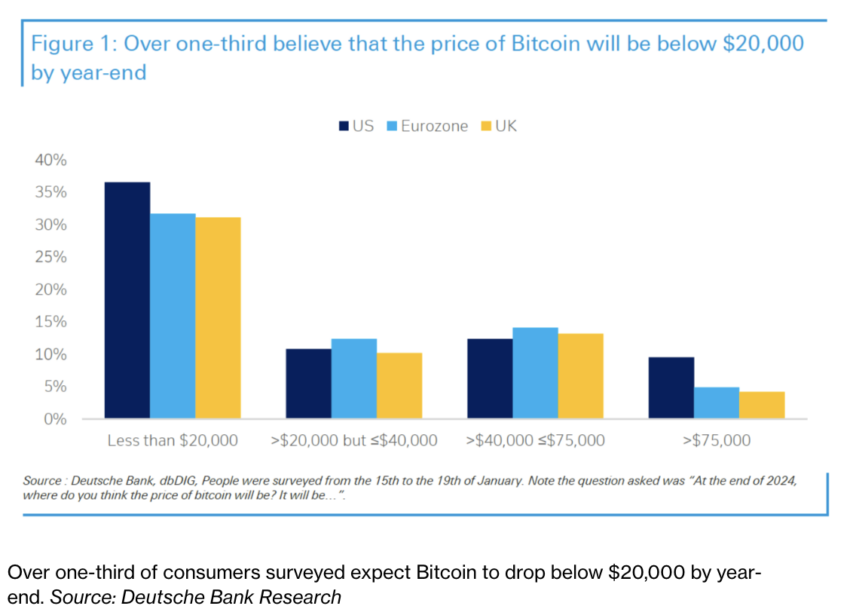

A Deutsche Bank Research report indicates a gloomy investor sentiment. Over one-third of surveyed individuals believe Bitcoin will drop below $20,000 by January 2025.

Recent trends in the cryptocurrency market show a significant shift. Bitcoin, the leading digital currency, fell below $39,000 yesterday, down by around 20% from its local top.

Will Bitcoin Drop to $20,000?

This survey involved 2,000 people from the US, UK, and Eurozone. It was conducted from January 15 to 19. Despite the pessimistic view, 15% of participants see a potential rebound. They expect Bitcoin’s price to rise to between $40,000 and $75,000 by year-end.

Read more: What Is a Bitcoin ETF?

A spike in Bitcoin’s value to $49,000 occurred on January 11. This surge was due to the excitement over new spot Bitcoin ETFs. It was the highest point since March 2022.

However, subsequent sell-offs caused a sharp decline. As of writing, Bitcoin’s price hovers around $40,000.

Analysts Marion Laboure and Cassidy Ainsworth-Grace from Deutsche Bank highlighted the expectations from new spot Bitcoin ETFs in expanding the institutionalization of this veteran digital asset. Despite this, most ETF inflows have originated from retail investors, according to the report.

The investment landscape has shifted, with nearly $4 billion funneling into the new spot Bitcoin ETFs, particularly those managed by BlackRock and Fidelity. This influx, however, is counterbalanced by a withdrawal of $2.8 billion from Grayscale, transitioning from a fund to an ETF.

“While it has only been ~1 week since launch, the initial net inflows into Bitcoin ETFs seems to be far less than the cryptocurrency community was touting in the financial media, and less than what we witnessed in the first week of flows into the Gold ETF when it launched in 2004.

We think much of the crypto-industry set a high bar for the ETF launches, and, while meaningful, we think expectations are simply too high and unrealistic,” said JPMorgan analyst

Pre-Halving Correction?

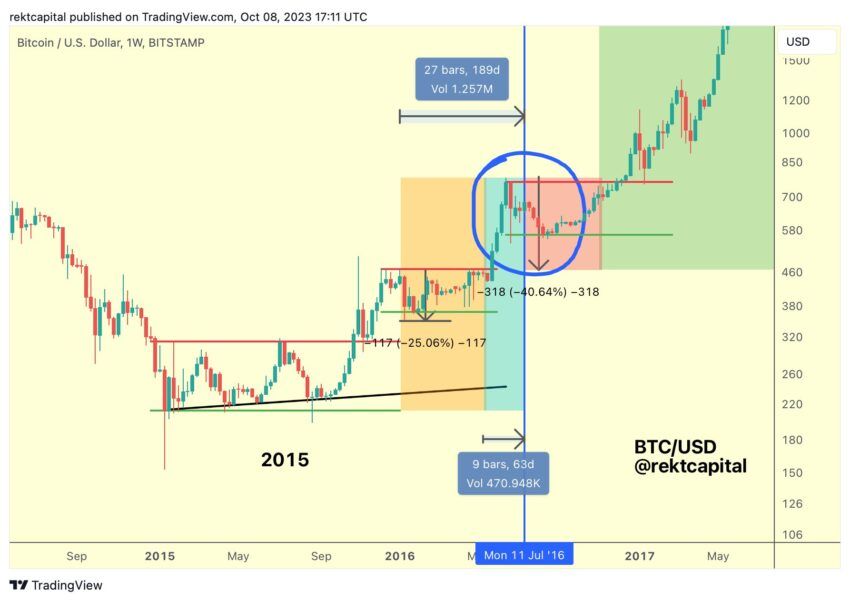

Yet, there’s a historical pattern that offers a glimmer of hope. Bitcoin markets are known for their cyclical nature, often echoing past trends. A study of the 189-day lead-up to the 2016 Bitcoin halving revealed a 25% retracement in Bitcoin’s value, marking a pre-halving re-accumulation phase that persisted until two months before the event.

In every past cycle, Bitcoin’s bull market peak occurred the year following a halving, suggesting a potential peak in 2025. The current market trajectory also closely mirrors the 2019 fractal, where a robust uptrend was followed by a sharp correction months before the halving.

Read more: Bitcoin Halving Cycles and Investment Strategies: What To Know

Should this pattern hold, the first quarter of 2024 could witness a downturn in the cryptocurrency market. This scenario seems increasingly plausible amidst the pre-halving hype and the euphoria surrounding the approval of the spot Bitcoin ETF.

In conclusion, while Bitcoin’s immediate future appears fraught with uncertainty, its history of cyclical patterns provides a roadmap for potential future trends.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.