Ordinals on Bitcoin have ignited significant debates that have polarized the crypto community, casting a shadow on the ORDI token price.

The discourse has intensified over the past week as core developers vow to censor Bitcoin Oridnals, with industry leaders like Max Keiser labeling them as a “bug” on the network.

Will Ordinals Be Censored?

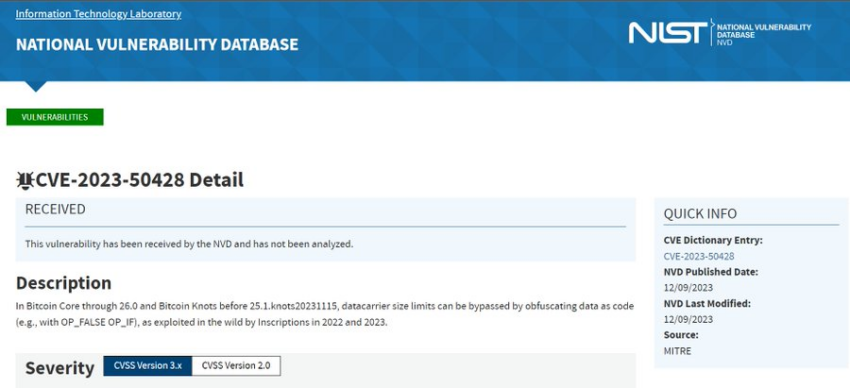

The concerns were raised when Bitcoin core developer Luke Dashjr described it as a “vulnerability” spamming the blockchain. Dashjr later revealed that the bug concerns have entered the US National Vulnerability Database as CVE-2023-50428.

Bitcoin podcaster Peter McCormack shed further light on the contentious nature of Ordinals. He emphasized that these assets fail to benefit those utilizing Bitcoin for payments as they only contribute to a high-fee environment.

“What people need is good money, so in the short-term, the high-fee environment introduced by Ordinals has a supremely negative effect on the use of Bitcoin as money, as a high-fee environment reduces the number of people who can afford to store Bitcoin on-chain and complicates the opening of channels on Lightning,” McCormack said.

However, Ordinals proponents like Eric Lombrozo highlighted that any attempt to censor Bitcoin transactions would fail.

“All attempts to censor Bitcoin transactions, no matter how well intended, will fail. By design. Economic incentives are all that ultimately matters. That is how it is supposed to work.. If anyone actually succeeds, it implies Bitcoin is fundamentally broken, and we may as well scrap it and go back to the drawing board,” Lombrozo said.

Ordinals developer Casey Rodamour also sees the asset as a solution to Bitcoin’s security challenges by incentivizing miners. He believes the diversity of demand sources for Bitcoin block space is advantageous.

“Maybe having different sources of demand for Bitcoin block space is good. If the different sources of demand are less than perfectly correlated, the aggregate demand curve will be might be smoother than its constituents,” Rodamour said.

Meanwhile, DeFi researcher Ignas pointed out that while Inscriptions have led to a spike in Bitcoin transaction fees, they are profitable for miners.

“So as long as at least one Bitcoin mining pool includes Inscription transactions, they won’t go away,” Ignas added.

Ordinal inscriptions, akin to NFTs, represent digital assets engraved on satoshis, the smallest units of Bitcoin. These inscriptions encompass various media forms like artwork, text, videos, and even video games. Since its inception in January, approximately 50 million inscriptions have emerged on the Bitcoin blockchain.

Is ORDI Price Going to Zero?

The possibility of Ordinals being censored could significantly impact the price of ORDI. Earlier in the week, LookOnChain noted a whale who dumped all 59,000 ORDI, around $3.5 million, following Dashjr’s “vulnerability” statement.

Likewise, YouTuber Jerry Banfield described ORDI as a “risky Bitcoin BRC-20 token on its way to zero” because of the censorship concerns surrounding it.

“There is a very real risk that the Ordinal protocol or the way its being executed now is removed so that you cant do it in the future. That might not happen but there is a huge risk that might annihilate all of these Ordinals levels at once,” Banfield said.

Read more: 7 Must-Have Cryptocurrencies for Your Portfolio Before the Next Bull Run

The foregoing shows that any censorship or removal of the protocol from Bitcoin would have a massive negative impact on ORDI’s price. Still, ORDI remains one of the best-performing assets of the ongoing bull market. It has seen its value rise by more than 2,600% year-to-date.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.