Following the broader market cues, Fetch.ai’s (FET) price fell below the support of $2, but it is likely on the verge of bouncing back.

This is because the altcoin is in an ideal spot for accumulation, indicating potential gains going forward.

Fetch.ai Is Undervalued

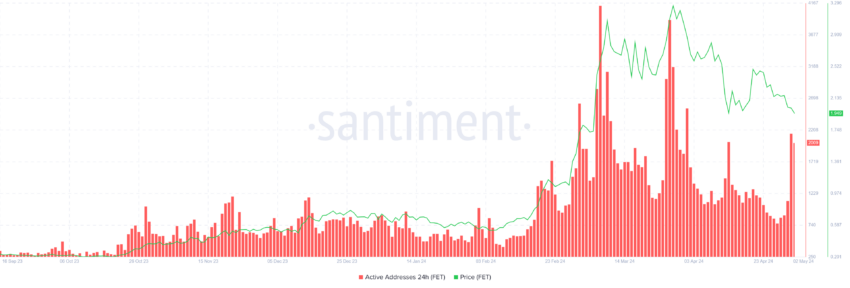

Fetch.ai’s price could observe a recovery, given the altcoin is trading above a key support level. Currently, the altcoin is noting a surge in participation. This is evident in the increase in active addresses in the last 48 hours.

The total number of investors conducting transactions on the network rose from 1,152 to 2,152, marking a 93% increase. While this could be interpreted as FET holders attempting to sell to minimize their losses, the larger picture is bullish.

An increase in participation combined with a decrease in price is usually considered a buy signal. This divergence created by the daily active addresses and price suggests increased supply and lower demand, making it an ideal buy zone.

Furthermore, FET is highly undervalued at the moment, which makes it an attractive investment. This can be noted using the Sharpe Ratio.

This indicator measures the risk-adjusted return of an investment, considering its volatility. It helps investors assess the return generated per unit of risk taken, providing insight into the efficiency of an investment in generating returns relative to its risk.

Given that Fetch.ai’s Sharpe ratio is bouncing back from a six-month low, it has considerable room for growth.

Read More: How Will Artificial Intelligence (AI) Transform Crypto?

FET Price Prediction: Gains Ahead

Fetch.ai’s price, trading at $1.95 at the time of writing, is just under the support line formed at $1.96. This support level has been tested multiple times in the past and has not yet been broken down. Considerable gains have followed a bounce back from this support.

Thus, the likely outcome for FET is a rally towards $2.46. This resistance was tested in the last run-up from $1.96 and would mark a 25% rally for Fetch.ai price, provided it successfully breached the $2.26 barrier.

Read More: Top 9 Artificial Intelligence (AI) Cryptocurrencies in 2024

On the other hand, if Fetch.ai’s price falls through the support at $1.96, it could escape the consolidation. In doing so, the bullish thesis will be invalidated, and FET could fall to $1.71.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.