Bitcoin (BTC) led last week’s crypto investment outflows, seeing $643 million in negative flows. Ethereum followed with outflows totaling $98 million, while Solana stood out with positive inflows of $6.2 million.

Traders and investors remain uneasy as they brace for key US economic events this week and throughout September, which could significantly impact market sentiment.

Bitcoin At The Forefront of Crypto Investment Outflows

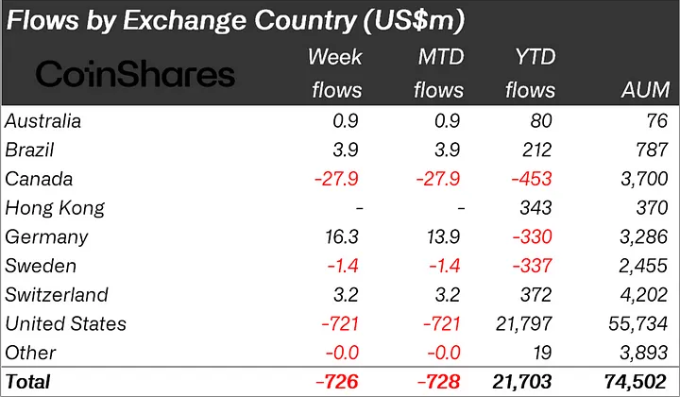

Crypto investment products saw outflows of $726 million last week, levels not seen since March. The US dominated the outflows, contributing $721 million in negative flows, highlighting regional concerns ahead of key economic events.

The latest CoinShares report ascribes the negative flows to interest rate cut uncertainty. This followed last week’s weak jobs report and other US economic data, which left traders and investors cautious about future market conditions.

“This negative sentiment was driven by stronger-than-expected macroeconomic data from the previous week, which increased the likelihood of a 25 bp interest rate cut by the US Federal Reserve. However, daily outflows slowed later in the week as employment data fell short of expectations, leaving market opinions on a potential 50bp rate cut highly divided. The markets are now awaiting Tuesday’s Consumer Price Index (CP|) inflation report, with a 50bp cut more likely if inflation comes in below expectations,” read the report.

Read more: How To Trade a Bitcoin ETF: A Step-by-Step Approach

Variations in the CME Fed Watchtool reflect this trends. After last Friday’s jobs report, the probability of a 50 basis points (bps) rate cut rose to 55%, compared to 45% for a 25 bps cut.

By Monday, however, the tool indicated a 75% probability of a 25 bps cut, with only a 25% chance of a 50 bps reduction. These shifts highlight ongoing uncertainty, with most expecting a rate cut at the September 17-18 Federal Reserve meeting, though the size remains unclear.

This week’s US economic calendar, particularly the August Consumer Price Index (CPI) report on Wednesday, could intensify the uncertainty. The CPI data from the Bureau of Labor Statistics (BLS) will be pivotal in shaping the Fed’s upcoming rate decision. Some experts argue that rate cuts might negatively impact Bitcoin.

Read more: How to Invest in Ethereum ETFs?

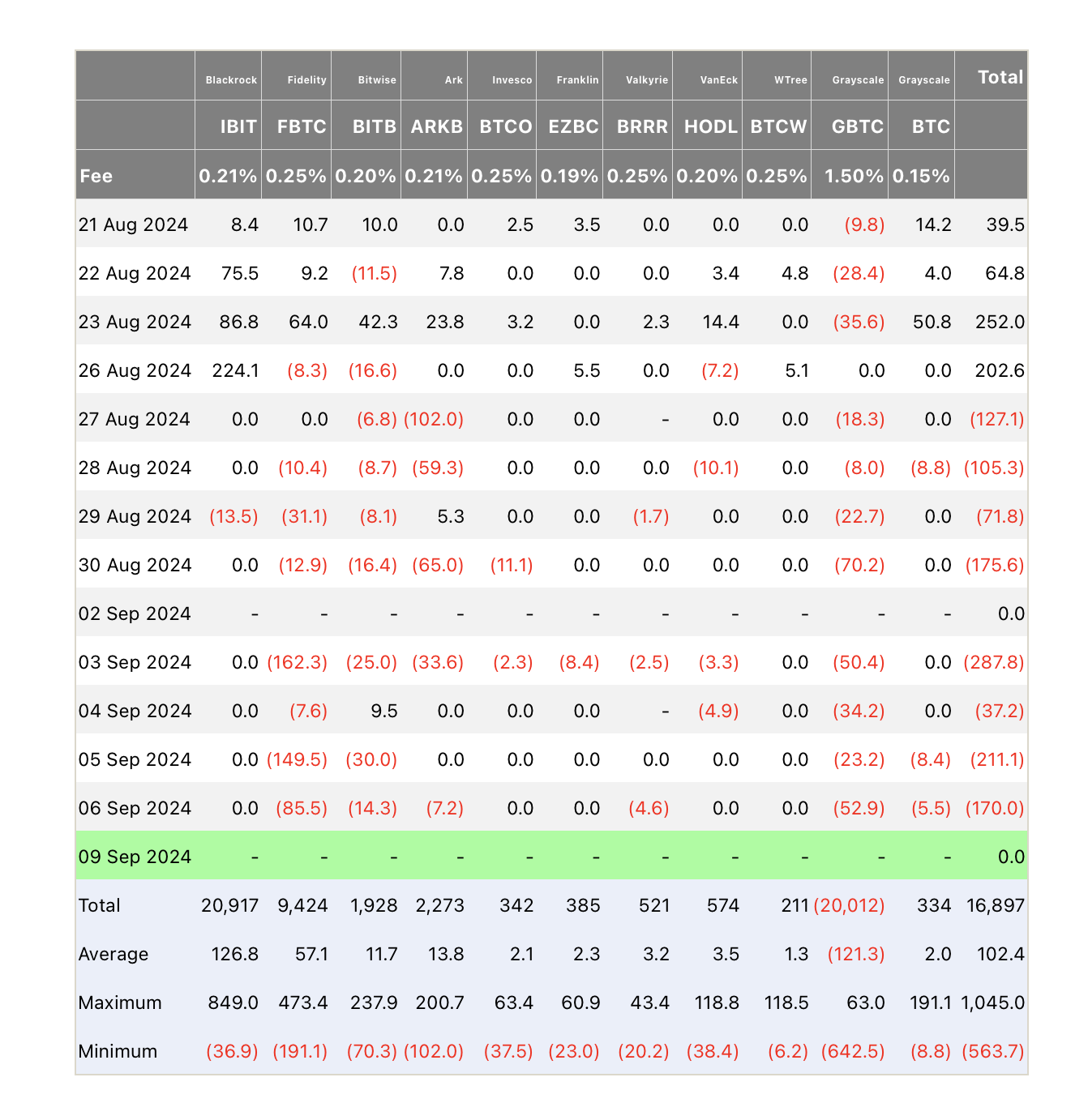

Meanwhile, Bloomberg reported the longest streak of daily net outflows from US Bitcoin ETFs since their listing, with investors withdrawing nearly $1.2 billion over eight consecutive trading days leading up to September 6.

Ethereum has also seen declining institutional interest, mirroring Bitcoin’s struggles. Data from Farside shows almost zero flows for most Ethereum ETFs, while Grayscale reports negative flows, explaining the $98 million outflows for Ethereum last week.

Disclaimer

In adherence to the Trust Project guidelines, BeInCrypto is committed to unbiased, transparent reporting. This news article aims to provide accurate, timely information. However, readers are advised to verify facts independently and consult with a professional before making any decisions based on this content. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.