The DOGE price has cleared a significant long-term resistance area, but an upward movement is yet to begin, as typically seen after such breakouts.

Nevertheless, both weekly and daily time frame readings support a potential increase, validating the long-term breakout.

Dogecoin Price Breaks Out From Long-Term Resistance

In the weekly time frame technical analysis for DOGE, it is noted that the cryptocurrency has been following a downward resistance trendline since reaching its all-time high of $0.739 in May 2021. This decline led to a low point of $0.049 (green icon) in June 2022.

Subsequently, DOGE went through a recovery phase and started trading above the $0.060 horizontal support level. Despite several unsuccessful attempts over six months, the price of DOGE finally broke above the resistance line on July 15. The line had been established for a remarkable 805 days.

Your financial future is a click away. Predict crypto prices now:

Breakouts from such long-term structures often lead to significant price increases, as they indicate the end of the previous trend. It is possible that the increase was caused by Elon Musk’s rebranding of Twitter.

However, it’s worth noting that the price increase has not yet begun as expected.

The weekly Relative Strength Index (RSI) reading does not offer a definite conclusion. RSI is a momentum indicator employed by traders to evaluate whether a market is overbought or oversold, aiding in decisions related to buying or selling an asset.

When RSI readings are above 50 and moving upwards, it suggests that the bulls retain an advantage. On the other hand, readings below 50 suggest the opposite.

Read More: Best Upcoming Airdrops in 2023

DOGE Price Prediction: Has the Bullish Reversal Begun?

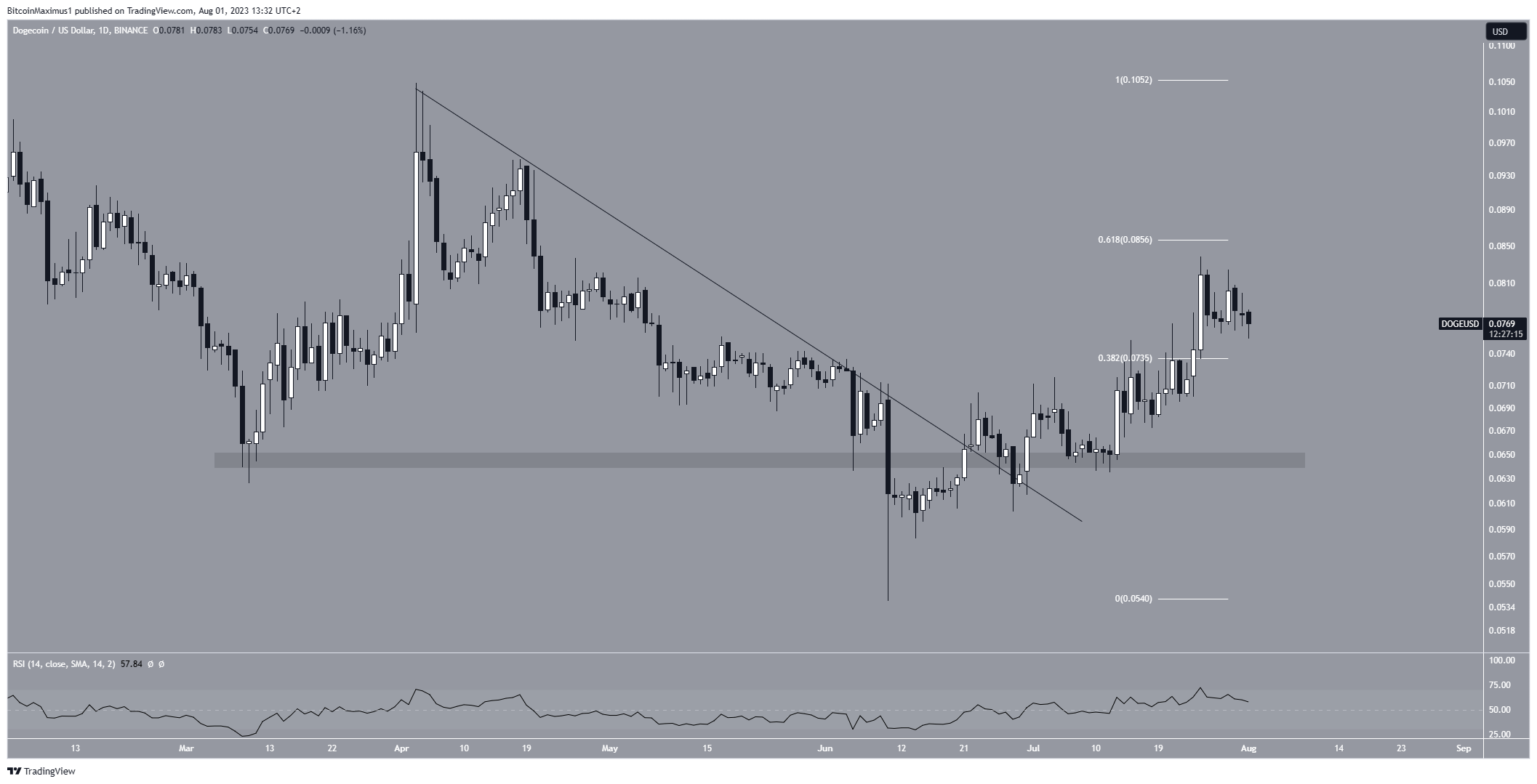

The daily time frame’s technical analysis indicates a mostly bullish outlook, which is supported by the price action and RSI readings.

On June 22, the DOGE price broke out from a descending resistance line and confirmed it as support, leading to an upward movement. After several attempts, DOGE successfully surpassed the 0.382 Fib retracement resistance level at $0.075. It currently trades below the 0.618 Fib retracement at $0.085.

The 0.618 Fib retracement resistance level often acts as the top/bottom if the movement is corrective. As a result, a decisive close above it will confirm the validity of the long-term breakout. In that case, it could lead to an increase to the next long-term resistance at $0.15.

The daily RSI is above 50 and increasing. Therefore, it supports the continuing of the upward movement.

However, a close below the 0.382 Fib will mean that the DOGE price trend is bearish. In that case, the price could fall to the long-term support at $0.060.

For BeInCrypto’s latest crypto market analysis, click here.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.