In a recent report, Bitwise’s Senior Crypto Research Analyst, Juan Leon, highlights the transformative potential of the intersection between artificial intelligence (AI) and the crypto industry.

According to Leon, fusing these two emerging sectors could significantly impact the global economy. This convergence could potentially enhance various industries and revolutionize our interaction with technology and digital assets.

AI and Crypto Synergy: The Next Big Thing in Innovation

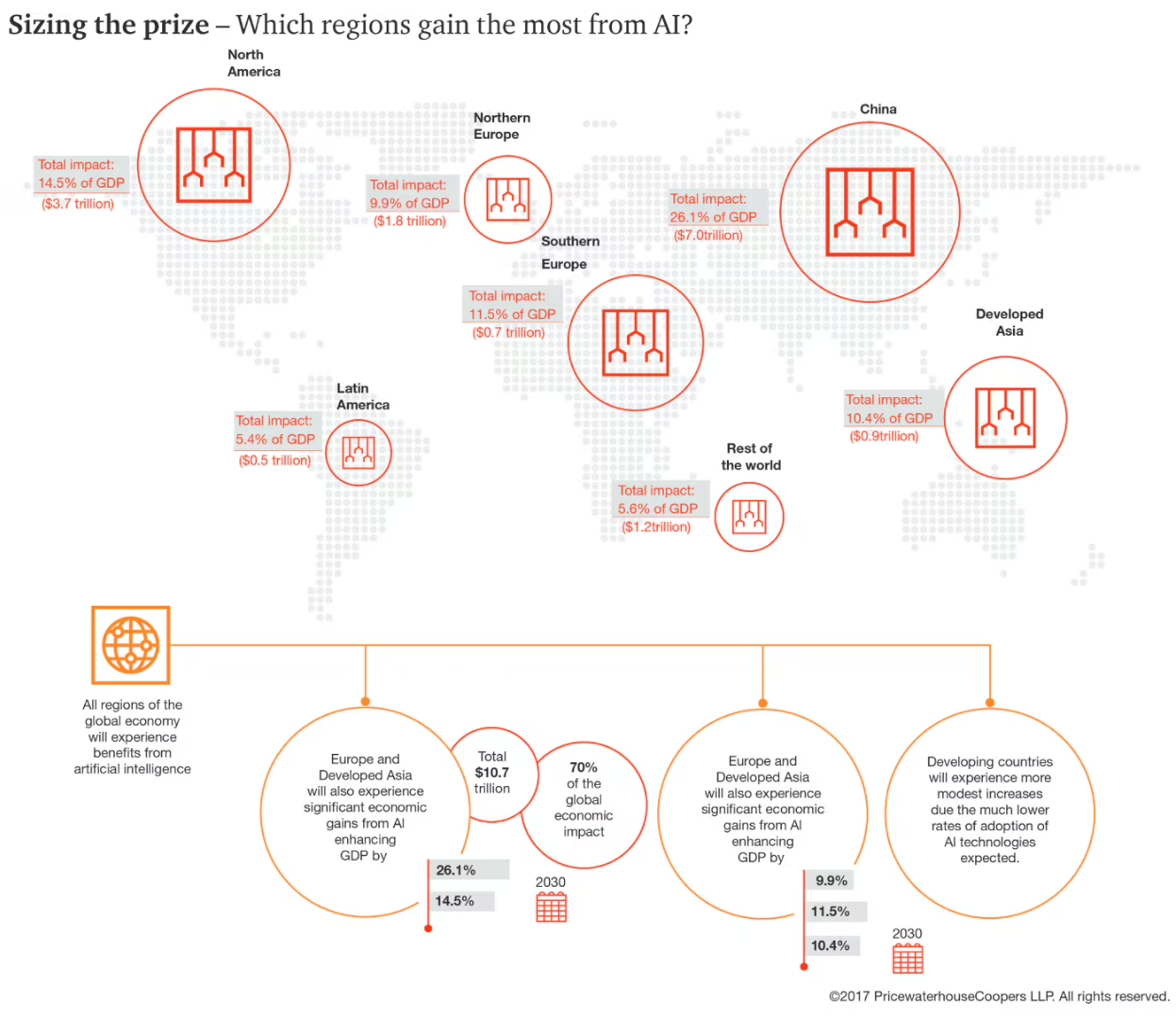

Leon emphasizes that the fusion between AI and crypto is poised to be much larger than currently anticipated. He projects it could add a collective $20 trillion to global GDP by 2030.

