Bitcoin’s (BTC) price has consolidated around the $29,500 support level after the Aug 10 CPI report showed a mild 0.2% inflation increase. On-chain analysis explores whether crypto investors will HODL for a $32,000 retest or book profits in the coming days.

On August 10, the US Bureau of Labour and Statistics published the CPI report for July 2023, showing a mild increase in inflation. Though the inflation report matched market expectations, the initial investor reactions saw the BTC price drop slightly toward $29,300.

On-chain data suggests that Bitcoin bulls are making efforts behind the scenes to trigger an early price rebound.

Bitcoin Investors Have Moved Another 6,000 Coins Off Exchanges After CPI Report

According to on-chain data, Bitcoin investors responded to the August 10 CPI report by moving 5,949 BTC worth approximately $175 million off exchanges.

CryptoQuant’s Exchange Reserves chart below reveals that this brings total withdrawals in August to 19,837 BTC, worth a staggering $585 million.

Exchange Reserves track real-time changes in the total Bitcoin balances that investors have deposited into crypto exchanges globally. A persistent drop in Exchange Reserves means investors are looking to HODL for future gains rather than seeking short-term selling opportunities.

This signals that while the CPI report has triggered a weak price retracement, the bulls are making moves to flip the script in the coming days.

Bulls are Making Efforts to Prevent a Major Price Correction

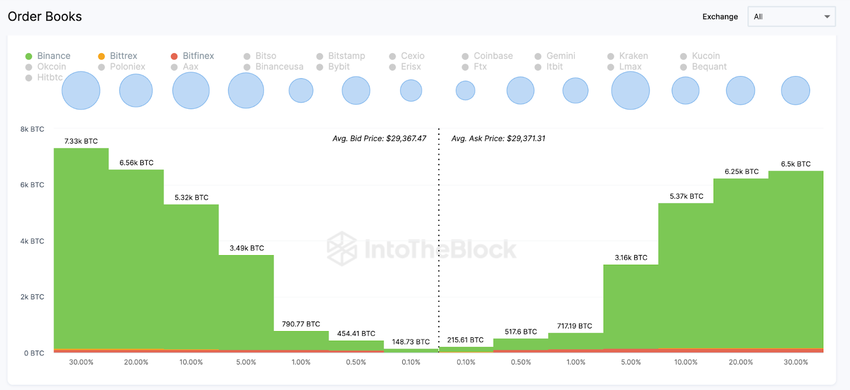

Bullish Bitcoin traders have placed more buy-orders, further confirming their positive outlook to prevent a prolonged BTC price decline. The Exchange On-chain Market Depth chart shows the volume of active buy/sell orders that crypto traders have placed across various exchanges.

As things stand, the bulls have prepared active orders to buy 24,000 Bitcoin around the current prices. Notably, this considerably outweighs the 22,700 active BTC sell orders from traders looking to exit.

When an asset’s active buy-orders outweigh market supply, it signals that it could be on the verge of a price rebound. As things stand, Bitcoin sell-orders have exceeded market supply by 1,300 BTC.

If the momentum turns bullish as predicted, the buyers could gradually increase bid prices in a race to get their orders filled quickly.

In summary, the drop in Exchange Reserves and rising market demand highlighted above could combine to trigger a BTC price recovery.

Read More: Best Upcoming Airdrops in 2023

BTC Price Prediction: $31,000 Could be Next

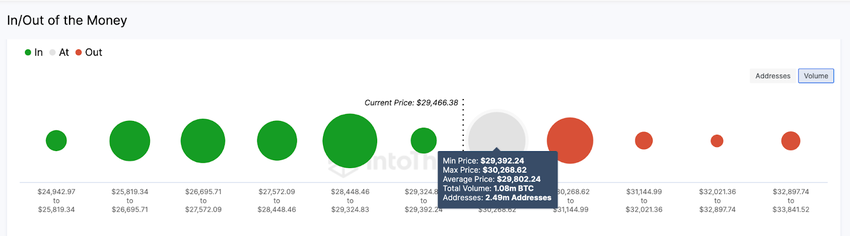

The In/Out of Money (IOMAP) data shows the current distribution of BTC holders’ entry prices to establish key support and resistance levels. It shows that the $30,200 territory is the critical sell-wall that could prevent BTC from hitting the $31,000 price target.

As depicted below, 2.49 million addresses had bought 1.08 million coins at an average price of $30,268. If they close their positions, they could trigger a pullback.

But if the Bitcoin investors keep moving coins off exchanges as previously highlighted, the supply squeeze will likely propel BTC toward the $31,000 target.

Still, the bears could invalidate that positive BTC price prediction if the price falls below the $28,500 support. However, the 176,000 addresses that purchased 944,000 BTC at the average price of $28,488 could offer considerable support.

Nevertheless, BTC could sink toward $27,000 if that support level caves in.