Bitcoin’s underwhelming start to August 2023 continued with another sizeable correction on Thursday. On-chain data analysis explores critical indicators that could see Bitcoin price drop below the critical $29,000 support level.

Since BTC dropped from $31,850 in mid-July, Bitcoin’s price has continued to hit lower lows. Critical on-chain indicators reveal long-term BTC holders are bracing for a potential price reversal.

Bitcoin Long-Term Holders are Booking Profits

Bitcoin has witnessed intense sell-pressure from long-term investors this week. According to Santiment’s Age Consumed data, the sell-off began around July 31, as the BTC price closed the month below $29,500.

Indicatively, BTC Age Consumed currently sits at 5.97 million, up 190% from the 2.06 million recorded on July 29.

Age Consumed evaluates the sentiment among long-term investors by tracking how many long-held coins are currently being traded. It is derived by multiplying the number of recently traded tokens by the number of days since they were last moved.

As observed above, multiple spikes in Age Consumed means that long-held coins are on the move. Evidently, the sell-off among long-term holders has played a major role in preventing BTC from rebounding above $30,000.

The key to crypto’s future prices? Just a click away:

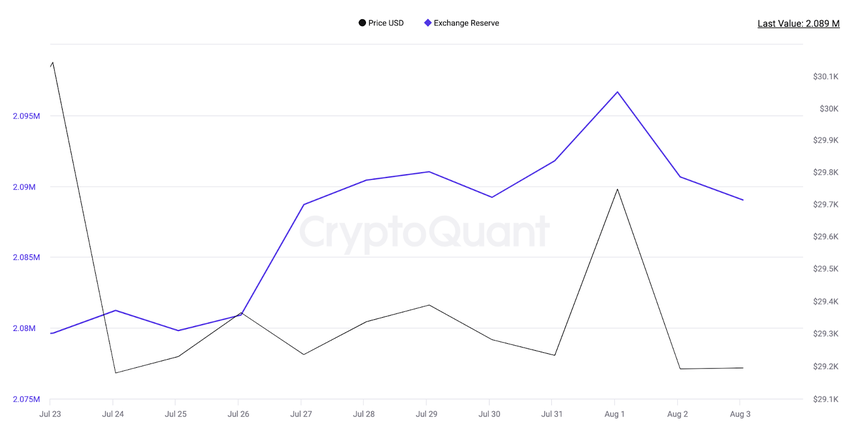

Investors are Piling up Exchange Deposits

According to Cryptoquant, the Bitcoin Exchange Supply has increased significantly this week. It appears investors are growing wary with Bitcoin’s price stagnating within the $29,000 – $29,900 range. In response, they have started moving BTC into exchanges to get ahead of a potential bearish reversal.

Pointedly, between July 25 and Aug 3, BTC investors increased their cumulative Exchange Reserve by an eye-popping 8,600 coins.

Exchange Reserve data tracks the number of tokens investors have deposited in recognized crypto exchange wallets. When it increases, as observed above, it signals that the investors could be bracing up for a potential downswing.

In summary, if the long-term holders intensify the selling pressure, BTC holders could promptly unload their exchange reserves. This bearish outlook means that Bitcoin could drop below $29,000 for the first time since June 20.

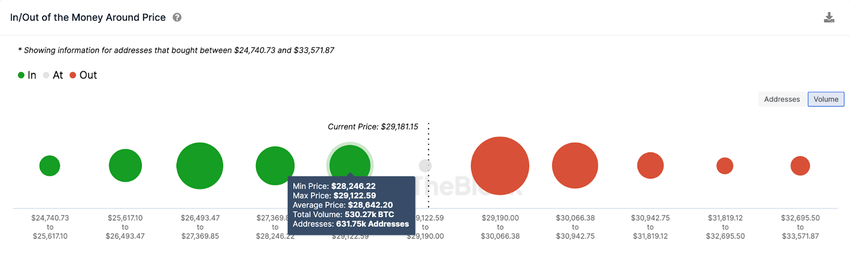

BTC Price Prediction: $28,500 Could Be the Next Significant Support

With current mild-bearish momentum, Bitcoin looks set to make a brief detour below $28,500. But for that to happen, the bears must clear the $29,100 resistance. However, as seen below, 631,000 addresses that bought 530,000 BTC at the average price of $28,600 could prevent the drop.

But if that support level fails to trigger a substantial rebound, Bitcoin price could drop promptly toward $28,000.

Still, if BTC regains positive momentum, the bulls could force a rebound toward $30,000. Although, 2.67 million holders have bought into BTC at the average price of $29,571 and could stand in the way.

Nevertheless, BTC could reclaim the $30,000 milestone if the bulls can flip that resistance sell-wall.

Read More: 6 Best Copy Trading Platforms in 2023