“PwC projects that AI and crypto could add $15.7 trillion and $1.8 trillion to the global economy by 2030, respectively. While that adds up to $17.5 trillion, I would not be surprised to see their synergies have a compounding effect that could drive the combined value to $20 trillion or beyond,” he stated.

Read more: How Will Artificial Intelligence (AI) Transform Crypto?

One key area of this intersection is Bitcoin mining, where the infrastructure used for mining is becoming increasingly valuable to AI companies. The current AI boom, driven by the demand for data centers and powerful chips, has led to a shortage of these resources.

Bitcoin miners, equipped with the necessary hardware and cooling systems, are filling this gap. For example, he points to CoreWeave’s offer to acquire Bitcoin miner Core Scientific.

“The offer came the same week that Core Scientific announced the largest miner-AI partnership to date: a $3.5 billion deal to host CoreWeave’s AI-related services in its data centers over the next 12 years,” he noted.

Felix Mohr, Managing Partner of MohrWolfe, also shares his perspective on the potential of adopting AI in the Bitcoin mining industry. Mohr pointed out that incorporating AI could add extra revenue for Bitcoin mining businesses.

“If small Bitcoin miners join together with a larger miner, they can make profits more predictable. This, however, results in consolidation in the Bitcoin mining world. Incorporating AI could generate new revenue streams or make existing ones more profitable,” Mohr explained to BeInCrypto.

Furthermore, Leon explores longer-term opportunities in this intersection, such as information validation. AI has brought about challenges like deep fakes and biased content. However, blockchain technology, known for its transparency and immutability, can address these issues.

“One example: A startup called Attestiv creates digital ‘fingerprints’ for videos based on their metadata. […] Theoretically, we could see similar ways of validating everything from original research to official government communications. It’s why many experts affirm that blockchains will play a pivotal role in putting checks and balances on AI,” he said.

Moreover, Leon sees that integrating AI with crypto could revolutionize virtual assistants. Pairing AI-driven tools with smart contracts and digital currencies could enable these assistants to perform more complex tasks efficiently, enhancing productivity.

Additionally, Mohsin Waqar, CEO of Senet, has highlighted how AI technologies are transforming the crypto market. He pointed out that AI enhances predictive accuracy, automates trading strategies, and improves risk management. Machine learning algorithms also analyze vast datasets to identify market trends and patterns, enabling more informed trading decisions.

“Over the next decade, AI is expected to further integrate with blockchain technology, creating decentralized autonomous organizations (DAOs) that operate with minimal human intervention. Real-life examples include platforms like Numerai, which uses AI to aggregate predictions from data scientists worldwide, and Enigma, which leverages AI to enhance data privacy and secure computations on the blockchain,” Waqar added.

Despite the potential, he suggested that there might be some potential challenges. He mentioned several key issues that need urgent attention. These include data privacy, algorithmic transparency, and the potential for AI-driven market manipulation.

“Regulatory frameworks must evolve to address these challenges, ensuring AI systems operate transparently and ethically. The industry must adopt standards for AI development and deployment, emphasizing accountability and security to maintain trust. Collaboration between regulatory bodies, industry stakeholders, and AI developers will be crucial to creating a sustainable environment that fosters innovation while protecting investor interests and ensuring market integrity,” Waqar told BeInCrypto.

Read more: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

These experts’ insights align with the broader trend of crypto companies tapping into the AI sector. In March, BeInCrypto reported that stablecoin issuer Tether announced a strategic expansion toward AI technologies by focusing on developing open-source, multimodal AI models. The company will also integrate AI solutions into its market-driven products, transforming how crypto and AI intersect to solve real-world issues.