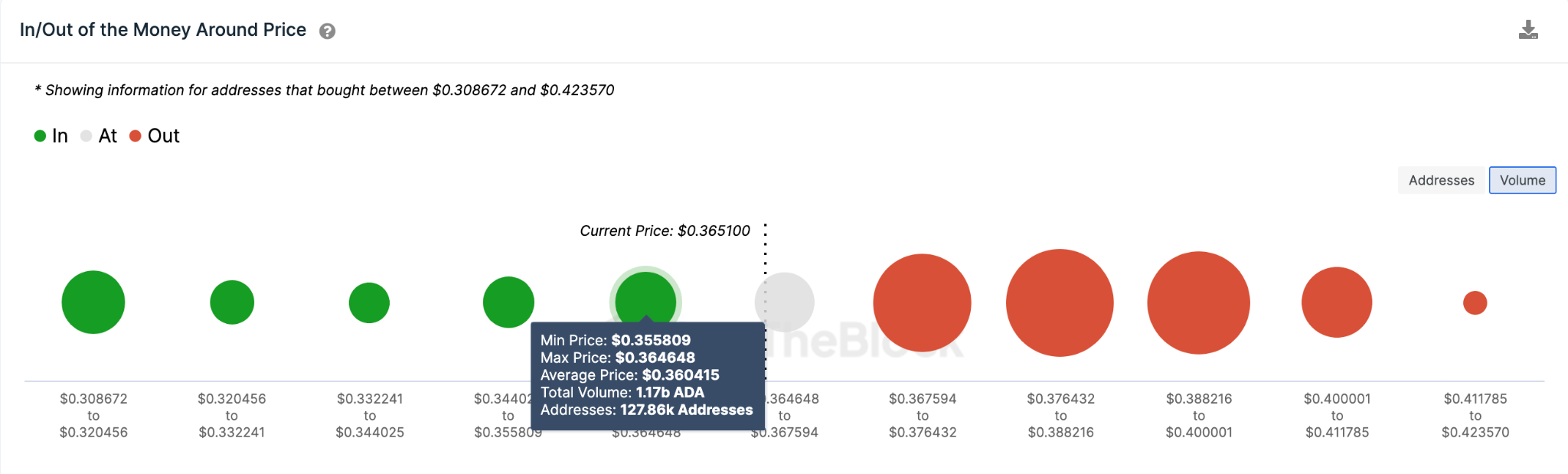

According to IntoTheBlock’s In/Out of Money Around Price (IOMAP) data, ADA will likely drop to $0.3 in the coming days.

For the bears to be confident of the downward Cardano price prediction, ADA has to drop below the critical $0.35 support.

At that zone, 127,000 investors that bought 1.17 billion ADA for an average price of $0.35 will attempt to prevent the drop.

But if the bearish scenario plays out as expected, ADA price could drop as far as $0.30.

Conversely, the bulls could trigger a bullish price reversal if ADA manages to break above $0.38.

But at that zone, 156,000 investors who bought 4.0 billion ADA for a maximum price of $0.38 could book profits and inadvertently slow the rally.

If ADA can breach that resistance, investors could expect a prolonged rally toward $0.42.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.